Undiscovered Gems In France Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The French market has shown resilience amid global economic shifts, with the CAC 40 Index adding 0.47% recently, reflecting cautious optimism among investors. As small-cap stocks gain traction in this environment, identifying promising opportunities becomes crucial for those looking to capitalize on potential growth. In this context, a good stock often combines solid fundamentals with the ability to navigate current market conditions effectively. Here are three small-cap companies in France that stand out as undiscovered gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 72.14% | 5.72% | 19.86% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Fiducial Real Estate | 33.77% | 1.63% | 3.30% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher with operations spanning France, the rest of Europe, the Americas, and the Asia Pacific, and has a market cap of approximately €694.21 million.

Operations: Axway Software SA generates its revenue from four primary segments: License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services excluding Subscription (€35.49 million).

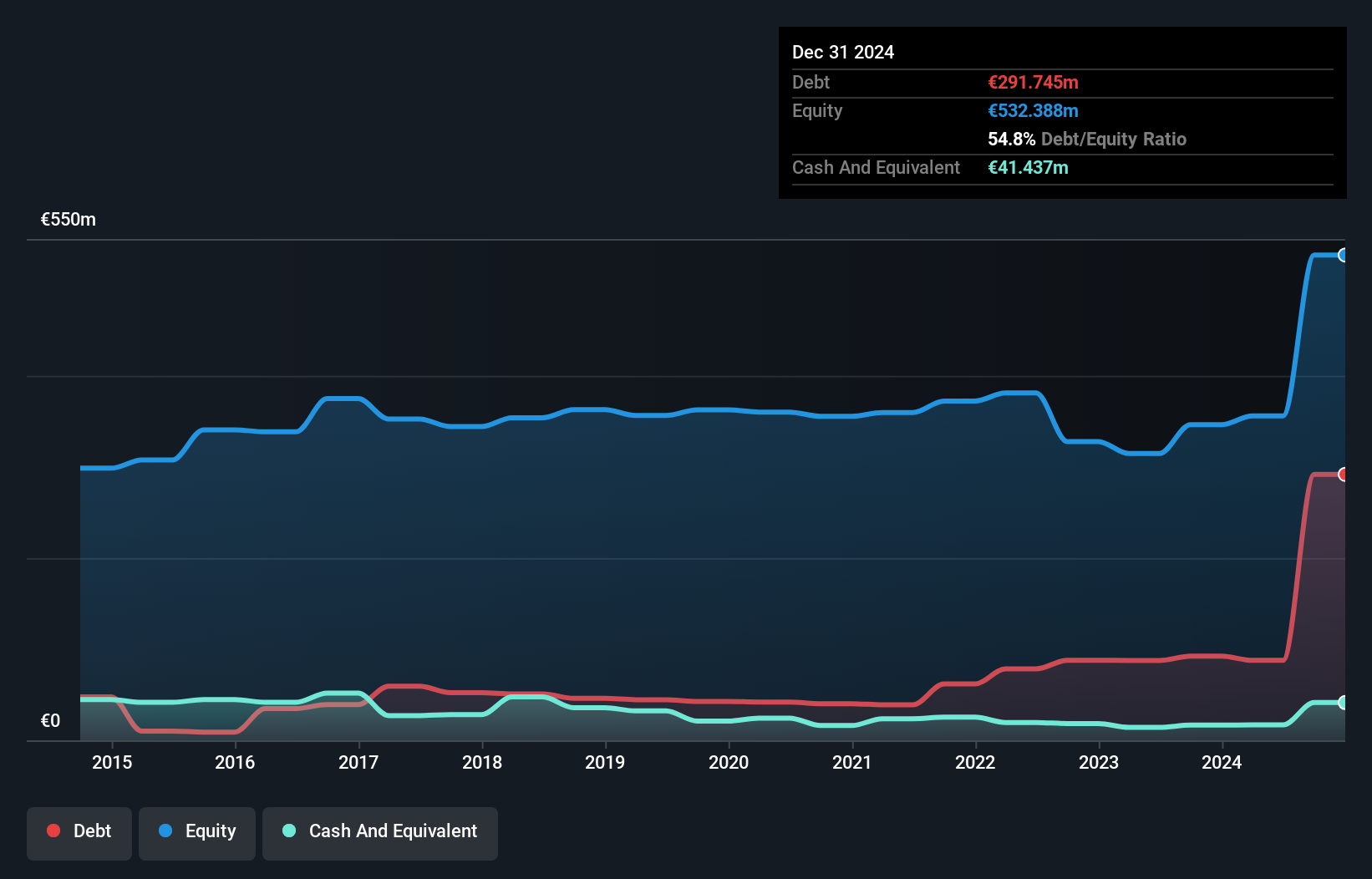

Axway Software, a small French tech company, has shown promising financial metrics recently. With a price-to-earnings ratio of 19.9x below the industry average of 35.1x and high-quality earnings, Axway stands out in its sector. The net debt to equity ratio is satisfactory at 19.9%, and interest payments are well covered by EBIT at 10.1x coverage. Despite shareholder dilution over the past year, Axway's recent profitability and strategic acquisitions position it for potential growth in the coming years.

- Get an in-depth perspective on Axway Software's performance by reading our health report here.

Explore historical data to track Axway Software's performance over time in our Past section.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services in France and internationally, with a market cap of €1.06 billion.

Operations: Neurones generates revenue primarily through its infrastructure, application, and consulting services. The company reported a market cap of €1.06 billion.

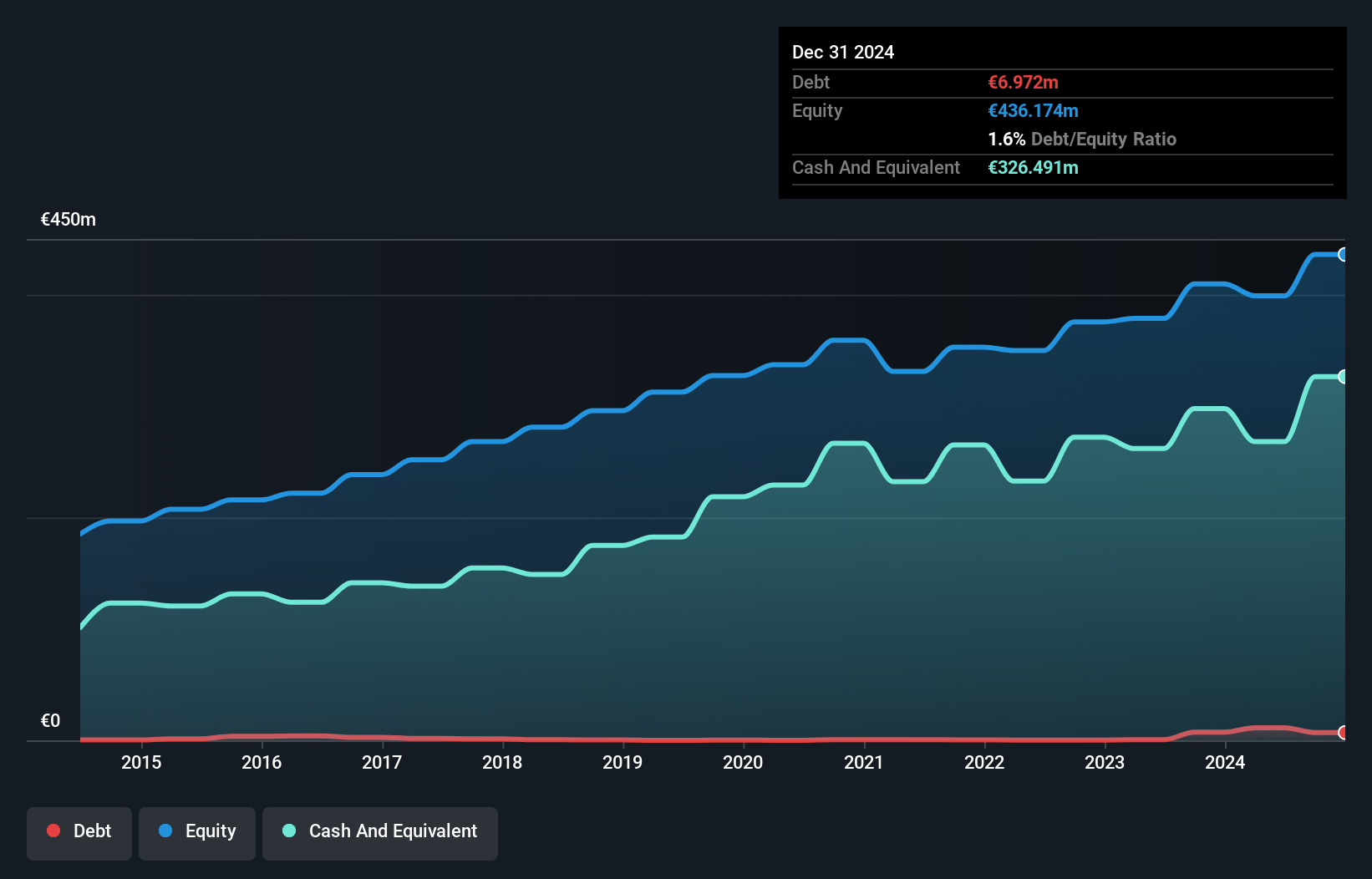

Neurones has shown resilience in the IT sector, with earnings growth of 1.8% over the past year, outpacing the industry average of -7.4%. The company reported half-year revenue of €402.43 million, up from €368.69 million last year, although net income dipped slightly to €24.5 million from €25.42 million previously. Their debt-to-equity ratio rose to 2.8% over five years but remains manageable with more cash than total debt and positive free cash flow at €63.97 million as of June 2023.

- Unlock comprehensive insights into our analysis of Neurones stock in this health report.

Examine Neurones' past performance report to understand how it has performed in the past.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA produces, distributes, and markets dairy and cheese products in France, the rest of Europe, and internationally with a market cap of €692.76 million.

Operations: Savencia's revenue streams primarily come from the production, distribution, and marketing of dairy and cheese products across various regions. The company has a market cap of €692.76 million.

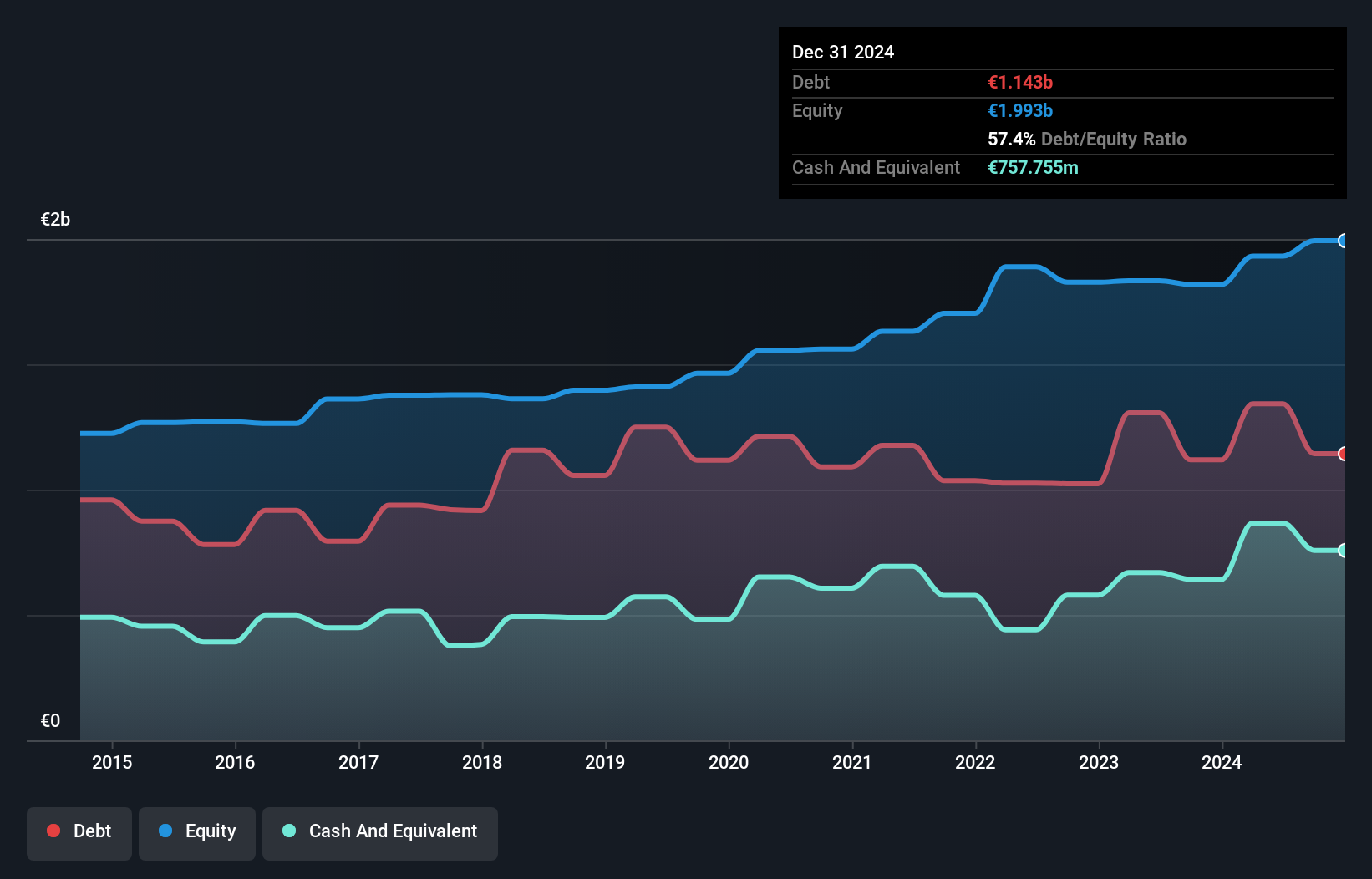

Savencia's recent half-year earnings report showed sales of €3.38 billion, slightly up from €3.38 billion last year, with net income rising to €57.92 million from €51.29 million. Basic and diluted EPS both increased to €4.33 from €3.8 previously, reflecting robust performance despite a one-off loss of €43.6M impacting the past 12 months' results ending June 30, 2024. The company’s net debt to equity ratio stands at a satisfactory 24.9%, and its EBIT covers interest payments by 12.7x.

- Navigate through the intricacies of Savencia with our comprehensive health report here.

Gain insights into Savencia's past trends and performance with our Past report.

Where To Now?

- Gain an insight into the universe of 31 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AXW

Axway Software

Operates as an infrastructure software publisher in France, rest of Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with acceptable track record.