As the French market exhibits a steady temperament, remaining flat over the last week yet showing a 3.5% uplift over the past year, investors are eyeing opportunities for sustainable growth amidst predictions of a 10% annual increase in earnings. In this environment, selecting dividend stocks that offer not only regular income but also potential for capital appreciation becomes increasingly compelling for those looking to bolster their portfolios.

Top 10 Dividend Stocks In France

Click here to see the full list of Top Dividend Stocks.

| Name | Dividend Yield |

| CBo Territoria (ENXTPA:CBOT) | 6.67% |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 7.79% |

| Teleperformance (ENXTPA:TEP) | 2.73% |

| Equasens Société anonyme (ENXTPA:EQS) | 2.40% |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 2.88% |

| Neurones (ENXTPA:NRO) | 2.43% |

| Trigano (ENXTPA:TRI) | 2.38% |

| TotalEnergies (ENXTPA:TTE) | 5.34% |

| Thermador Groupe (ENXTPA:THEP) | 2.46% |

| Legrand (ENXTPA:LR) | 2.04% |

Underneath we present 3 selections from our Top Dividend Stocks screen.

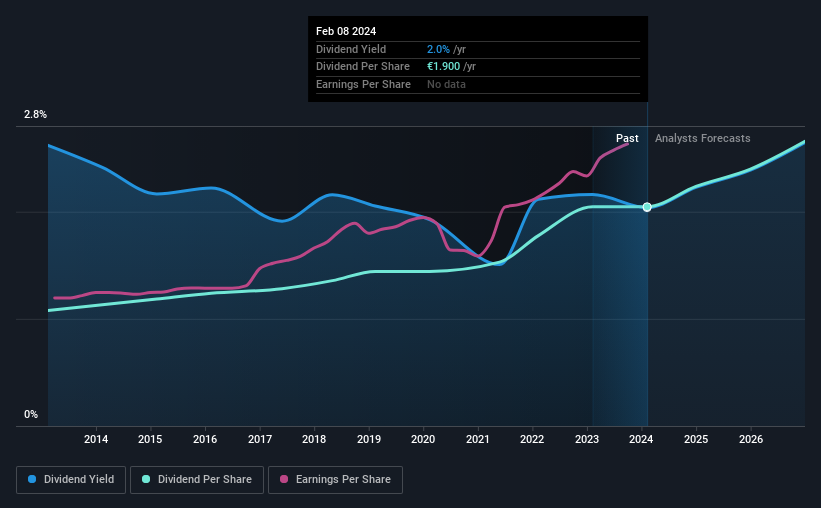

L.D.C (ENXTPA:LOUP)

L.D.C S.A., a French multinational, operates in the poultry and processed products sector with a market capitalization of €2.31 billion. Its revenue streams are primarily from poultry (€4.46 billion) and have international reach (€877 million). The analysis reveals L.D.C's financial prudence, evidenced by halving its debt to equity ratio over five years and consistently increasing earnings by an average of 12.1% annually during the same period. Notably, profit margins have improved, with current net margins surpassing those of the previous year. The company's dividends appear sustainable due to a low payout ratio and ample coverage by both earnings and cash flows; however, dividend payments have shown volatility over the past decade. Despite this inconsistency, L.D.C has managed to increase its dividend payouts over time but offers a yield that is modest compared to France's top dividend payers. Revenue growth is expected but at a modest pace, while debt levels are comfortably serviced by operating cash flow and interest obligations are easily met by earned interest income. Take a closer look at L.D.C's potential here.

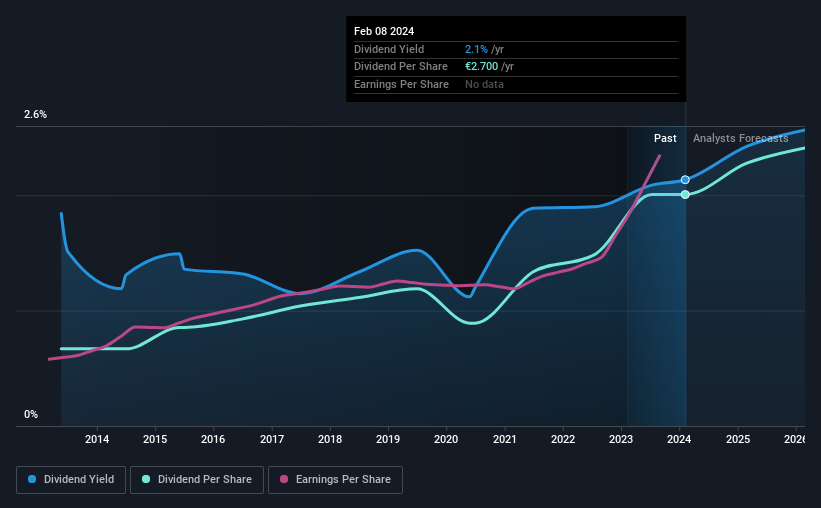

Legrand (ENXTPA:LR)

Legrand SA, a global provider of electrical and digital building infrastructures, has a market capitalization of €24.44 billion, with its electric equipment segment generating €8.49 billion in revenue. Analyzing Legrand's financial health in the context of dividend stocks reveals a mixed picture; while the company's earnings have consistently grown over the past five years and its profit margins have improved from last year, debt to equity ratios have seen an uptick. However, Legrand demonstrates strong cash flow management with operating cash flows sufficiently covering debt and interest payments by comfortable margins. Dividend sustainability is underscored by low payout ratios on both earnings and cash flows, indicating that dividends are well-protected despite not being among the highest yields in France. The company has also maintained stable dividends over the past decade with an upward trend but faces modest forecasts for future revenue and profit growth. Navigate through the intricacies of Legrand with our comprehensive report here.

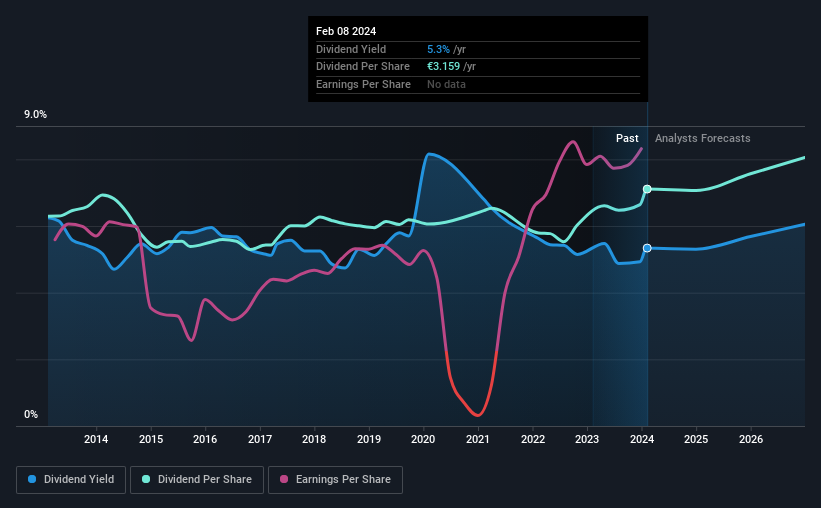

TotalEnergies (ENXTPA:TTE)

TotalEnergies SE operates across diverse energy sectors, with its Refining & Chemicals and Marketing & Services segments as significant revenue contributors. The company's financial analysis reveals a positive trend in debt management, with a reduction in the debt to equity ratio over five years and robust coverage of debt by operating cash flow. Earnings have grown notably annually over this period, although recent growth has decelerated compared to the five-year average. Despite not offering top-tier dividend yields in comparison to the French market's best performers, TotalEnergies' dividends are sustainable; supported by a conservative payout ratio and ample coverage from both earnings and cash flows. Dividend reliability is evidenced through consistent payments over the past decade, yet future forecasts suggest potential challenges with expected declines in profit and revenue growth. Click to explore a detailed breakdown of our findings on TotalEnergies.

Final Thoughts

Harness the power of data-driven insights to uncover dividend stocks tailored to your financial goals with the Simply Wall St screener. Access the full spectrum of Top Dividend Stocks by clicking on this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether L.D.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LOUP

L.D.C

L.D.C. S.A. produces and sells poultry and processed products in France and internationally.

Very undervalued with flawless balance sheet.