- France

- /

- Commercial Services

- /

- ENXTPA:BB

European Dividend Stocks To Consider: 3 Noteworthy Picks

Reviewed by Simply Wall St

As European markets experience a boost from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are increasingly turning their attention to dividend stocks as a means of securing steady income amidst the fluctuating economic landscape. In this environment, selecting dividend stocks with strong fundamentals and reliable payout histories can offer stability and potential for growth, making them an attractive consideration for those looking to navigate the current market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.23% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.24% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.59% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.56% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.50% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.03% | ★★★★★☆ |

Click here to see the full list of 218 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A., known for its retail and online distribution of clothing, footwear, accessories, and household products across Spain, Europe, the Americas, Asia, and globally, has a market cap of approximately €135.43 billion.

Operations: Industria de Diseño Textil, S.A. generates revenue through its diverse segments, including the sale of clothing, footwear, accessories, and household products across various regions such as Spain, Europe, the Americas, and Asia.

Dividend Yield: 3.9%

Industria de Diseño Textil's dividend payments have been volatile over the past decade, despite an increase in payouts during this period. The dividends are covered by both earnings and cash flows, with a payout ratio of 60% and a cash payout ratio of 79.1%. However, its dividend yield of 3.86% is lower than the top tier in Spain. Recent financials show modest growth with Q1 sales at €8.27 billion and net income at €1.31 billion.

- Get an in-depth perspective on Industria de Diseño Textil's performance by reading our dividend report here.

- Our valuation report here indicates Industria de Diseño Textil may be overvalued.

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products with a market cap of €2.19 billion.

Operations: Société BIC SA generates its revenue from several key segments: Flame for Life (€762 million), Blade Excellence (€574 million), and Human Expression (€767 million).

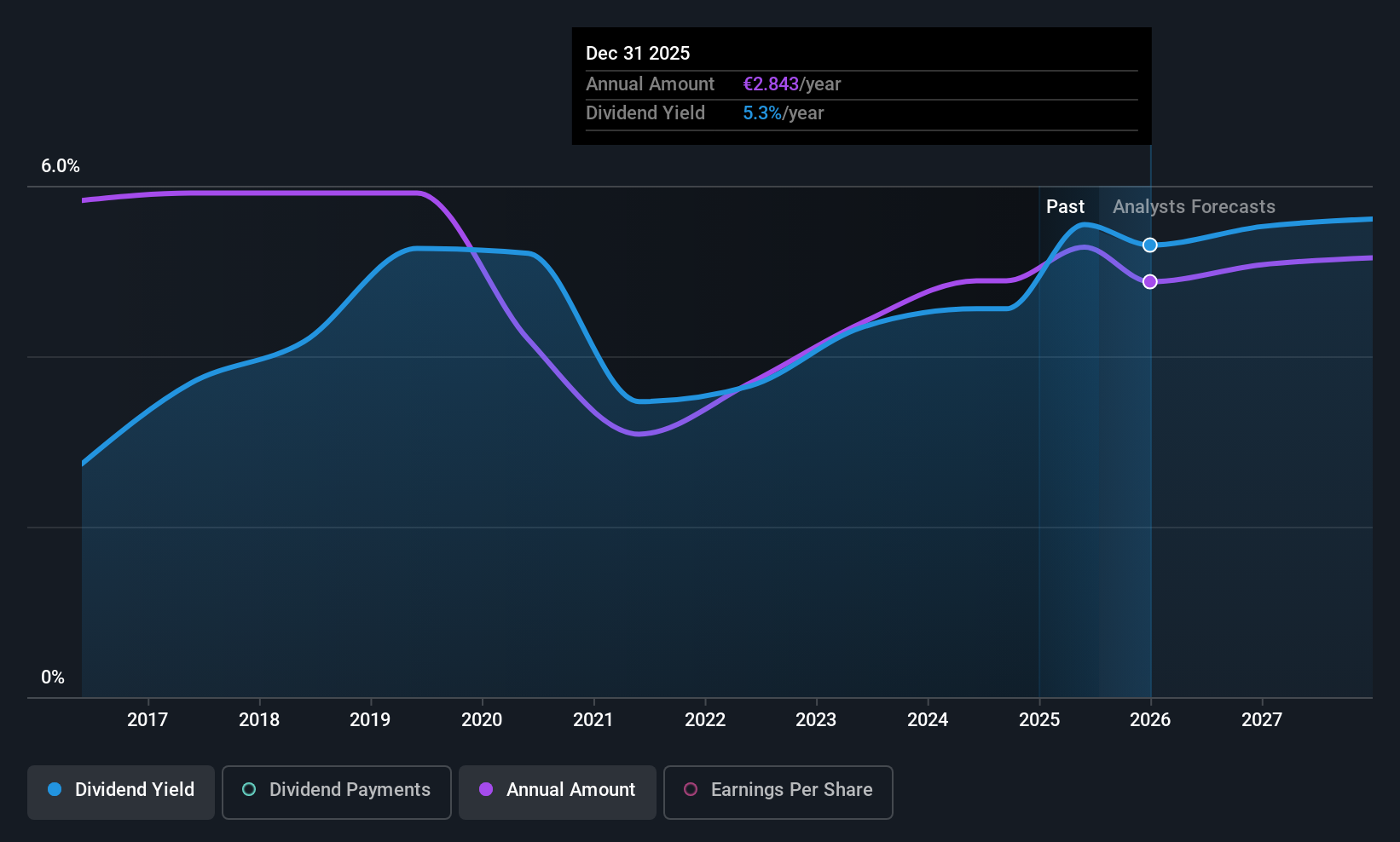

Dividend Yield: 5.8%

Société BIC's dividends are covered by earnings and cash flows, with payout ratios of 71.8% and 57.8%, respectively. Despite a history of volatility, the dividend has grown over the past decade, recently increasing by 8% to €3.08 per share for fiscal year 2024. The yield is among the top in France at 5.79%. Recent leadership changes include appointing Rob Versloot as CEO to drive sustainable growth amid stable sales projections for 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Société BIC.

- According our valuation report, there's an indication that Société BIC's share price might be on the cheaper side.

High (ENXTPA:HCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €90.62 million.

Operations: High Co. SA generates revenue primarily from its advertising segment, amounting to €146.38 million.

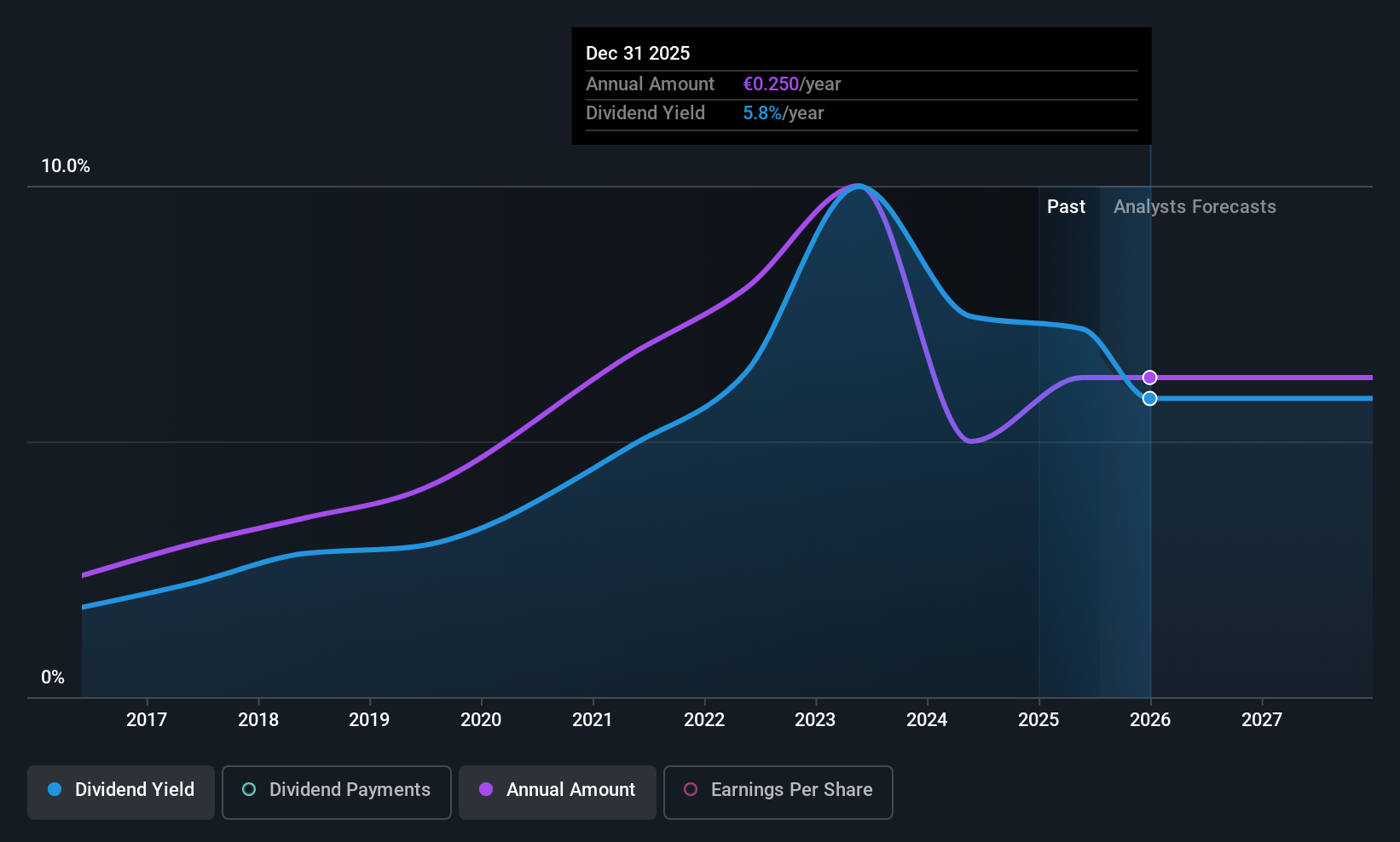

Dividend Yield: 5.4%

HCO's dividends are well-covered by earnings and cash flows, with payout ratios of 63.5% and 20.4%, respectively. Despite a history of volatility, the dividend has grown over the past decade. Currently yielding 5.42%, it ranks in the top quartile among French dividend payers. However, its unstable track record raises sustainability concerns as earnings are forecast to decline by an average of 13.9% annually over the next three years while trading at a significant discount to fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of High.

- Insights from our recent valuation report point to the potential undervaluation of High shares in the market.

Key Takeaways

- Embark on your investment journey to our 218 Top European Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BB

Société BIC

Manufactures and sells stationery, lighter, shaver, and other products worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives