Bolloré SE (EPA:BOL) will pay a dividend of €0.04 on the 13th of June. Based on this payment, the dividend yield will be 1.4%, which is fairly typical for the industry.

View our latest analysis for Bolloré

Bolloré's Distributions May Be Difficult To Sustain

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before making this announcement, Bolloré was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Analysts expect EPS to fall by 44.1% over the next year. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Bolloré Has A Solid Track Record

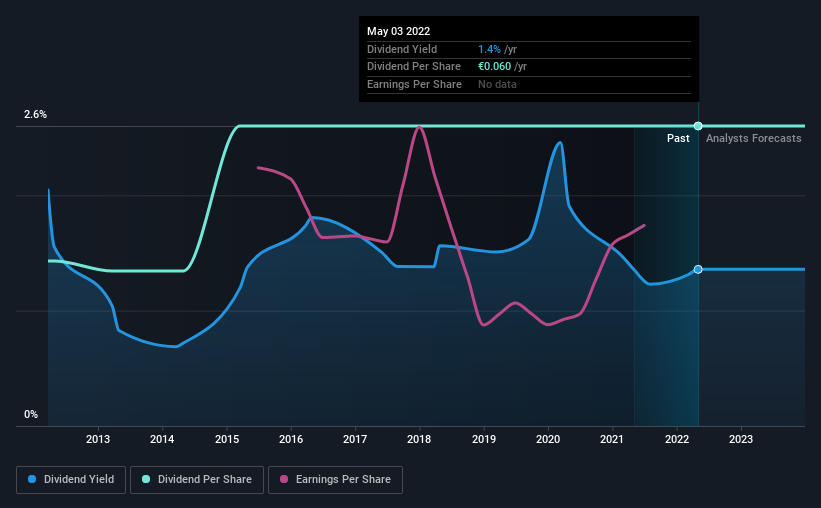

The company has a sustained record of paying dividends with very little fluctuation. The first annual payment during the last 10 years was €0.033 in 2012, and the most recent fiscal year payment was €0.06. This works out to be a compound annual growth rate (CAGR) of approximately 6.2% a year over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth Is Doubtful

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. It's not great to see that Bolloré's earnings per share has fallen at approximately 9.6% per year over the past five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

Overall, we think Bolloré is a solid choice as a dividend stock, even though the dividend wasn't raised this year. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Now, if you want to look closer, it would be worth checking out our free research on Bolloré management tenure, salary, and performance. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, Asia, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.