EuropaCorp (EPA:ALECP) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 4.3% isn't as impressive.

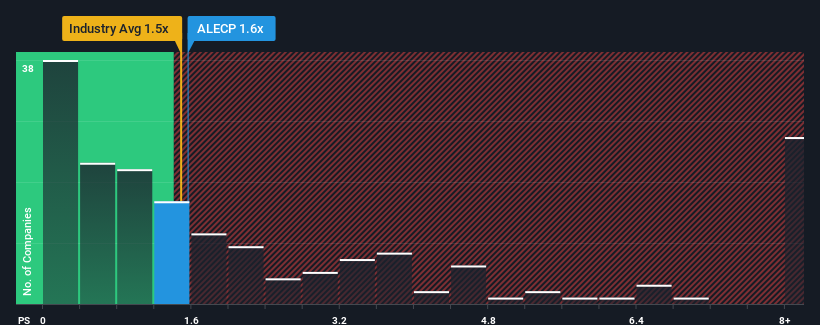

Since its price has surged higher, when almost half of the companies in France's Entertainment industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider EuropaCorp as a stock probably not worth researching with its 1.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for EuropaCorp

What Does EuropaCorp's Recent Performance Look Like?

EuropaCorp could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on EuropaCorp will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like EuropaCorp's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 3.9% over the next year. With the industry predicted to deliver 3.7% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that EuropaCorp is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

EuropaCorp's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting EuropaCorp's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for EuropaCorp (1 is potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EuropaCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALECP

EuropaCorp

Engages in the production and distribution of films and television series and dramas in France and internationally.

High growth potential and fair value.

Market Insights

Community Narratives