- France

- /

- Medical Equipment

- /

- ENXTPA:EL

With EPS Growth And More, EssilorLuxottica Société anonyme (EPA:EL) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in EssilorLuxottica Société anonyme (EPA:EL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for EssilorLuxottica Société anonyme

EssilorLuxottica Société anonyme's Improving Profits

In the last three years EssilorLuxottica Société anonyme's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. EssilorLuxottica Société anonyme's EPS skyrocketed from €4.02 to €5.20, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 30%.

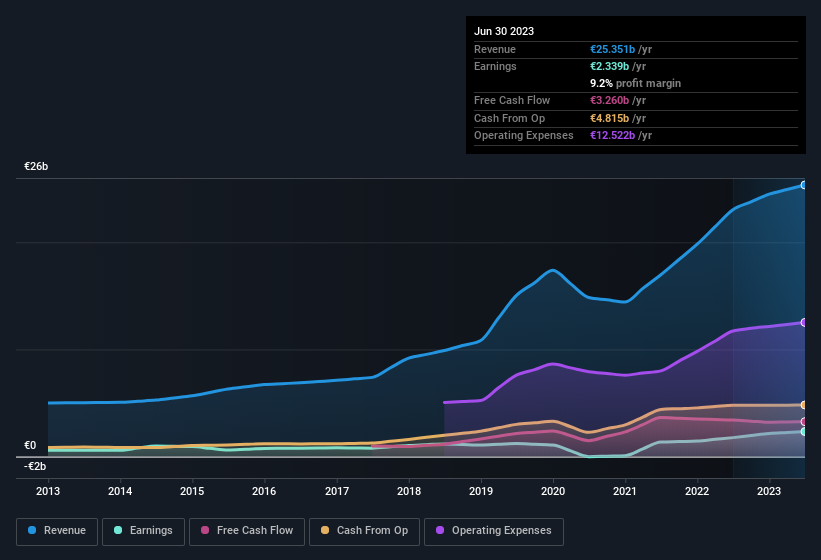

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for EssilorLuxottica Société anonyme remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 10% to €25b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for EssilorLuxottica Société anonyme's future EPS 100% free.

Are EssilorLuxottica Société anonyme Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a €83b company like EssilorLuxottica Société anonyme. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Holding €79m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

Should You Add EssilorLuxottica Société anonyme To Your Watchlist?

For growth investors, EssilorLuxottica Société anonyme's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of EssilorLuxottica Société anonyme.

Although EssilorLuxottica Société anonyme certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in Europe, the Middle East, Africa, Latin America, the Asia-Pacific, and North America.

Moderate growth potential with mediocre balance sheet.