Danone (ENXTPA:BN) Valuation in Focus as Investors Weigh Recent Share Price Gains

Reviewed by Simply Wall St

Danone (ENXTPA:BN) shares have been relatively steady, with the stock showing modest movements over the past week and month. Investors are watching to see how recent performance compares with the company's longer term growth.

See our latest analysis for Danone.

Momentum has clearly shifted for Danone this year, with the share price currently at $77.66 and a year-to-date price return of 19.7%. Combined with a robust 1-year total shareholder return of 22.6%, this points to gradually building optimism, especially following a strong three- and five-year run that outpaces many sector peers.

If Danone’s performance sparks your interest, now is a timely moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Danone’s recent strength signals that its shares remain undervalued, or if positive sentiment and future growth have already been fully priced in. This could leave little room for new buyers to benefit.

Most Popular Narrative: 1.4% Undervalued

With Danone's fair value calculated at €78.77, only slightly above its last close of €77.66, market sentiment appears finely balanced. All eyes are on the financial drivers shaping this consensus valuation.

“Continued innovation and expansion in health-driven, functional foods and specialized nutrition, such as high-protein, probiotic, and medical nutrition products, positions Danone to capture above-market revenue growth as global consumers become increasingly focused on wellness and science-based nutrition. Geographic broadening in emerging markets, especially across Asia, Africa, and Latin America, leverages rising urbanization and the growing middle class to expand Danone's addressable market and drive long-term revenue and volume gains.”

Want to understand the secret behind this eye-catching price target? It’s not just about steady sales. There are bold assumptions fueling ambitious forecasts, and a vision for margins that you might not expect from a food giant. Get the full scoop behind the number-crunching and discover which future milestones are key to this valuation.

Result: Fair Value of €78.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in core dairy categories and foreign exchange volatility could affect Danone’s future momentum if not proactively addressed.

Find out about the key risks to this Danone narrative.

Another View: Multiples Raise Questions About Value

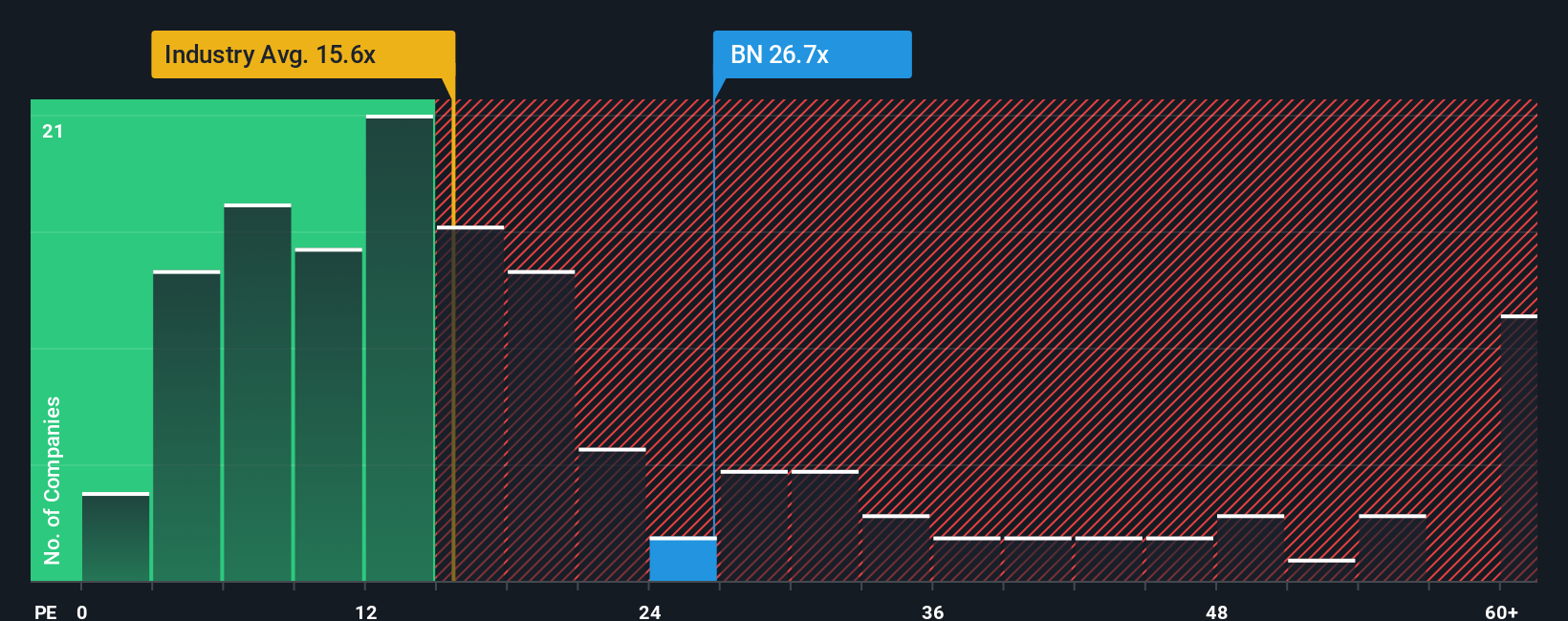

While the consensus valuation sees Danone as modestly undervalued, a closer look at its price-to-earnings ratio adds some skepticism. Danone trades at 27.3x earnings, significantly higher than both its peer average of 12x and the food industry’s 14.7x. Even compared to the fair ratio of 24.7x, the current multiple suggests Danone might be carrying a valuation premium that leaves less margin for error. Can such a premium be justified? Or does it expose investors to downside risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danone Narrative

If you want to dig deeper or see the numbers differently, you can take just a few minutes to shape your own perspective. Do it your way

A great starting point for your Danone research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't watch from the sidelines while others uncover tomorrow’s winners. Check out these unique opportunities on Simply Wall Street and position yourself for what’s next.

- Capitalize on high-growth sectors by starting with these 27 AI penny stocks, which are at the forefront of transformative technologies and market momentum.

- Secure consistent income and stability by researching these 18 dividend stocks with yields > 3%, which deliver yields above 3% and stand out for their strong fundamentals.

- Ride the innovation wave as you evaluate these 81 cryptocurrency and blockchain stocks, which are pioneering advances in digital assets and blockchain ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives