Stock Analysis

- France

- /

- Healthtech

- /

- ENXTPA:EQS

Exploring Equasens Société Anonyme and Two More High-Yielding Dividend Stocks

Amid a backdrop of fluctuating global markets, with European shares on the rise and the French CAC 40 index showing resilience with a 0.79% increase, investors may seek stability through dividend-yielding stocks. In current conditions, a good stock often combines robust yield prospects with strong fundamentals to weather market volatility.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.68% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 7.76% | ★★★★★★ |

| Equasens Société anonyme (ENXTPA:EQS) | 2.25% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 2.95% | ★★★★★☆ |

| Trigano (ENXTPA:TRI) | 2.41% | ★★★★★☆ |

| Thermador Groupe (ENXTPA:THEP) | 2.56% | ★★★★★☆ |

| TotalEnergies (ENXTPA:TTE) | 5.16% | ★★★★★☆ |

| Legrand (ENXTPA:LR) | 2.18% | ★★★★★☆ |

| Neurones (ENXTPA:NRO) | 2.40% | ★★★★★☆ |

| Gérard Perrier Industrie (ENXTPA:PERR) | 2.18% | ★★★★☆☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Equasens Société anonyme (ENXTPA:EQS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Equasens Société anonyme specializes in delivering healthcare IT solutions across Europe, with a market capitalization of approximately €768.20 million.

Operations: Equasens Société anonyme generates its revenues primarily through two segments: Pharmagest, which contributes €163.27 million, and Axigate Link, adding €33.45 million to the company's financials.

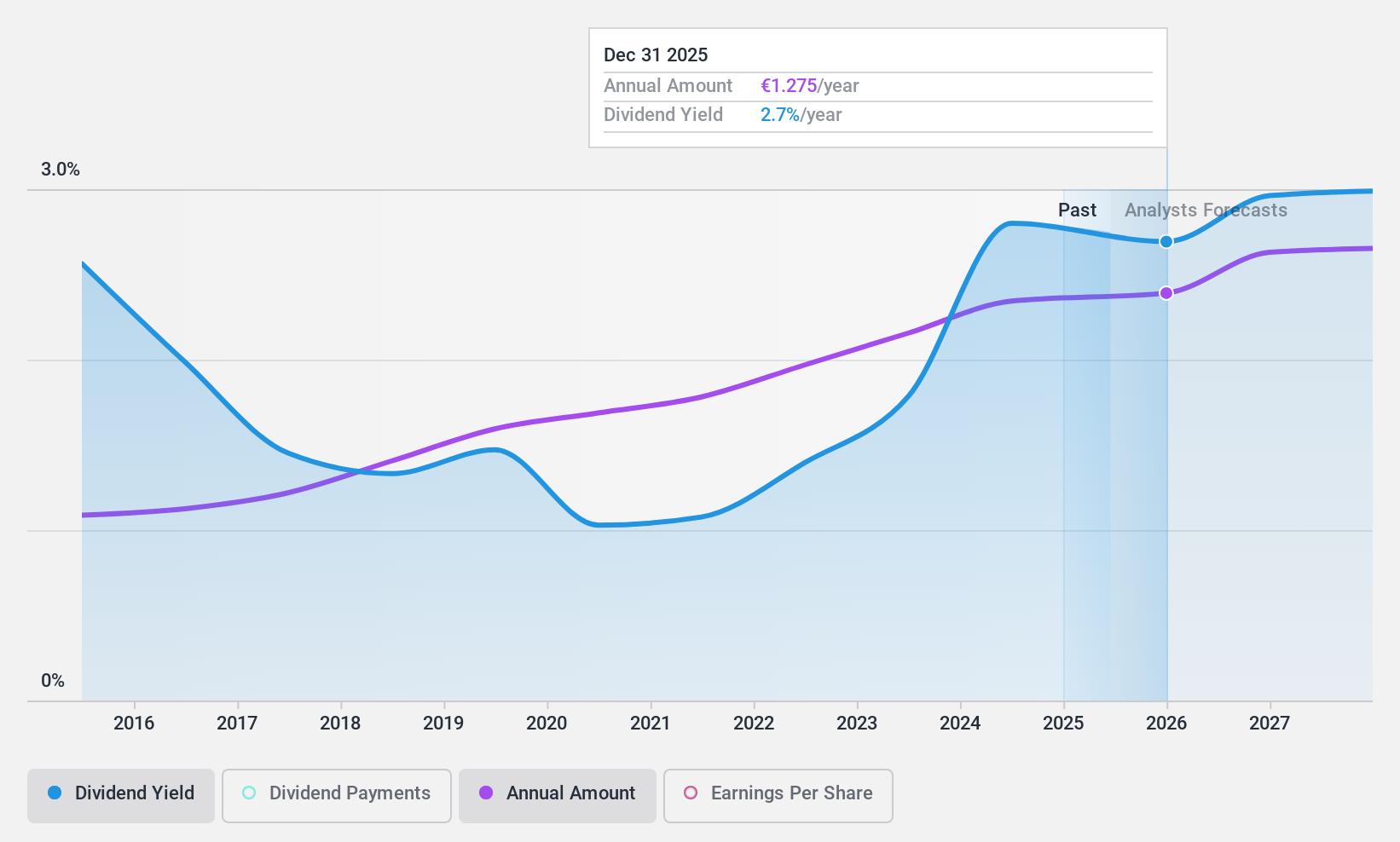

Dividend Yield: 2.3%

Equasens Société anonyme's dividend, yielding 2.25%, is backed by a sustainable payout ratio of 35.7% and cash flows with a payout ratio of 29.5%. Despite a slight revenue dip in Q4 to €57 million from €60.4 million the previous year, annual revenues increased to €219.7 million from €214.1 million, showing resilience. Executive reshuffles aim to bolster divisions like Pharmagest and Medical Solutions, potentially enhancing future performance and stability for shareholders. However, the dividend yield trails behind France's top payers at 5.6%.

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vicat S.A. is a France-based company specializing in the manufacture and distribution of cement, ready-mixed concrete, and aggregates for the construction industry, with a market capitalization of approximately €1.56 billion.

Operations: Vicat S.A. generates its revenue primarily through two segments: cement, contributing €2.53 billion, and concrete & aggregates with €1.51 billion in sales.

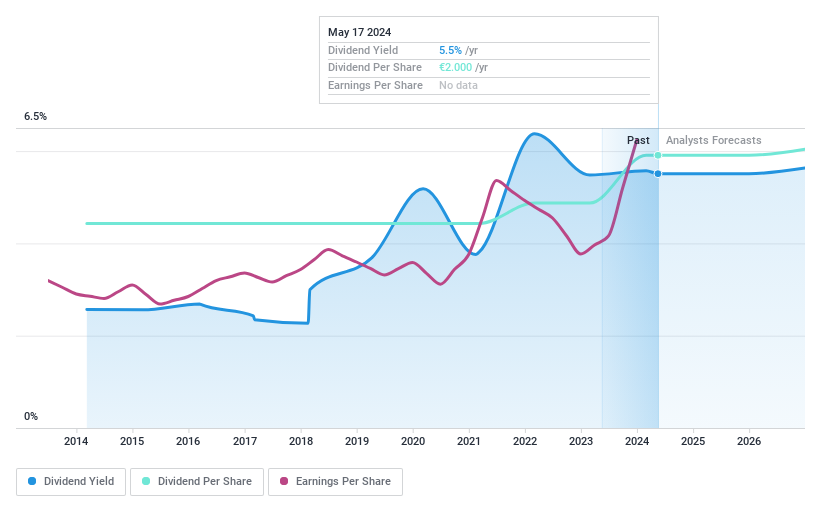

Dividend Yield: 5.7%

Vicat S.A. offers a compelling 5.68% dividend yield, exceeding the French market's top quartile average. The company's dividend has shown a decade of stability and growth, supported by earnings with a 34.7% payout ratio and strong cash flows at 31.8%. Despite this robust foundation, earnings are projected to slightly decline by an average of 0.7% annually over the next three years, signaling caution for future growth prospects. Vicat trades at a significant discount to estimated fair value and recently announced an upcoming dividend of €2 per share, reinforcing its commitment to shareholder returns amidst high debt levels.

Thermador Groupe (ENXTPA:THEP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Thermador Groupe SA is a French-based company that specializes in the distribution of various products both domestically and internationally, with a market capitalization of approximately €747.79 million.

Operations: Thermador Groupe SA's revenue is generated through its distribution segments, including Aello (€19.95 million), Odrea (€79.62 million), Fginox (€17.03 million), Syveco (€34.27 million), Axelair (€7.45 million), Sectorial (€34.19 million), Distrilabo (€6.75 million), Thermacoma (€21.67 million), Jetly Pumps (€62.14 million), Sodeco Valves (€23.93 million), Mecafer / Domac (€40.58 million), Pbtub Tubes in Materials (€29.88million) , Sferaco Valves and Fittings( €95 .46million) , Isocel Manufacturers Boilers( €10 .85million) , and Thermador Accessories of Heating( €112 .99million).

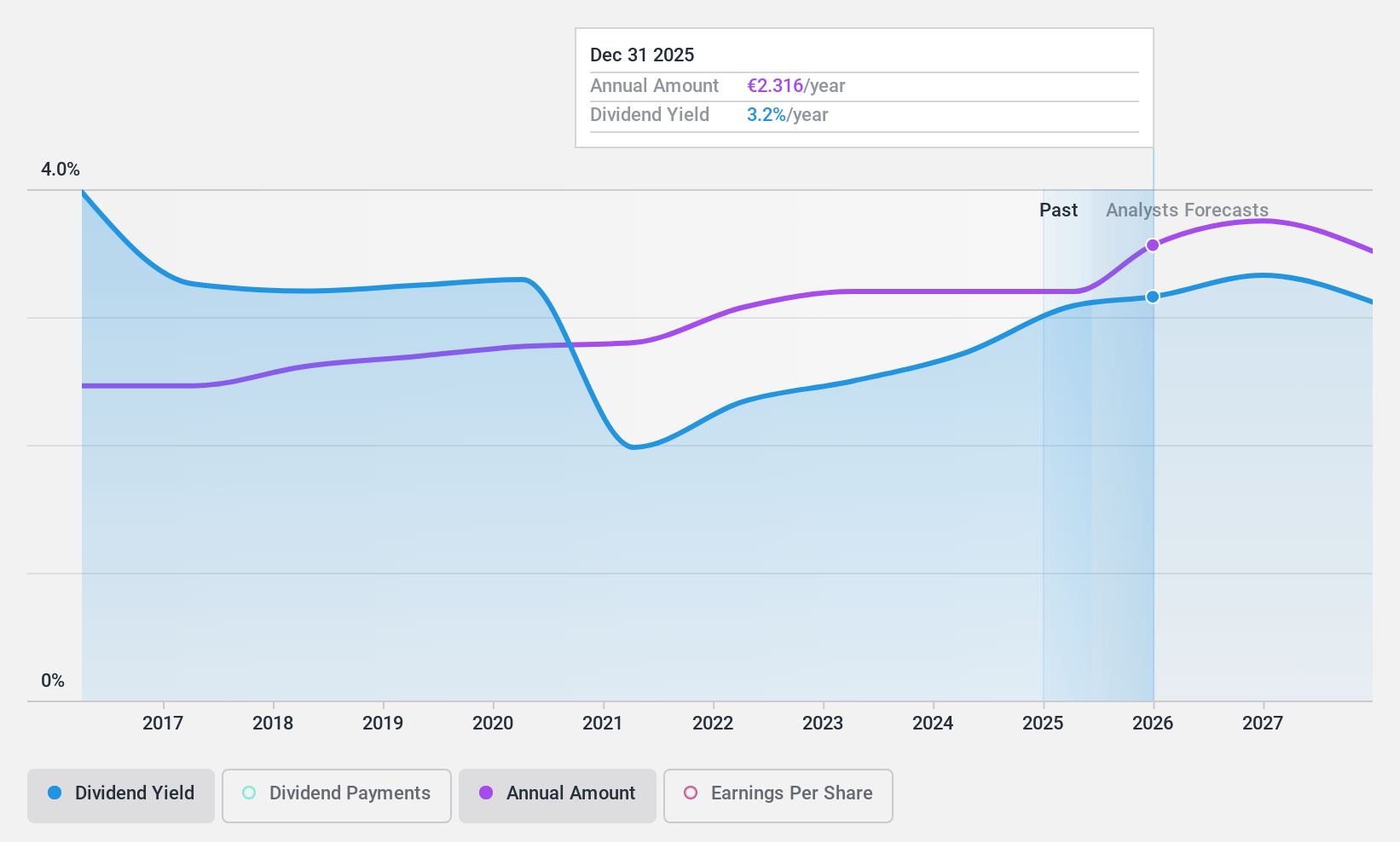

Dividend Yield: 2.6%

Thermador Groupe maintains a modest dividend yield of €2.56, underperforming the top French dividend payers. However, its decade-long track record of consistent growth in dividends is backed by a sustainable payout ratio of 30.6% and cash flow coverage at 37.9%. Despite earnings expected to dip slightly by an average of 0.6% per year over the next three years, the stock trades below fair value estimates, potentially offering upside alongside reliable shareholder payouts.

Make It Happen

- Dive into all 28 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Equasens Société anonyme is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EQS

Equasens Société anonyme

Equasens Société anonyme provides healthcare IT solutions in Europe.

Flawless balance sheet with solid track record and pays a dividend.