- France

- /

- Personal Products

- /

- ENXTPA:OR

Dr.G’s Amazon-Only US Debut Might Change the Case for Investing in L'Oréal (ENXTPA:OR)

Reviewed by Sasha Jovanovic

- Dr.G, now owned by L'Oréal Group, officially launched in the United States exclusively on Amazon in November 2025, marking its first U.S. debut as part of L'Oréal.

- This move highlights L'Oréal's investment in advancing clinical K-beauty and expanding mass-market accessibility by coupling dermatologist expertise with global brand reach.

- We'll explore how L'Oréal's commitment to local innovation and market expansion influences its long-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

L'Oréal Investment Narrative Recap

Owning L'Oréal stock is fundamentally about confidence in its ability to drive global growth through leading product innovation, strong execution in emerging and digital channels, and premium brand positioning. The exclusive US launch of Dr.G on Amazon showcases ongoing portfolio expansion, but does not materially alter L'Oréal’s biggest short-term catalyst: accelerating e-commerce sales. The largest risk remains intensifying competition from digital-native and local brands, particularly in Asia and skincare, which could pressure market share and margins.

Among L'Oréal's latest announcements, the opening of its new North America Research & Innovation Center stands out as most relevant here, reinforcing the company’s focus on local R&D and support for new brand launches like Dr.G. This substantial investment in US-based innovation fits directly with efforts to adapt to shifts in consumer preferences and boost the success of category expansion in high-potential markets.

Yet, despite these strengths, investors should not overlook the growing risk in Asia where...

Read the full narrative on L'Oréal (it's free!)

L'Oréal's narrative projects €50.7 billion revenue and €8.0 billion earnings by 2028. This requires 5.0% yearly revenue growth and a €1.9 billion earnings increase from €6.1 billion today.

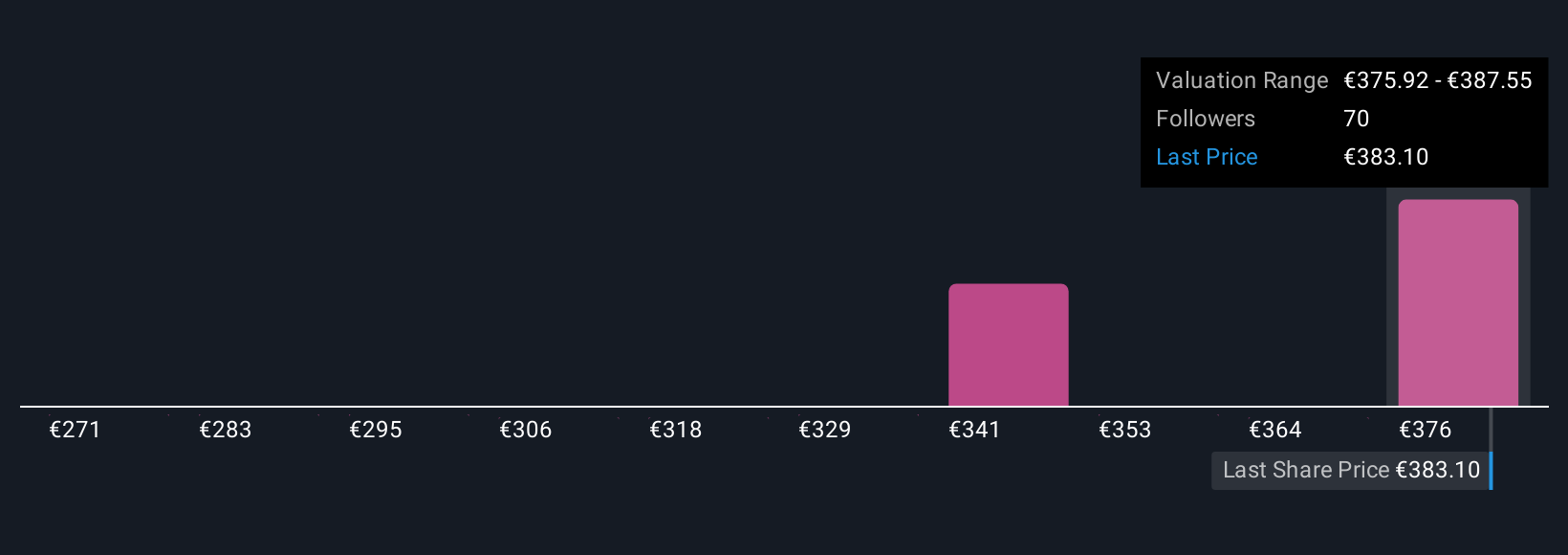

Uncover how L'Oréal's forecasts yield a €387.55 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimate L'Oréal’s fair value between €285.96 and €387.55. While opinions differ, the prevailing risk of losing market share to digital-native and local rivals could have far-reaching effects on future revenue trends.

Explore 6 other fair value estimates on L'Oréal - why the stock might be worth as much as 9% more than the current price!

Build Your Own L'Oréal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L'Oréal research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free L'Oréal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L'Oréal's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives