Bonduelle SCA's (EPA:BON) CEO Might Not Expect Shareholders To Be So Generous This Year

Bonduelle SCA (EPA:BON) has not performed well recently and CEO Guillaume Debrosse will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 02 December 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Bonduelle

Comparing Bonduelle SCA's CEO Compensation With the industry

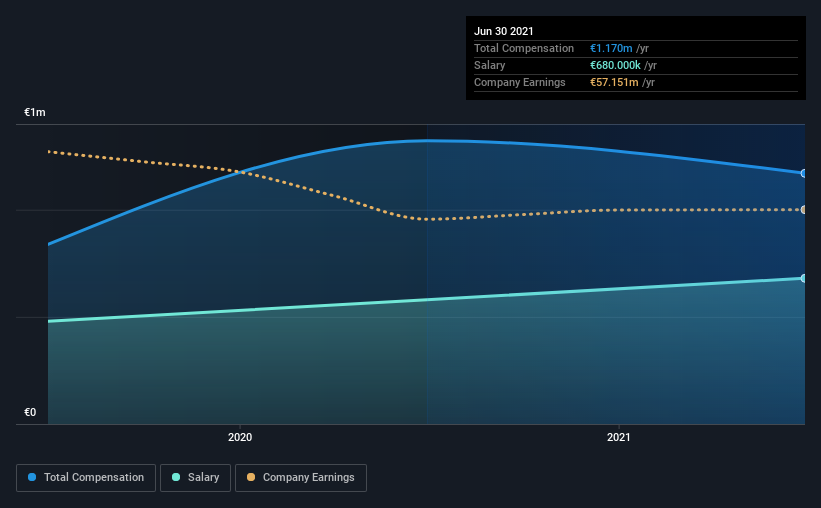

At the time of writing, our data shows that Bonduelle SCA has a market capitalization of €686m, and reported total annual CEO compensation of €1.2m for the year to June 2021. We note that's a decrease of 12% compared to last year. Notably, the salary which is €680.0k, represents a considerable chunk of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from €357m to €1.4b, we found that the median CEO total compensation was €702k. Hence, we can conclude that Guillaume Debrosse is remunerated higher than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | €680k | €580k | 58% |

| Other | €490k | €742k | 42% |

| Total Compensation | €1.2m | €1.3m | 100% |

Speaking on an industry level, nearly 58% of total compensation represents salary, while the remainder of 42% is other remuneration. Although there is a difference in how total compensation is set, Bonduelle more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Bonduelle SCA's Growth Numbers

Bonduelle SCA has reduced its earnings per share by 7.9% a year over the last three years. In the last year, its revenue is down 2.7%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bonduelle SCA Been A Good Investment?

With a three year total loss of 29% for the shareholders, Bonduelle SCA would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Bonduelle that you should be aware of before investing.

Switching gears from Bonduelle, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Bonduelle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:BON

Bonduelle

Engages in the provision of plant-based food in Europe and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives