- France

- /

- Basic Materials

- /

- ENXTPA:ALHGR

Hoffmann Green Cement Technologies Societe anonyme (EPA:ALHGR investor five-year losses grow to 79% as the stock sheds €9.2m this past week

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Hoffmann Green Cement Technologies Societe anonyme (EPA:ALHGR) for five whole years - as the share price tanked 79%. We also note that the stock has performed poorly over the last year, with the share price down 51%. More recently, the share price has dropped a further 15% in a month.

Since Hoffmann Green Cement Technologies Societe anonyme has shed €9.2m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Given that Hoffmann Green Cement Technologies Societe anonyme didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Hoffmann Green Cement Technologies Societe anonyme saw its revenue increase by 57% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 12% throughout that time. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

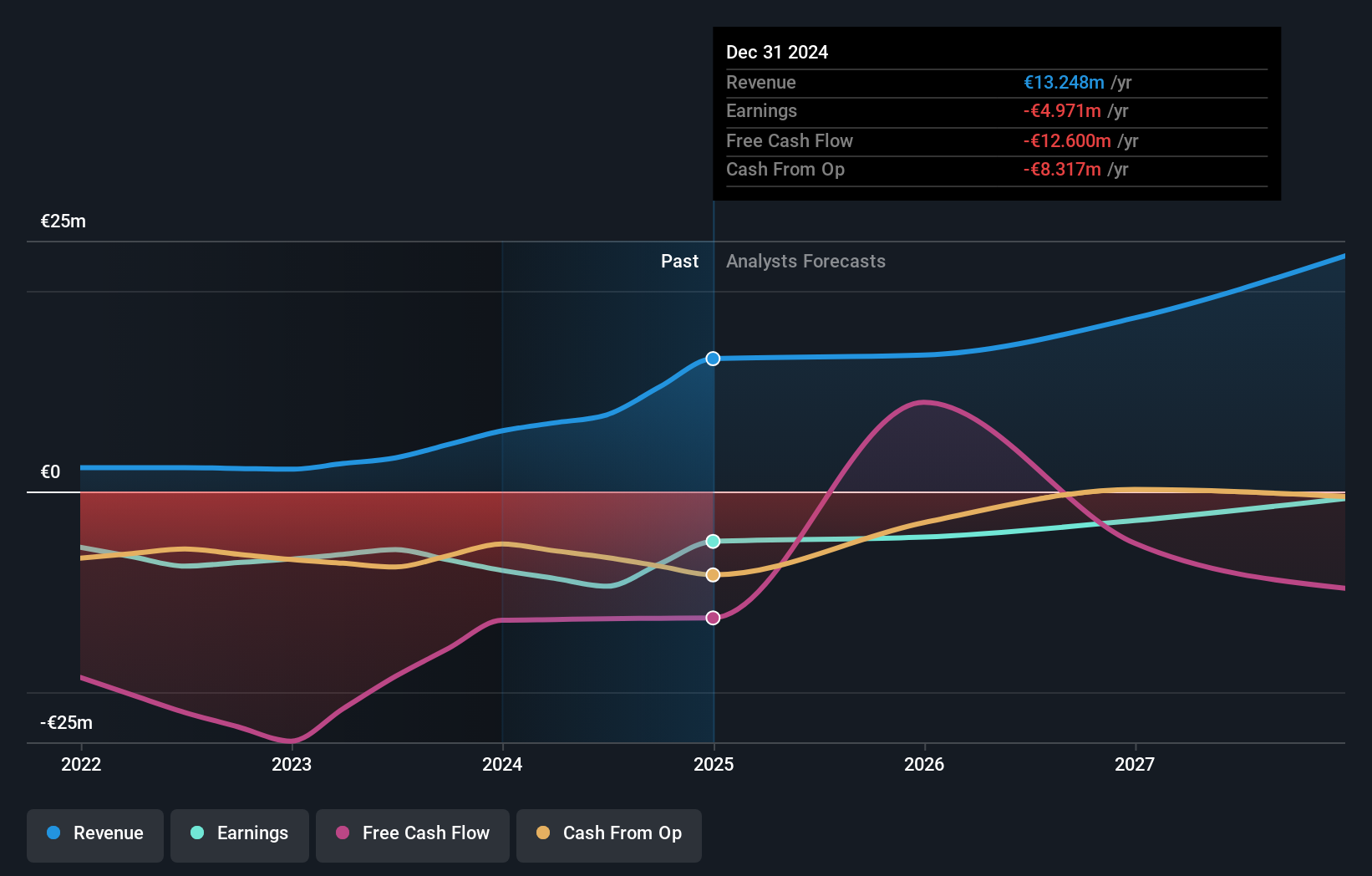

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Hoffmann Green Cement Technologies Societe anonyme in this interactive graph of future profit estimates.

A Different Perspective

Investors in Hoffmann Green Cement Technologies Societe anonyme had a tough year, with a total loss of 51%, against a market gain of about 5.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Hoffmann Green Cement Technologies Societe anonyme (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hoffmann Green Cement Technologies Societe anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHGR

Hoffmann Green Cement Technologies Societe anonyme

Designs, produces, distributes, and markets clinker-free decarbonized cement products in France.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success