Eutelsat (ENXTPA:ETL) Unprofitability Persists as Price Trades Far Below DCF Fair Value Estimate

Reviewed by Simply Wall St

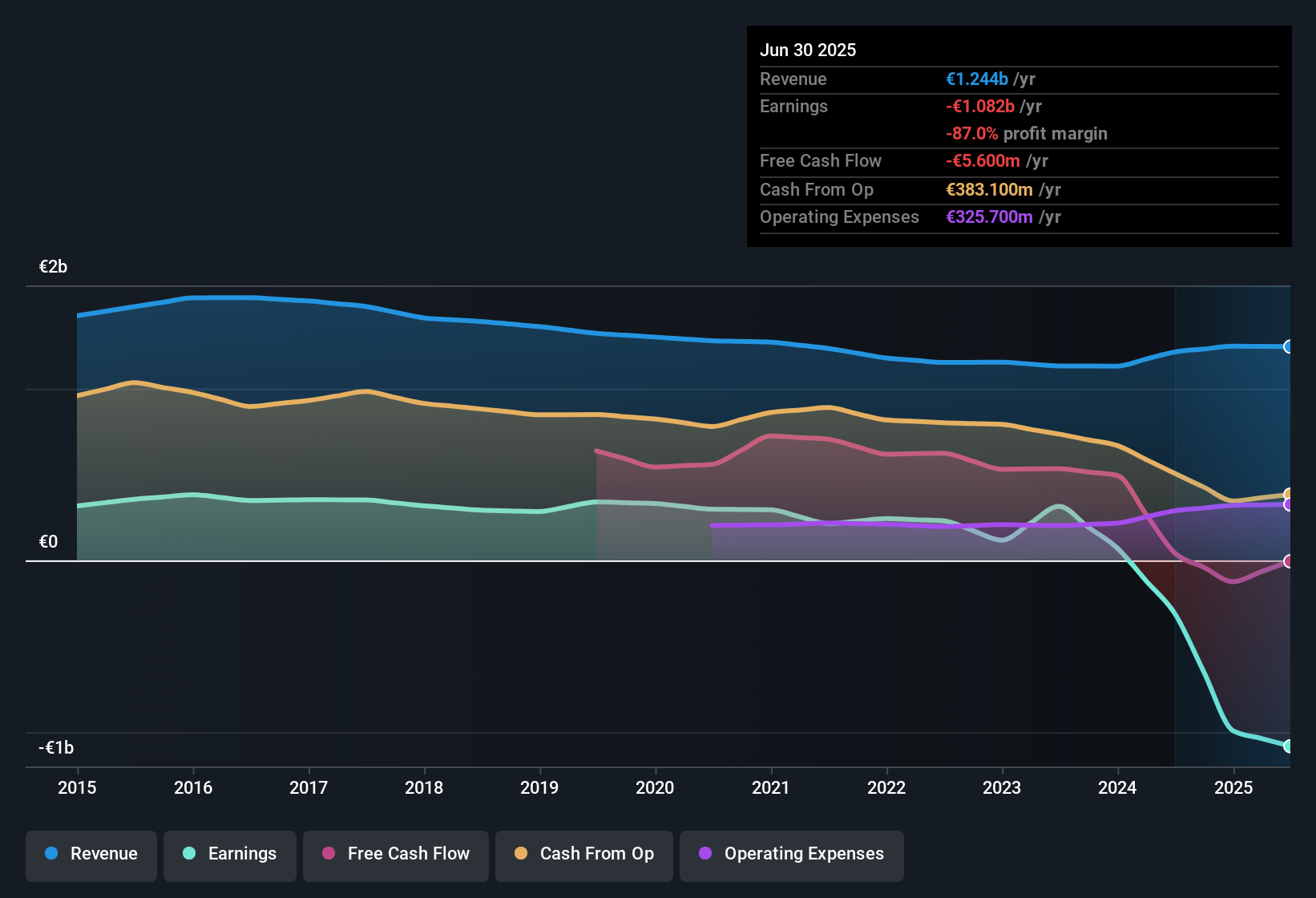

Eutelsat Communications (ENXTPA:ETL) remains unprofitable, with losses having accelerated at a rate of 69% per year over the past five years. The company is forecast to continue posting losses through the next three years. While revenue is expected to grow at 3.8% per year, this trails the broader French market rate of 5.5%. Eutelsat’s Price-To-Sales Ratio of 1.3x appears expensive compared to industry peers. Despite ongoing challenges, shares are currently trading at €3.36, significantly below the estimated fair value of €19.37. This may appeal to value-focused investors but highlights substantial risks tied to financial health and stock volatility.

See our full analysis for Eutelsat Communications.Now, let’s see how these headline figures stack up against the major narratives shaping investor sentiment. Some expectations may get confirmed, and others could be challenged.

See what the community is saying about Eutelsat Communications

New Satellite Initiatives Fuel Growth Ambitions

- The signing of the SpaceRISE consortium agreement and the IRIS² project positions Eutelsat to generate approximately €6.5 billion in revenues over 12 years, laying the groundwork for growth from expanded satellite infrastructure investments.

- Analysts' consensus view highlights that these major commitments are expected to accelerate long-term revenue, especially through LEO satellite projects and capacity expansion.

- Revenue from high-growth segments like mobile connectivity and government contracts, including deals with NIGCOMSAT and the U.S. Department of Defense, are noted as catalysts that analysts believe could sustain the company's revenue streams as the broader market shifts demand towards LEO solutions.

- However, despite these investments, the expected annual revenue growth of 2.7% still trails the broader French market rate of 5.5%. Outperformance will depend on how well these projects deliver results compared to traditional business segments.

- Analysts' consensus view sees the company's focus on reallocating resources and increasing financial efficiency through reduced gross CapEx in GEO assets and reinvestment in LEO expansion as key pillars supporting a turnaround in margins and future earnings.

- The sale of passive infrastructure to EQT is expected to inject €500 million in fresh capital by 2026. Analysts believe this can be redeployed for further LEO investment, boosting competitive positioning and long-term profitability.

- These financial moves aim to improve net margins and address persistent losses, though their success will depend on execution and the competitive landscape for satellite connectivity over the next few years.

GEO Segment Headwinds Pressure Stability

- A €535 million impairment recorded on GEO assets signals reduced expectations for future cash flows from this segment and increased exposure to market decline, especially in traditional video and B2C connectivity services.

- Analysts' consensus view notes the company’s backlog has slipped to €3.7 billion (from €3.9 billion), with erosion primarily in the Video segment. This highlights the risk that persistent weakness in GEO could strain overall revenue stability.

- Consensus points out that temporary revenue delays, including those from Konnect VHTS contracts, may continue to affect short-term revenue if not resolved. Analysts are watching closely for any further declines in GEO business as new LEO investments ramp up.

- The net debt to adjusted EBITDA ratio has risen, reflecting increased financial pressure that could limit flexibility unless new LEO-driven growth offsets declining GEO revenues.

Discount to DCF Fair Value Appears Striking

- Eutelsat’s current share price of €3.36 trades at a dramatic discount to the stated DCF fair value of €19.37. This gap stands out compared to industry norms and peer multiples.

- According to analysts' consensus view, the contradiction between persistent unprofitability and the apparent value opportunity is creating tension in valuation, since a price-to-sales ratio of 1.3x remains high relative to sector averages.

- Consensus cautions that unless profit margins rise dramatically toward the media industry average of 6.7% by 2028, and earnings turn positive, the discount to fair value may prove illusory for investors, especially with continued revenue growth lagging the broader market.

- Even with an analyst price target 15.6% above the current price, there are polarized views ranging from €1.20 to €6.70, underlining how much depends on execution and future margin improvement.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Eutelsat Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the numbers another way? Share your insights and shape your investment perspective in just a few minutes. Do it your way

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Eutelsat’s persistent losses, rising financial leverage, and unstable earnings outlook make its financial health and future profitability highly uncertain for investors.

If you want companies with stronger balance sheets and lower risk, check out solid balance sheet and fundamentals stocks screener (1974 results) that are built to weather uncertain conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives