How Strong China Sales and 2025 Outlook at Danone (ENXTPA:BN) Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- Danone reported third-quarter 2025 sales of €6.88 billion, surpassing expectations as robust growth in China’s infant milk formula and medical nutrition offset weaker demand in North America.

- The company reconfirmed its full-year 2025 outlook, highlighting China's contribution as an increasingly critical driver amid concerns about regional diversification and evolving consumer preferences.

- We’ll explore how China’s exceptional performance and Danone’s renewed guidance may influence the company’s investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Danone Investment Narrative Recap

To be a Danone shareholder right now, you have to believe that its pivot toward growth in specialized nutrition and emerging markets, especially China, can counterbalance ongoing weakness in core, mature Western markets. The recent Q3 sales beat, led by China, underscores this short-term catalyst; however, exposure to shifts in Chinese demand and regional concentration remains the biggest risk. The latest results don't materially change that risk/reward trade-off, but highlight the urgency of regional diversification.

Of all recent announcements, Danone's confirmed 2025 guidance is most relevant, signaling management’s confidence in delivering 3% to 5% like-for-like sales growth with operating income outpacing sales. This outlook ties directly into the current growth catalyst: expanding high-margin nutrition segments while managing headwinds in traditional dairy and plant-based categories. Ultimately, this forward guidance reinforces the central investment thesis but doesn't fully address the sustainability of China's performance.

Yet, investors should be aware that despite robust Chinese growth, there are mounting concerns about Danone’s regional reliance and the implications if...

Read the full narrative on Danone (it's free!)

Danone's outlook suggests revenue of €29.9 billion and earnings of €2.7 billion by 2028. This is based on an assumed annual revenue growth rate of 3.0% and represents a €0.9 billion increase in earnings from the current €1.8 billion.

Uncover how Danone's forecasts yield a €76.88 fair value, in line with its current price.

Exploring Other Perspectives

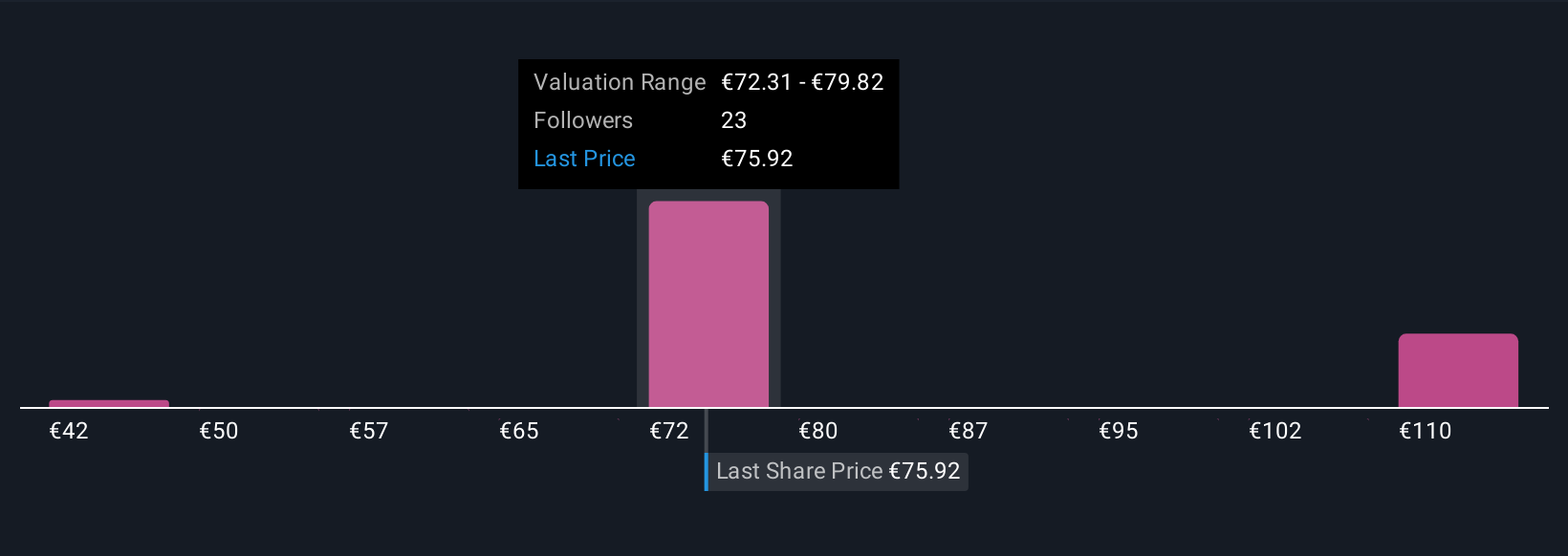

Five fair value estimates from the Simply Wall St Community for Danone range widely from €42.30 to €114.27 per share. While China's high-margin segment drives optimism, you should consider how concentrated regional growth can affect long-term stability and weigh multiple views before making decisions.

Explore 5 other fair value estimates on Danone - why the stock might be worth 45% less than the current price!

Build Your Own Danone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Danone research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Danone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Danone's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives