As global markets continue to react to mixed economic data, the French CAC 40 Index has seen a notable decline of 3.54% amid broader European market turbulence. Despite these fluctuations, dividend stocks remain a focal point for investors seeking steady income and potential resilience in uncertain times. In light of current market conditions, selecting dividend stocks with strong fundamentals and consistent payout histories can be particularly advantageous. Here are three top dividend stocks on Euronext Paris to consider for August 2024.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.50% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.57% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.88% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.02% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 5.68% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.52% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.17% | ★★★★★☆ |

| Rexel (ENXTPA:RXL) | 5.65% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.37% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our Top Euronext Paris Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

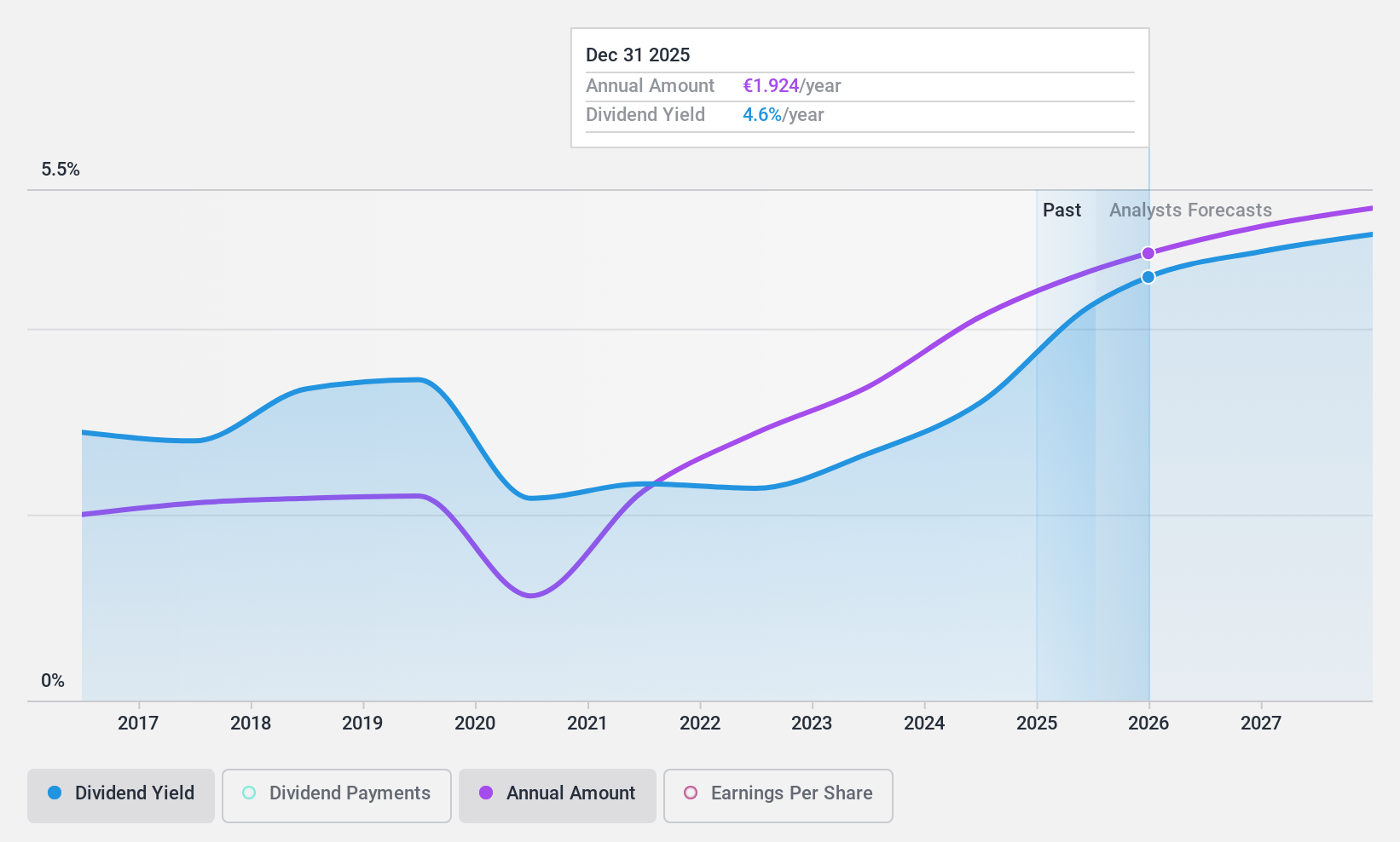

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €2.37 billion, offers survey-based research services to companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific through its subsidiaries.

Operations: Ipsos SA generates €2.44 billion from its survey-based research services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Dividend Yield: 3%

Ipsos's dividend payments are well-covered by earnings (39.3% payout ratio) and cash flows (25.3% cash payout ratio), though they have been volatile over the past decade. The company's recent H1 2024 earnings report showed a rise in net income to €77.95 million from €56.35 million, reflecting strong financial health which supports dividend sustainability despite past instability. However, its 3% yield is below the top quartile of French market payers (5.48%).

- Navigate through the intricacies of Ipsos with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Ipsos is priced lower than what may be justified by its financials.

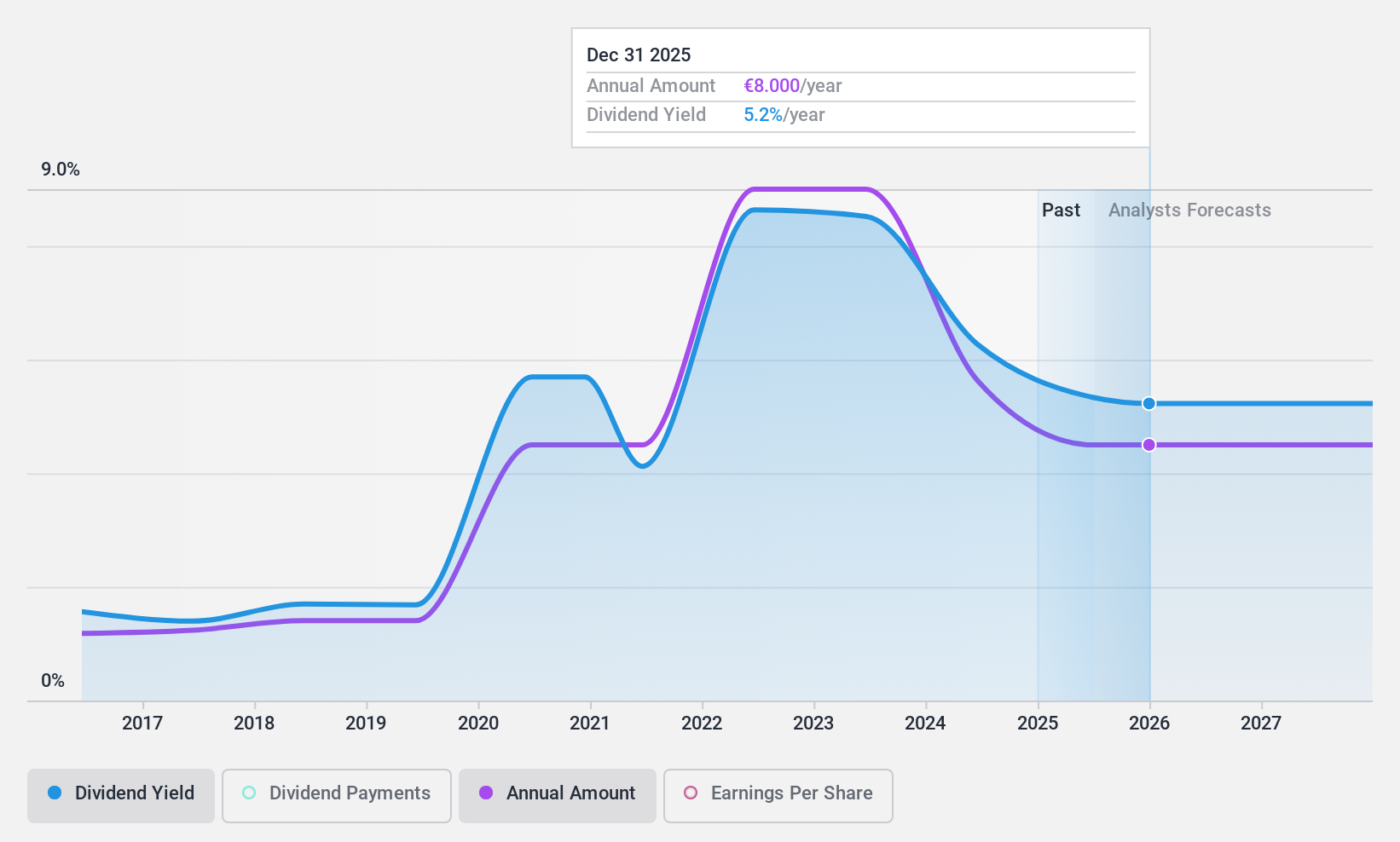

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA, with a market cap of €569.04 million, distributes building materials and tools across France.

Operations: Samse SA generates revenue primarily from its Trading segment (€1.74 billion) and Do-It-Yourself segment (€431.46 million).

Dividend Yield: 6%

Samse's dividend yield of 6.02% places it in the top 25% of French market payers, and its payments are well-covered by earnings (44.8% payout ratio) and cash flows (36.8% cash payout ratio). Although the dividends have increased over the past decade, they have been volatile with significant annual drops exceeding 20%. The stock trades at a slight discount to its estimated fair value, offering good relative value compared to peers.

- Get an in-depth perspective on Samse's performance by reading our dividend report here.

- The analysis detailed in our Samse valuation report hints at an deflated share price compared to its estimated value.

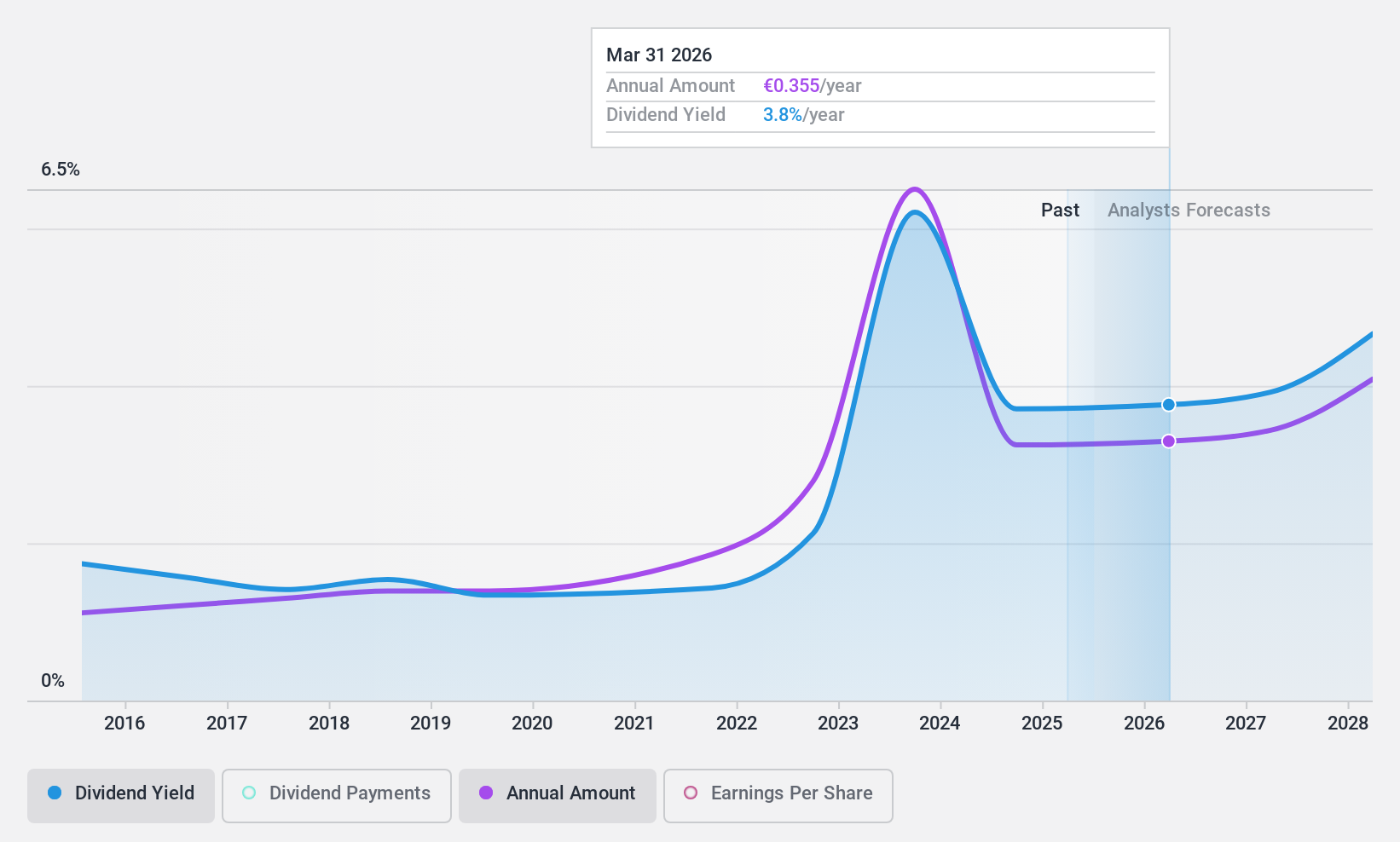

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA, with a market cap of €672.79 million, operates in the wine industry worldwide.

Operations: Oeneo SA generates revenue primarily from Corking (€211.57 million) and Breeding (€94.17 million) segments.

Dividend Yield: 3.4%

Oeneo's dividend yield of 3.37% is lower than the top 25% of French market payers, and its payments have been inconsistent over the past decade. Despite this, dividends are covered by earnings (78.2% payout ratio) and cash flows (83.3% cash payout ratio). The company trades at a discount to its estimated fair value. Recent financial results showed a decline in sales to €305.73 million and net income to €28.85 million for the year ended March 31, 2024.

- Take a closer look at Oeneo's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Oeneo shares in the market.

Summing It All Up

- Delve into our full catalog of 37 Top Euronext Paris Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPS

Ipsos

Through its subsidiaries, provides survey-based research services for companies and institutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet, good value and pays a dividend.