Stock Analysis

- France

- /

- Medical Equipment

- /

- ENXTPA:GBT

Exploring Undervalued Opportunities on Euronext Paris With Edenred and Two More Stocks

Reviewed by Simply Wall St

As European markets experience a modest uplift, with France's CAC 40 Index seeing a gain of 0.63%, investors are keenly watching for opportunities that might be lurking beneath the surface of broad market movements. In this context, identifying undervalued stocks becomes particularly compelling, offering potential for those looking to invest in assets that may not yet reflect their intrinsic value given the current economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €25.70 | €50.92 | 49.5% |

| Wavestone (ENXTPA:WAVE) | €57.70 | €93.34 | 38.2% |

| Lectra (ENXTPA:LSS) | €28.90 | €44.00 | 34.3% |

| Thales (ENXTPA:HO) | €153.35 | €267.38 | 42.6% |

| Tikehau Capital (ENXTPA:TKO) | €23.05 | €32.55 | 29.2% |

| Guerbet (ENXTPA:GBT) | €39.65 | €79.11 | 49.9% |

| ENENSYS Technologies (ENXTPA:ALNN6) | €0.608 | €1.09 | 44% |

| Vivendi (ENXTPA:VIV) | €10.99 | €16.36 | 32.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.66 | €9.95 | 43.1% |

| OVH Groupe (ENXTPA:OVH) | €5.70 | €7.57 | 24.7% |

Here's a peek at a few of the choices from the screener.

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a global digital platform for services and payments, catering to companies, employees, and merchants, with a market capitalization of approximately €10.27 billion.

Operations: The company generates revenue primarily through its Business Services segment, which amounted to €2.31 billion.

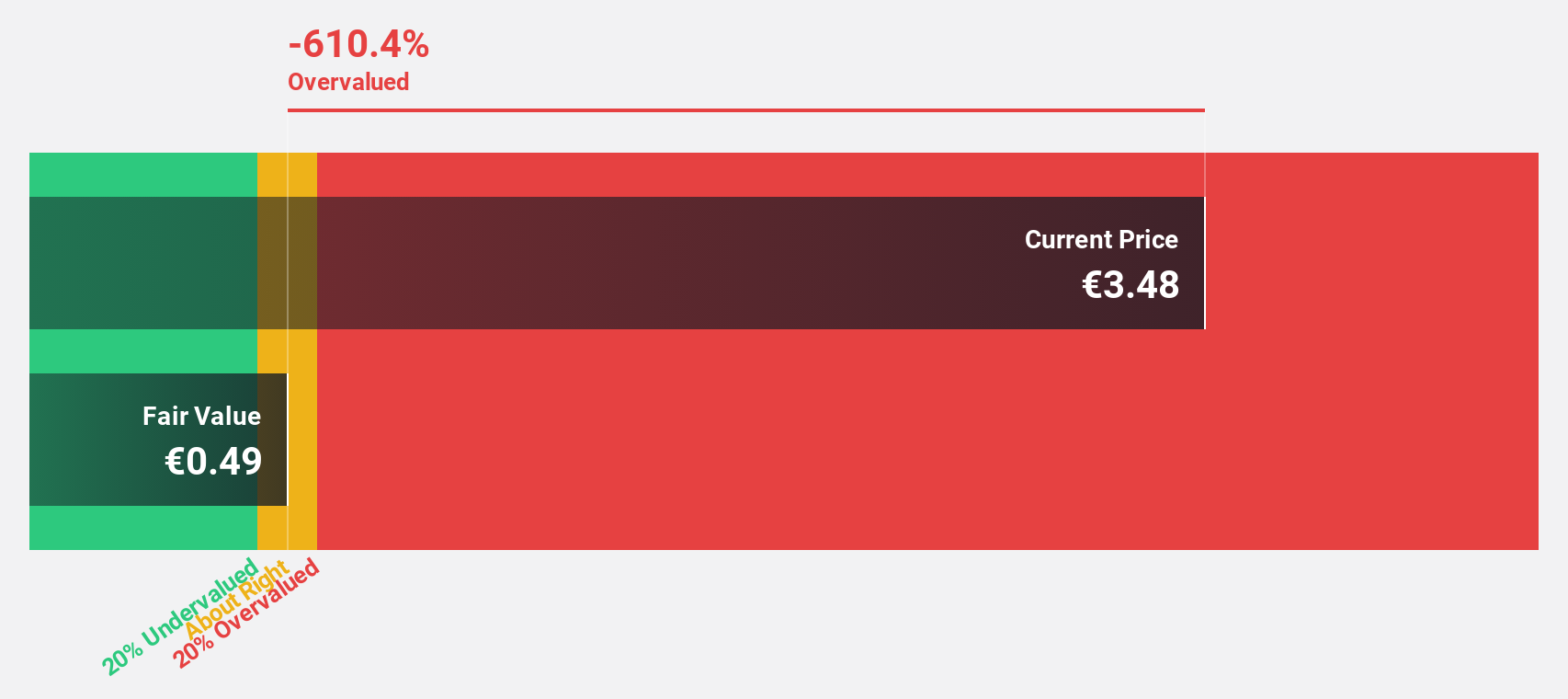

Estimated Discount To Fair Value: 13.7%

Edenred, priced at €41.24, is observed to be 13.7% below its estimated fair value of €47.76, suggesting a potential undervaluation based on discounted cash flows. Despite a high level of debt and dividends not well covered by earnings, Edenred's forecasted earnings growth at 20.3% per year outpaces the French market's 10.9%. However, its profit margins have declined from last year's 19.9% to 11.6%. Analysts predict a substantial price increase of 49.1%, reflecting optimism in its financial trajectory despite some underlying concerns.

- Our earnings growth report unveils the potential for significant increases in Edenred's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Edenred.

Guerbet (ENXTPA:GBT)

Overview: Guerbet SA is a company focused on the development and marketing of contrast media products, delivery systems, medical devices, and related solutions, with a market capitalization of approximately €498.71 million.

Operations: The company generates €795.65 million from the research, development, production, and sale of contrast media for medical imaging.

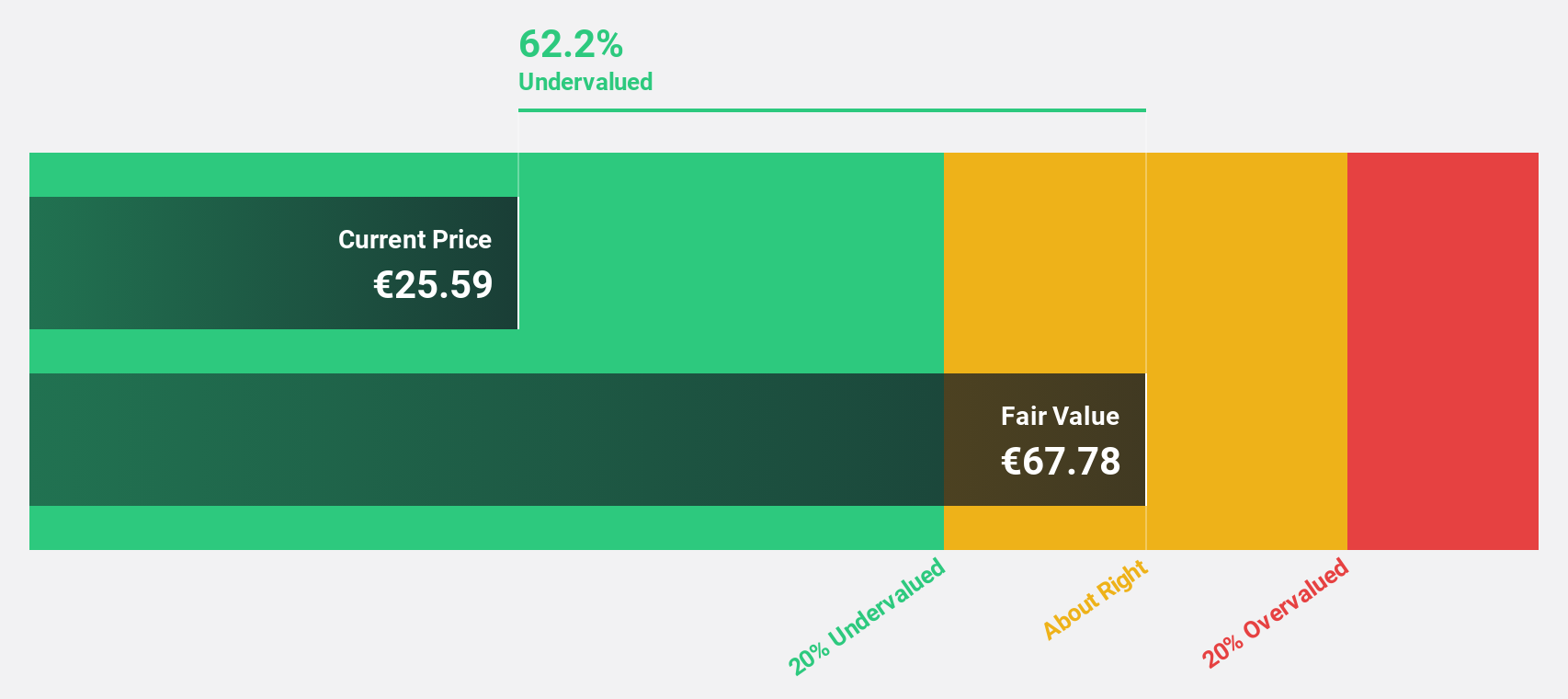

Estimated Discount To Fair Value: 49.9%

Guerbet, trading at €39.65, is substantially below its fair value of €79.11, indicating a significant undervaluation based on discounted cash flows. Recent strategic alliances and leadership changes signal potential enhancements in operational dynamics and market reach, particularly in innovative radiopharmaceuticals. However, concerns linger as debt is poorly covered by operating cash flow and the forecasted Return on Equity remains low at 10.4%. Despite these challenges, earnings are expected to grow by 24.22% annually.

- Insights from our recent growth report point to a promising forecast for Guerbet's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Guerbet.

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is a France-based entertainment, media, and communication company with operations across Europe, the Americas, Asia/Oceania, and Africa, boasting a market capitalization of €11.26 billion.

Operations: Vivendi's revenue is primarily generated through Canal + Group (€6.06 billion), followed by Havas Group (€2.87 billion), Lagardère (€0.67 billion), Gameloft (€0.31 billion), Prisma Media (€0.31 billion), Vivendi Village (€0.18 billion), and New Initiatives (€0.15 billion).

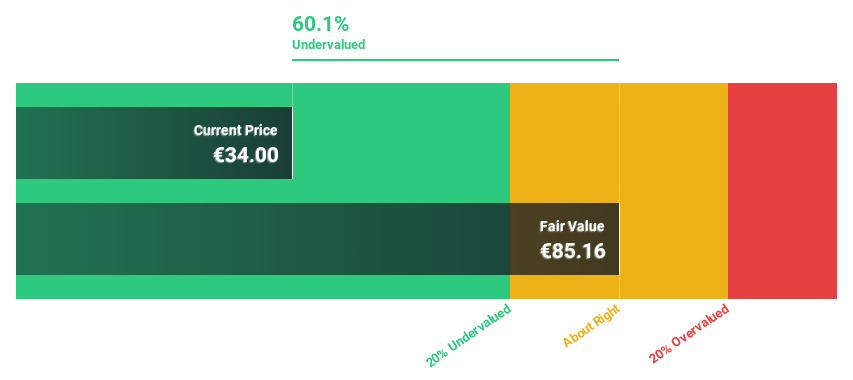

Estimated Discount To Fair Value: 32.8%

Vivendi, priced at €10.99, shows a notable undervaluation against its fair value of €16.36, suggesting potential in cash flow perspectives. With earnings expected to rise by 29.27% annually, it outpaces the broader French market's growth rate. However, its return on equity is projected to remain low at 6%, indicating possible concerns about future profitability efficiency despite rapid revenue and profit growth forecasts and recent strategic moves like Canal+'s planned listing which could reshape financial structures favorably.

- Our expertly prepared growth report on Vivendi implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Vivendi stock in this financial health report.

Summing It All Up

- Gain an insight into the universe of 15 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Guerbet is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GBT

Guerbet

Engages in the development and marketing of contrast media products, delivery systems, medical devices, and related solutions.

Good value with reasonable growth potential.