High Co. SA's (EPA:HCO) 28% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, High Co. SA (EPA:HCO) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

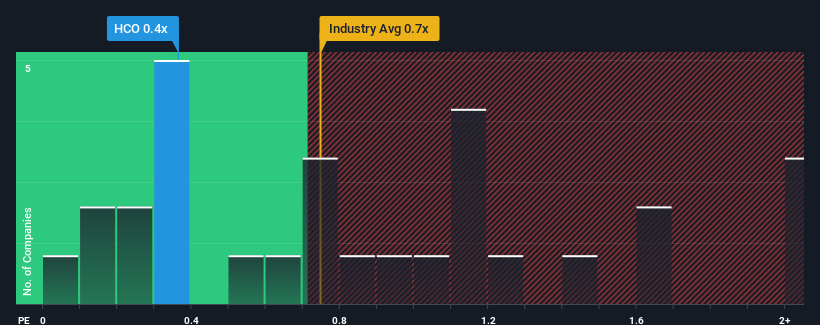

Even after such a large drop in price, you could still be forgiven for feeling indifferent about High's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Media industry in France is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for High

How High Has Been Performing

High's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on High will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think High's future stacks up against the industry? In that case, our free report is a great place to start.How Is High's Revenue Growth Trending?

In order to justify its P/S ratio, High would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.5% gain to the company's revenues. Revenue has also lifted 9.1% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 9.7% over the next year. With the industry predicted to deliver 8.6% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that High's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for High looks to be in line with the rest of the Media industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While High's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with High (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if High might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:HCO

High

Provides consumer engagement chain solutions in France, Belgium, and Spain.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives