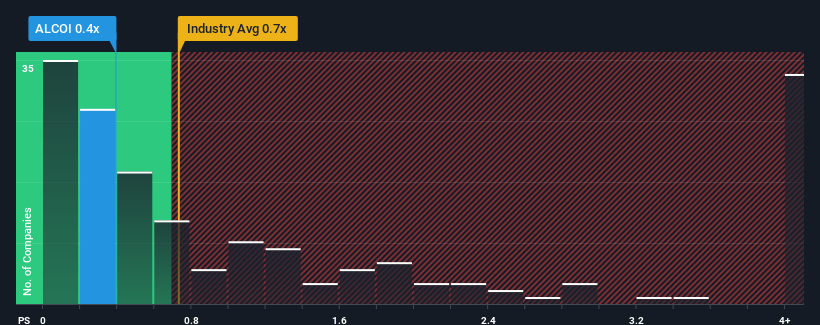

It's not a stretch to say that Coil S.A./N.V.'s (EPA:ALCOI) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in France, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Coil/N.V

What Does Coil/N.V's P/S Mean For Shareholders?

Coil/N.V has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Coil/N.V will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Coil/N.V would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.7%. As a result, revenue from three years ago have also fallen 2.8% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 8.7% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 1.8%, which is noticeably less attractive.

In light of this, it's curious that Coil/N.V's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Coil/N.V's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Coil/N.V currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 1 warning sign for Coil/N.V that you need to take into consideration.

If these risks are making you reconsider your opinion on Coil/N.V, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCOI

Coil/N.V

Provides anodizing services on aluminum flat rolled products in coil form, sheets, and panels in Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives