Eutelsat (ENXTPA:ETL): Exploring Valuation After Recent 20% One-Month Share Price Decline

Reviewed by Simply Wall St

Eutelsat Communications (ENXTPA:ETL) has seen its share price move over the past month, with recent data showing a 20% decline. This comes as investors weigh the company's ongoing performance and outlook within the broader communications sector.

See our latest analysis for Eutelsat Communications.

Despite a steep 20% slide in the share price over the past month, Eutelsat Communications is still up nearly 29% year-to-date. This reflects the stock's recent momentum reversal. However, with a 1-year total shareholder return of -7%, longer-term investors have faced headwinds even as short-term gains hinted at optimism that has quickly faded.

If you're wondering where momentum might be shifting next, this could be a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading nearly 21% below analyst price targets and its recent swings fresh in investors' minds, the key question is whether Eutelsat is currently undervalued or if the market has already taken into account all future growth potential.

Most Popular Narrative: 16.2% Undervalued

With Eutelsat Communications trading at €2.84 and the most widely followed narrative suggesting a fair value of €3.39, the market price trails consensus expectations and hints at meaningful upside. This gap puts the spotlight on the catalysts and numbers underlying the narrative’s valuation.

The continued ramp-up of LEO-related revenues, especially from high-growth segments like mobile connectivity and government services, supported by large contracts with organizations like NIGCOMSAT and the U.S. DoD, indicates potential for sustained revenue growth as these services scale. The planned procurement of 100 LEO satellites by the end of 2026 and the expected financing plan for further expansion reflect a forward-looking strategic positioning that anticipates market demand shifts towards LEO solutions and suggests potential for long-term revenue growth and improved competitive positioning.

Curious about how these ambitious growth bets stack up against analyst forecasts? A handful of powerful growth levers could shape the next chapter for Eutelsat. There is one key profit margin assumption and a bold set of revenue expectations that might surprise even seasoned investors. Want to uncover the precise scenario behind the consensus price target? See how Eutelsat’s valuation narrative is built on forward-looking financials, not past results.

Result: Fair Value of $3.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining revenues from GEO assets and recent asset impairments could challenge the bullish outlook if these trends persist in coming quarters.

Find out about the key risks to this Eutelsat Communications narrative.

Another View: Comparing Sales-Based Valuation

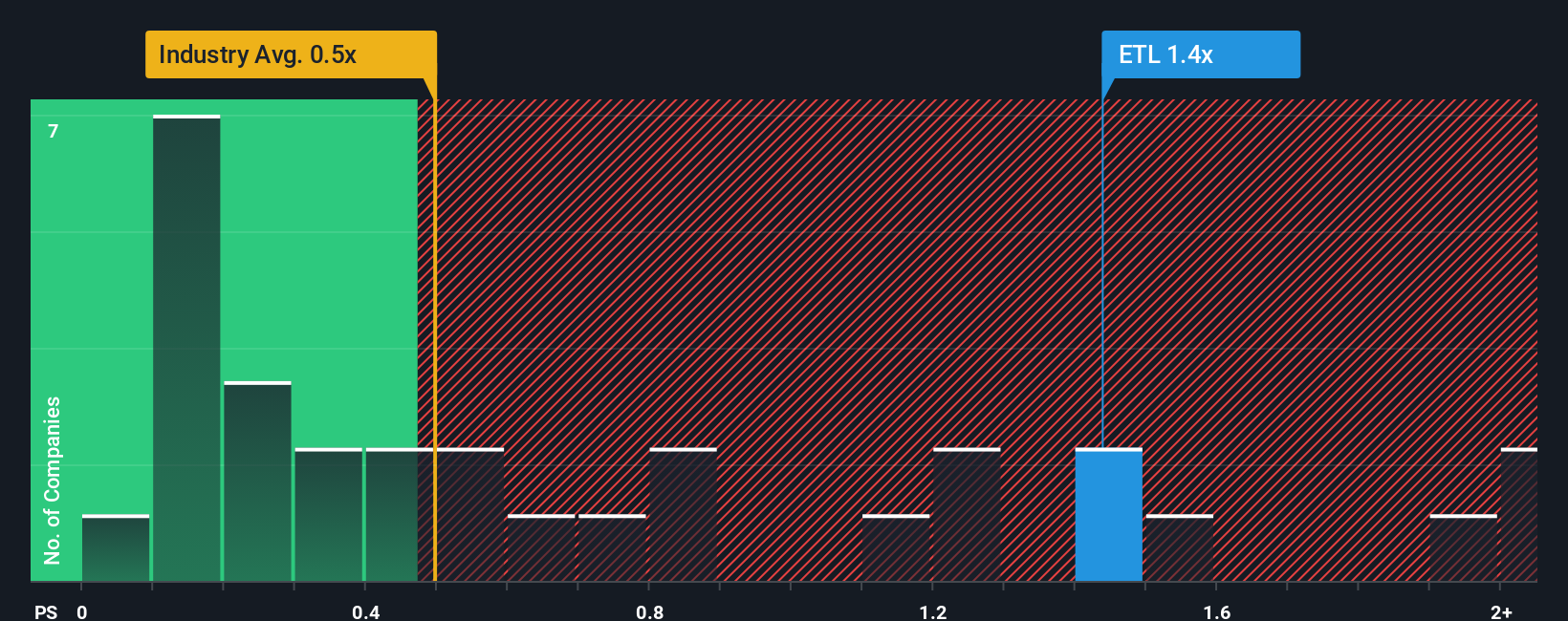

Looking through a different lens, Eutelsat’s price-to-sales ratio stands at 1.1x, which is more than double the French Media industry average of 0.5x and above its peer group at 0.7x. While this suggests the shares trade at a premium, they are still below the estimated fair ratio of 1.7x. This hints the market might eventually move higher. Is this premium justified by future growth, or has the market priced in too much risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eutelsat Communications Narrative

If you see a different story in the numbers or want a hands-on approach, you can dive into the data and build your own view in just a few minutes with Do it your way.

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to level up your portfolio? Smart investors know the next wave of opportunity is only a click away. These on-the-rise ideas could help you stay ahead.

- Sharpen your edge by tracking these 924 undervalued stocks based on cash flows that are priced below their potential and poised for a breakout when market sentiment shifts.

- Amplify your return potential as you target cash-generating companies by checking out these 14 dividend stocks with yields > 3% offering yields above 3%, perfect for maximizing passive income.

- Capitalize on emerging breakthroughs and follow these 26 quantum computing stocks pushing the boundaries of computing and transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success