- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Uncovering European Small Caps ELEn And 2 More Hidden Gems

Reviewed by Simply Wall St

As the European market navigates a complex landscape marked by mixed performance in major indices and ongoing trade discussions, small-cap stocks present intriguing opportunities for investors seeking growth potential. In this environment, identifying promising small caps like ELEn requires a keen eye for companies with strong fundamentals and the ability to adapt to evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 10.97% | -5.86% | -29.95% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★★

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy, Europe, and globally with a market capitalization of approximately €977.02 million.

Operations: EL.En. S.p.A. generates revenue primarily from its Medical and Industrial segments, with the Medical segment contributing €417.90 million and the Industrial segment adding €160.70 million.

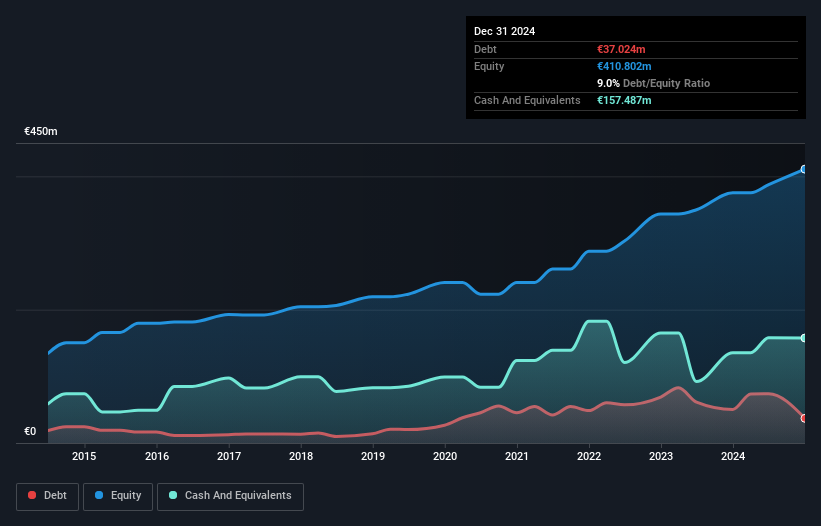

EL.En., a nimble player in the medical equipment industry, reported impressive earnings growth of 18.2% over the past year, outpacing the industry’s 16.4%. Its price-to-earnings ratio stands at 15.7x, below Italy's average of 17.2x, suggesting good value for investors. The company has reduced its debt-to-equity ratio from 15.7% to 11.4% over five years, showing improved financial health with more cash than debt on hand and positive free cash flow generation in recent quarters like €60 million as of June 2024 and €73 million by December that year. Despite these strengths, challenges such as legal disputes and weak performance in China could affect future stability; however, strategic divestments aim to bolster margins and revenue growth moving forward.

Oeneo (ENXTPA:SBT)

Simply Wall St Value Rating: ★★★★★★

Overview: Oeneo SA operates in the wine industry worldwide, with a market capitalization of approximately €608.54 million.

Operations: Oeneo generates revenue primarily from its Closures segment, contributing €222.47 million, and the Winemaking segment, adding €82.65 million.

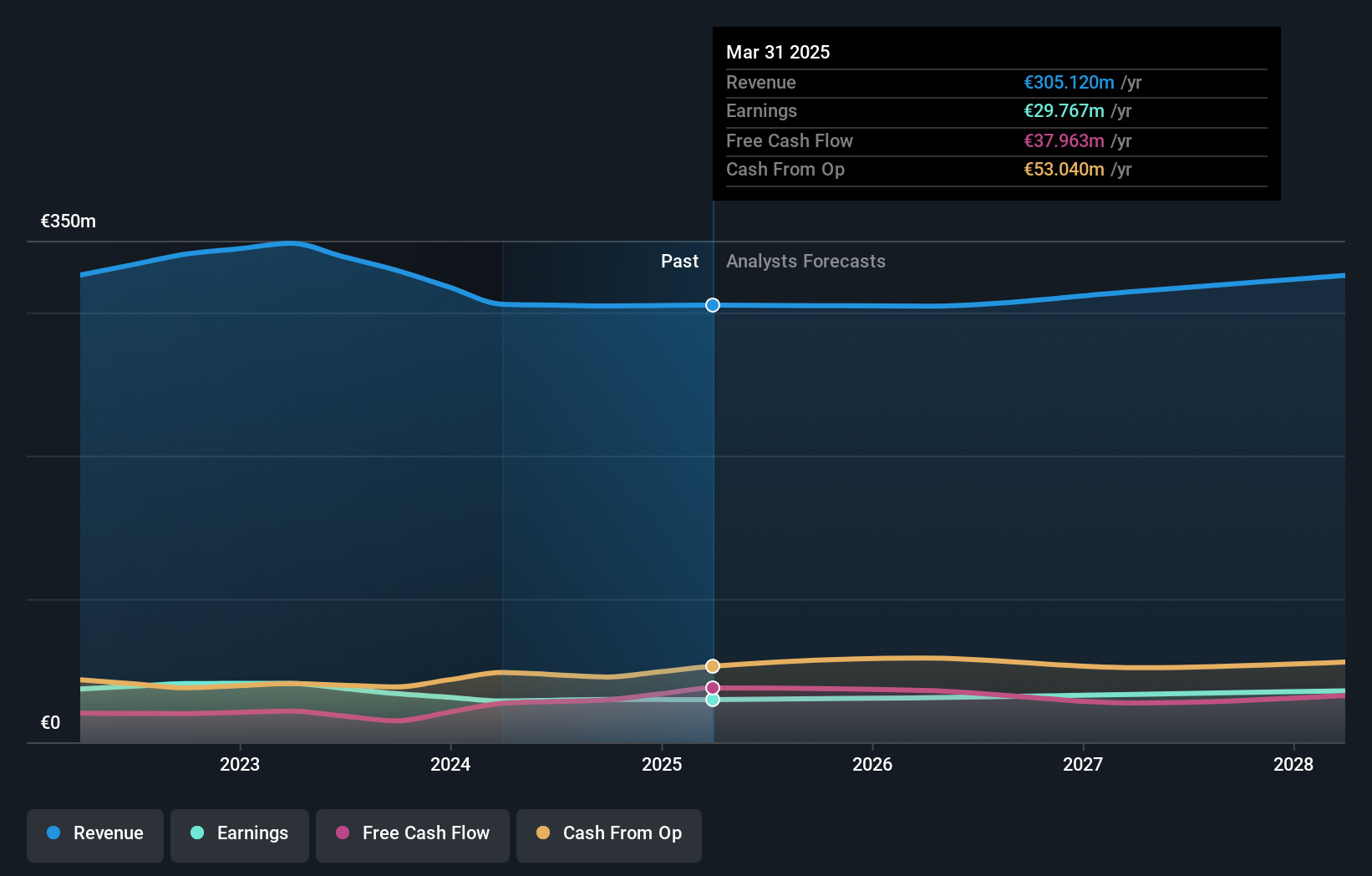

Oeneo, a niche player in the wine and spirits industry, has demonstrated resilience with its recent financial performance. The company reported net income of €29.77 million for the year ending March 31, 2025, slightly up from €28.85 million previously. Earnings per share also saw a modest increase to €0.46 from €0.45 last year, reflecting steady profitability despite sales remaining relatively flat at €305.12 million compared to the prior year's €305.73 million. With an upcoming dividend of €0.35 per share approved for October 2025, Oeneo seems committed to rewarding shareholders while maintaining stable earnings growth in a competitive market environment.

- Click here to discover the nuances of Oeneo with our detailed analytical health report.

Gain insights into Oeneo's historical performance by reviewing our past performance report.

XANO Industri (OM:XANO B)

Simply Wall St Value Rating: ★★★★★★

Overview: XANO Industri AB (publ) is a company that develops, manufactures, and sells industrial products and automation equipment across Sweden, the rest of the Nordic countries, Europe, and internationally with a market cap of approximately SEK3.88 billion.

Operations: XANO Industri generates revenue primarily from three segments: Industrial Solutions (SEK2.02 billion), Industrial Products (SEK872.13 million), and Precision Technology (SEK478.89 million).

XANO Industri, a nimble player in the machinery sector, has shown impressive resilience with earnings jumping 51% over the past year, outpacing the industry average of -0.4%. Despite a 14.8% annual decline in earnings over five years, recent performance is buoyed by significant one-off gains of SEK66.1M. The company reported second-quarter sales of SEK880M and net income rising to SEK45M from last year’s SEK33M, with basic EPS climbing to SEK0.76 from SEK0.55. Debt-free for five years now after shedding a previous debt-to-equity ratio of 74%, XANO's financial health seems robust and well-positioned for future growth opportunities.

- Click to explore a detailed breakdown of our findings in XANO Industri's health report.

Understand XANO Industri's track record by examining our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 324 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research, development, production, sale, and distribution of laser solutions in Italy, rest of Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives