- France

- /

- Personal Products

- /

- ENXTPA:ITP

Interparfums (ENXTPA:ITP): How Do Shares Stack Up After Strong Half-Year Earnings Growth?

Reviewed by Simply Wall St

Price-to-Earnings of 18.4x: Is it justified?

Based on its price-to-earnings (P/E) ratio of 18.4x, Interparfums appears attractively valued compared to both its industry peers and the broader sector. This multiple is notably below the European Personal Products industry average, which stands at 22.8x, and below the peer group average of 58.2x.

The price-to-earnings ratio indicates how much investors are willing to pay for each euro of the company’s earnings. In this sector, it is a common measure of market sentiment on future profit growth and operational quality. A lower P/E can suggest the market is not fully appreciating the underlying earnings potential, or it may point to lower growth expectations relative to higher-valued peers.

For Interparfums, the implication is that the market may be underpricing its historical earnings growth and profitability, possibly due to slower expected future growth compared to the industry and market averages. Investors should consider whether the lower multiple reflects a conservative outlook or represents a value opportunity.

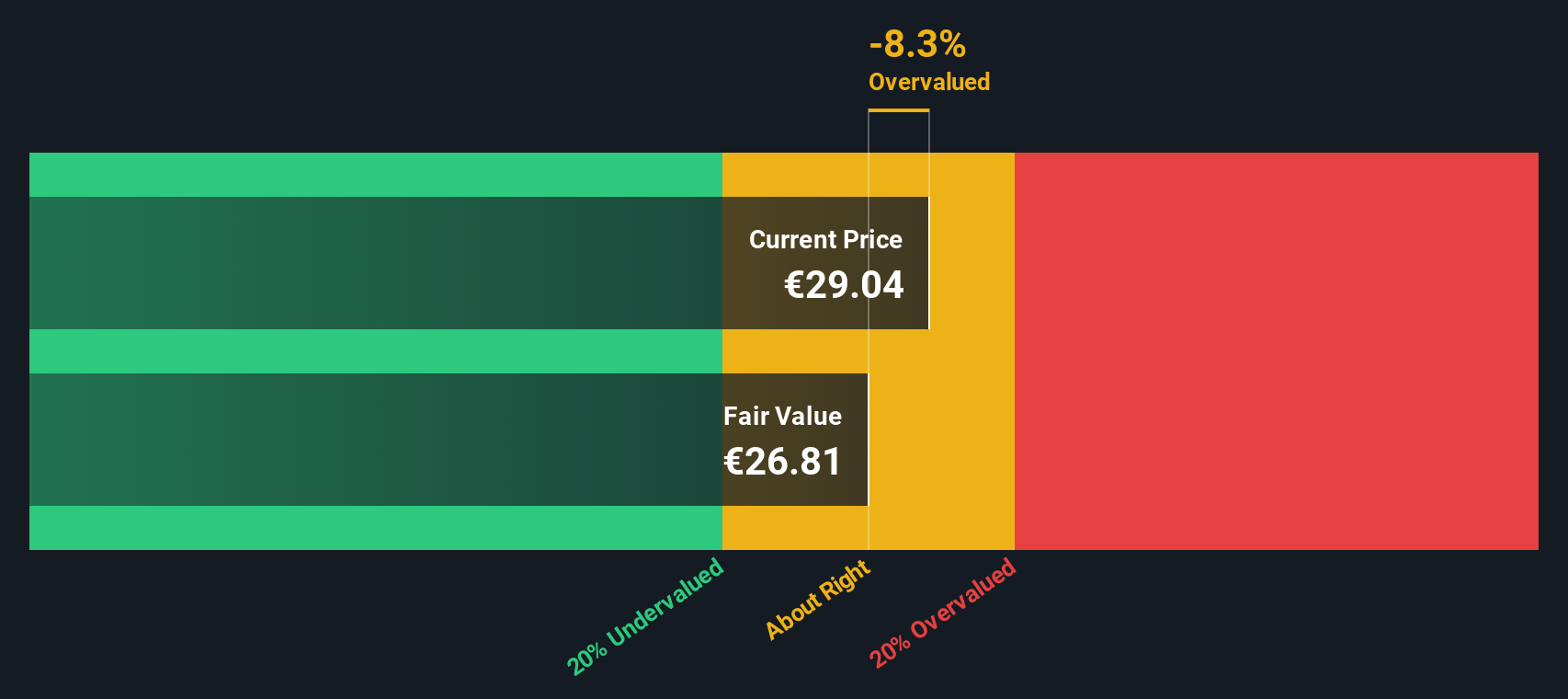

Result: Fair Value of €29.3 (ABOUT RIGHT)

See our latest analysis for Interparfums.However, slower revenue and net income growth, along with the recent share price decline, could challenge the current optimism around Interparfums’ valuation.

Find out about the key risks to this Interparfums narrative.Another View: The SWS DCF Model Tells a Different Story

Looking beyond traditional valuation ratios, our SWS DCF model takes a deep dive into Interparfums' future cash flows. Interestingly, this method suggests the stock may not be trading at a discount right now. It raises the question of whether expectations for future growth align with the market's optimism.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Interparfums Narrative

If you think there’s more to the story or want to dig into the data yourself, you can easily craft your own analysis in just a few minutes. Do it your way

A great starting point for your Interparfums research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't stop your search with just one stock. The smartest investors always keep hunting for fresh opportunities, and Simply Wall Street's Screeners are built to give you an edge.

- Unlock big yields and steady income as you uncover dividend stocks with yields > 3% offering over 3% returns. This option is designed for those who want more from their portfolio.

- Get ahead of the curve in technology by comparing promising advances in neural networks and automation with our exclusive list of AI penny stocks.

- Capitalize on undervalued companies flying under the radar by evaluating undervalued stocks based on cash flows based on real underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ITP

Interparfums

Designs, manufactures, and distributes perfumes and cosmetics through license agreements with ready-to-wear, jewelry, or accessories houses in France, Africa, North America, South America, Eastern Europe, Western Europe, Asia, and the Middle East.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives