Should Activist Pressure and the "Unlock the Future" Plan Prompt Action From AXA (ENXTPA:CS) Investors?

Reviewed by Sasha Jovanovic

- In recent days, activist investor Cevian has reportedly set its sights on AXA, considering a similar value-unlocking approach to its previous Aviva campaign, including possible asset sales and capital release strategies. AXA's CEO Thomas Buberl has just launched the "unlock the future" plan, aimed at higher earnings, improved return on equity, and elevating capital returns to shareholders.

- An interesting aspect is that AXA, despite holding a high solvency ratio and described as undervalued, now faces heightened expectations for capital deployment and possible restructuring, supported both by internal plans and external activist interest.

- We'll explore how activist involvement and the focus on capital efficiency may reshape AXA's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AXA Investment Narrative Recap

To be an AXA shareholder, you need to believe in its ability to drive sustained earnings growth and capital efficiency amid ongoing operational transformation. The recent activist attention from Cevian may accelerate AXA’s focus on capital returns and portfolio optimization, but the most immediate catalyst remains the company’s ability to maintain profitability in the face of persistent foreign exchange volatility, a risk that appears unchanged for now.

The latest share buyback updates are closely tied to the news, as both management and external parties spotlight AXA’s excess capital. With the program retiring over €1,200 million of shares this year, the company is sending a clear message about its capital priorities and commitment to shareholder returns, which may influence short term sentiment around expected future distributions.

Yet, in contrast to rising expectations for value creation, investors should be aware of ongoing risks such as ...

Read the full narrative on AXA (it's free!)

AXA's narrative projects €123.9 billion revenue and €8.9 billion earnings by 2028. This requires 10.0% yearly revenue growth and a €1.8 billion earnings increase from €7.1 billion currently.

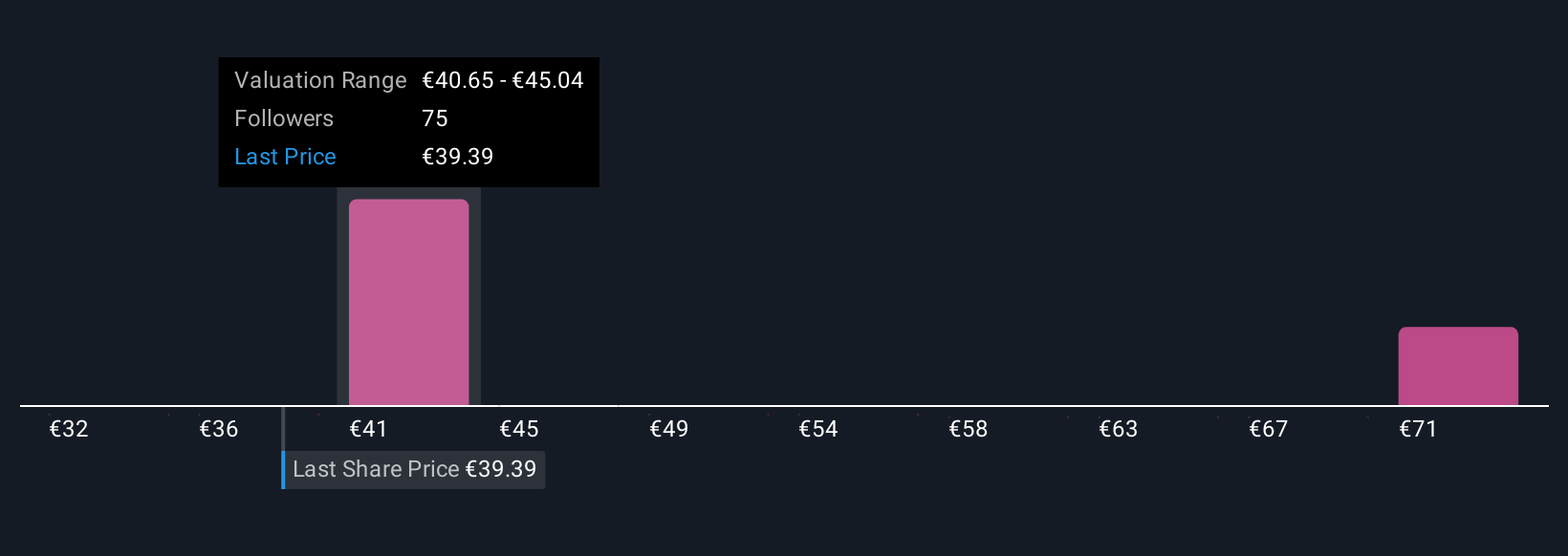

Uncover how AXA's forecasts yield a €44.96 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 12 fair value estimates for AXA, ranging from €39.78 to €75.85. Against this wide spectrum of views, maintain focus on AXA’s persistent FX exposure, which continues to weigh on near-term earnings stability.

Explore 12 other fair value estimates on AXA - why the stock might be worth just €39.78!

Build Your Own AXA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AXA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXA's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CS

AXA

Through its subsidiaries, insurance, asset management, and banking services worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives