Is Now the Right Moment for Danone After Shares Jump 19% in the Past Year?

Reviewed by Bailey Pemberton

- Wondering if Danone is a hidden gem or just another big name in the consumer staples sector? If you have ever questioned whether now is the right time to own the stock, you are not alone.

- Danone's shares have had some noteworthy moves lately, gaining 5.5% over the past month and delivering an impressive 19.1% return in the last year.

- Recent headlines have highlighted Danone's strategic initiatives, including sustainability goals and new product launches, sparking investor interest. Market watchers are also buzzing about regulatory developments that may influence the company's international operations.

- According to our valuation checks, Danone's score is 2 out of 6, suggesting the stock may not be the bargain some are hoping for. Before making up your mind, let’s see what traditional valuation methods reveal, and stick around for what could be an even smarter approach.

Danone scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Danone Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and discounting those figures back to today’s value. The idea is to determine what Danone’s long-term cash generation is worth right now, in euros, based on likely growth and the time value of money.

Currently, Danone reports Free Cash Flow (FCF) of €2.96 billion. According to analyst predictions and further extrapolation, Danone’s FCF is expected to increase to €3.23 billion by 2029, with a steady climb seen across the next decade. The first five years are based on actual analyst estimates. Projections beyond that use the platform’s best-fit extrapolation models. This method helps capture both expected performance and reasonable assumptions for later years.

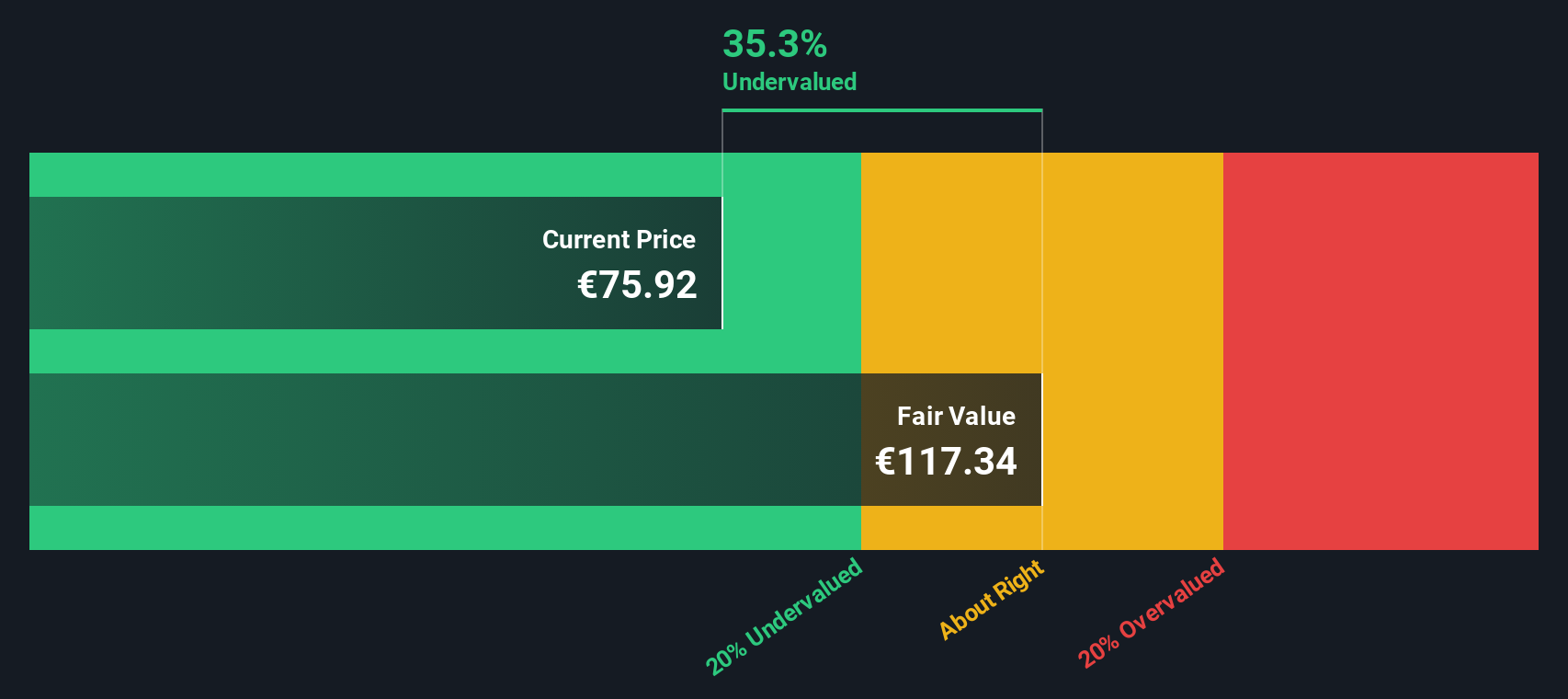

The DCF calculation arrives at an estimated intrinsic fair value for Danone shares of €122.68. With a current discount of 37.1%, this model suggests Danone is trading well below its projected worth based on cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Danone is undervalued by 37.1%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Danone Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular tool for valuing profitable companies like Danone, as it relates the current share price to the company’s earnings. Investors often turn to the PE ratio to gauge whether a stock is priced fairly, especially for established businesses generating steady profits.

What counts as a “normal” PE ratio depends on several factors, including expected growth rates and risk profile. Companies with strong growth prospects or lower risk can justify higher PE ratios because investors are willing to pay more for each euro of future earnings. Conversely, a weaker outlook or more uncertainty typically means a lower multiple is warranted.

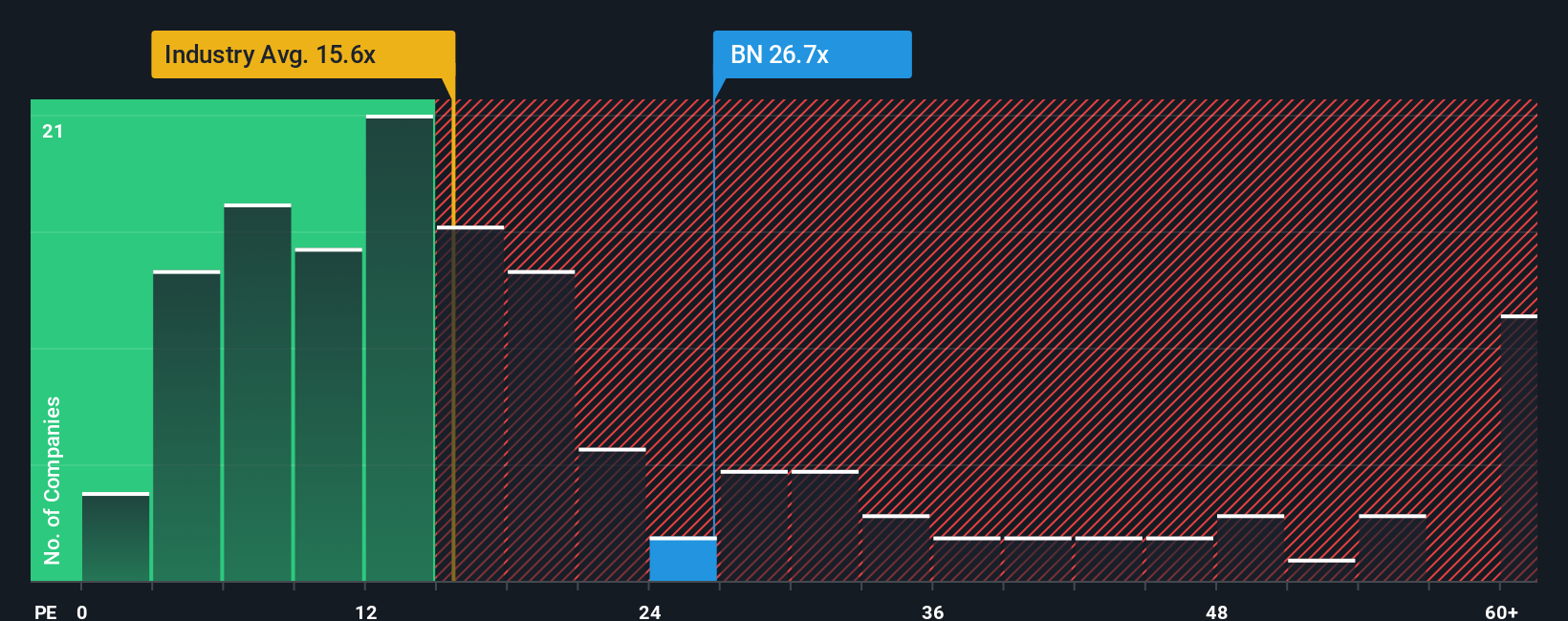

Looking at the numbers, Danone currently trades on a PE ratio of 27.1x. This is notably higher than the food industry average of 16.3x and its peer group’s average of 12.3x. This suggests a premium is being placed on the company’s shares compared to others in the sector.

This is where Simply Wall St's Fair Ratio comes in and provides a more nuanced assessment. The Fair Ratio for Danone is 24.6x, reflecting factors such as its growth expectations, risk profile, profit margins, industry, and market capitalization. Unlike simple peer or sector comparisons, the Fair Ratio gives a more accurate sense of what Danone should be worth by factoring in its unique qualities and outlook.

Comparing the Fair Ratio of 24.6x with Danone’s current 27.1x PE, the valuation is slightly ahead of what fundamentals would suggest. While Danone’s premium pricing is not extreme, it does point to the stock being modestly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danone Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives go beyond formulas and ratios by letting you frame your own story about Danone’s future, connecting what you believe about the business, such as its leadership in premium nutrition, digital growth, or its exposure to global risks, to your financial outlook, including assumptions for future revenue, profit margins, and a fair value for the stock.

Simply Wall St makes Narratives easy for investors of any level. On the Community page, millions share their perspectives and translate them directly into forecasts and fair values. This means your view of Danone, whether cautious or optimistic, gets connected to actionable numbers that are continuously updated as new news or earnings reports emerge. Narratives are much more dynamic and responsive than traditional models, helping you decide if now is the right time to buy or sell by comparing your fair value against the current market price.

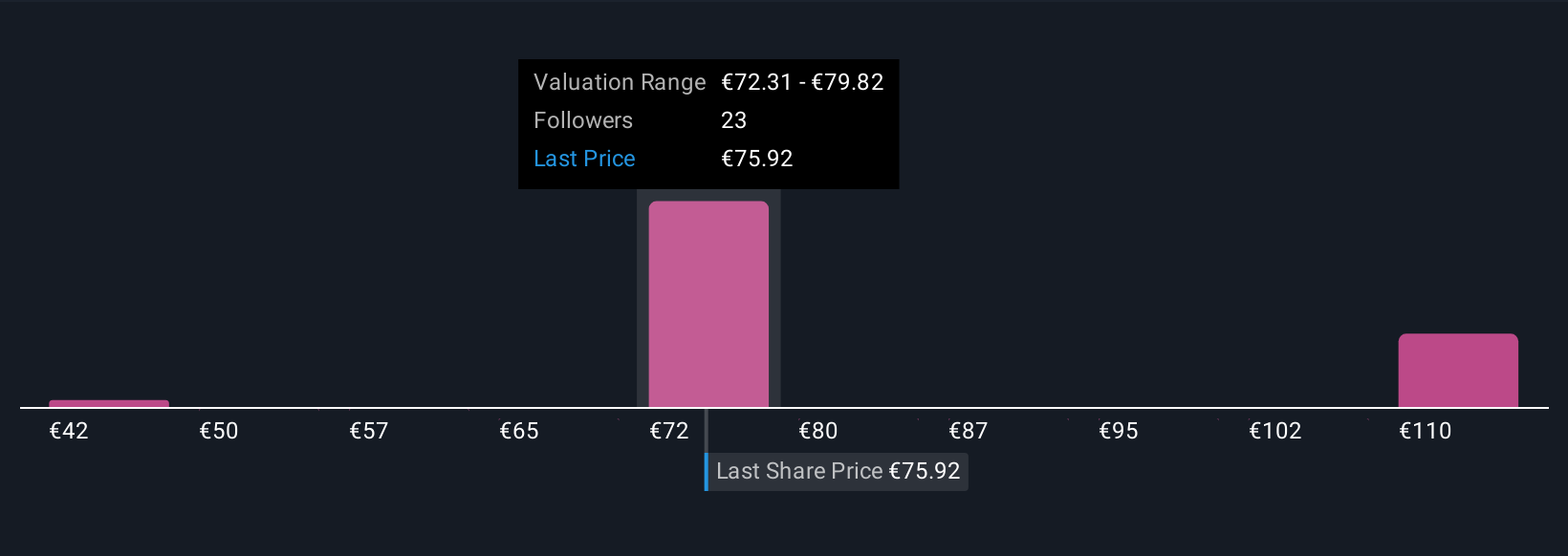

For example, when it comes to Danone, some investors project bullish scenarios, such as sustained growth in health-driven products and successful entry into emerging markets, putting fair value as high as €85. Others highlight risks around operational inefficiency, legacy products, or foreign exchange, setting fair value closer to €62. Narratives let you bring your outlook to life and make smarter investment decisions, supported by up-to-date data and real community insights.

Do you think there's more to the story for Danone? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives