Stock Analysis

- France

- /

- Healthtech

- /

- ENXTPA:CGM

Investors five-year losses continue as Cegedim (EPA:CGM) dips a further 19% this week, earnings continue to decline

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. For example, after five long years the Cegedim SA (EPA:CGM) share price is a whole 52% lower. That's an unpleasant experience for long term holders. And it's not just long term holders hurting, because the stock is down 32% in the last year. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Cegedim has shed €42m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Cegedim

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

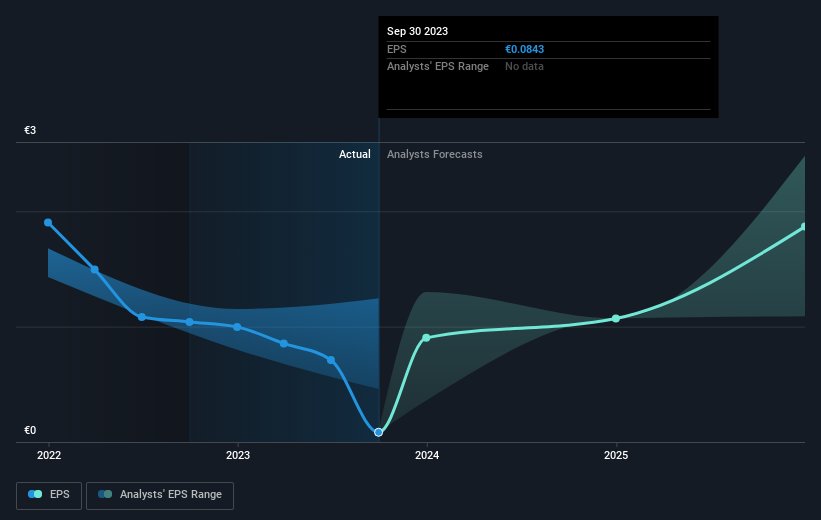

During the five years over which the share price declined, Cegedim's earnings per share (EPS) dropped by 33% each year. This fall in the EPS is worse than the 14% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. The high P/E ratio of 154.24 suggests that shareholders believe earnings will grow in the years ahead.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Cegedim's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 12% in the last year, Cegedim shareholders lost 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Cegedim better, we need to consider many other factors. For example, we've discovered 3 warning signs for Cegedim that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Cegedim is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CGM

Cegedim

Cegedim SA operates as a technology and services company in the field of digital data flow management for healthcare ecosystem and B2B, and business software publisher for healthcare and insurance professionals in France, other European countries, and internationally.

Very undervalued with adequate balance sheet.