- France

- /

- Medical Equipment

- /

- ENXTPA:EL

Does EssilorLuxottica’s Elite Scientific Committee Appointment Signal a New R&D Era for ENXTPA:EL?

Reviewed by Sasha Jovanovic

- EssilorLuxottica recently announced the formation of its Scientific Advisory Committee, bringing together five renowned experts, including Nobel and Fields medal laureates, to provide strategic scientific guidance across fields such as ophthalmology, optics, audiology, AI, and bioethics.

- This move strengthens EssilorLuxottica’s scientific foundation and highlights its focus on pioneering research and innovation in eye health and technology.

- We'll explore how the appointment of globally recognized scientists to its Advisory Committee may influence EssilorLuxottica’s investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

EssilorLuxottica Société anonyme Investment Narrative Recap

To be a shareholder in EssilorLuxottica, investors need confidence in the company's ability to balance high investment in scientific research and product innovation with the execution challenges of rapidly evolving optical technologies. While the formation of a Scientific Advisory Committee elevates the company’s scientific credibility, its immediate impact on the most important short-term catalyst, successful commercial adoption of smart and AI-enabled eyewear, appears limited; key risks such as margin pressure from new technologies and global inflation persist.

The most relevant recent announcement is the launch of the upgraded Stellest 2.0 platform for myopia management, as it directly supports the company’s position in high-growth, technology-driven eye health solutions, one of the primary catalysts for capturing market share and sustaining revenue growth in the face of industry disruption.

On the flip side, investors should be aware of execution risks around commercializing new wearable and smart eyewear products, particularly as ...

Read the full narrative on EssilorLuxottica Société anonyme (it's free!)

EssilorLuxottica Société anonyme is projected to reach €32.6 billion in revenue and €3.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.1% and an earnings increase of €1.3 billion from the current €2.4 billion.

Uncover how EssilorLuxottica Société anonyme's forecasts yield a €318.65 fair value, a 4% upside to its current price.

Exploring Other Perspectives

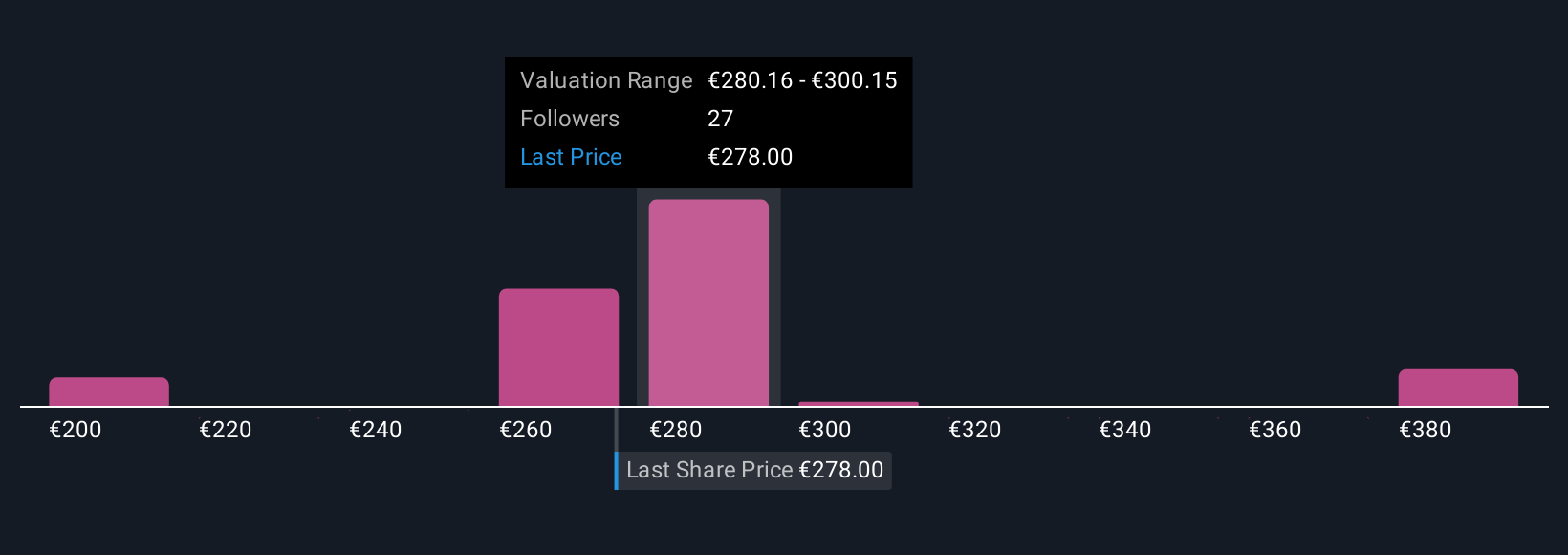

Fair value estimates from eight Simply Wall St Community members for EssilorLuxottica range from €200.22 to €400.08 per share, highlighting a span of outlooks. With commercial adoption of innovative eyewear still a major risk, you can explore how these differing viewpoints reflect the uncertainty in the company’s future performance.

Explore 8 other fair value estimates on EssilorLuxottica Société anonyme - why the stock might be worth 35% less than the current price!

Build Your Own EssilorLuxottica Société anonyme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EssilorLuxottica Société anonyme research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free EssilorLuxottica Société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EssilorLuxottica Société anonyme's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EL

EssilorLuxottica Société anonyme

Designs, manufactures, and distributes ophthalmic lenses, frames, and sunglasses in North America, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026