- France

- /

- Energy Services

- /

- ENXTPA:VK

Is Now the Right Time to Reassess Vallourec After Recent Expansion and Contract Renewals?

Reviewed by Bailey Pemberton

- Wondering if Vallourec stock is undervalued or primed to soar further? You are not alone, as plenty of investors are taking a closer look at what sets this company apart from its sector peers.

- The stock has delivered a 15.3% return over the last year, with some volatility along the way. It is up 3.3% over the past week but down 3.3% in the last month.

- Recent headlines have spotlighted Vallourec's strategic expansion into new markets and renewed contracts with major energy players. These developments help explain both recent optimism around the stock and some of the choppiness in price as investors digest what the changes mean for long-term growth.

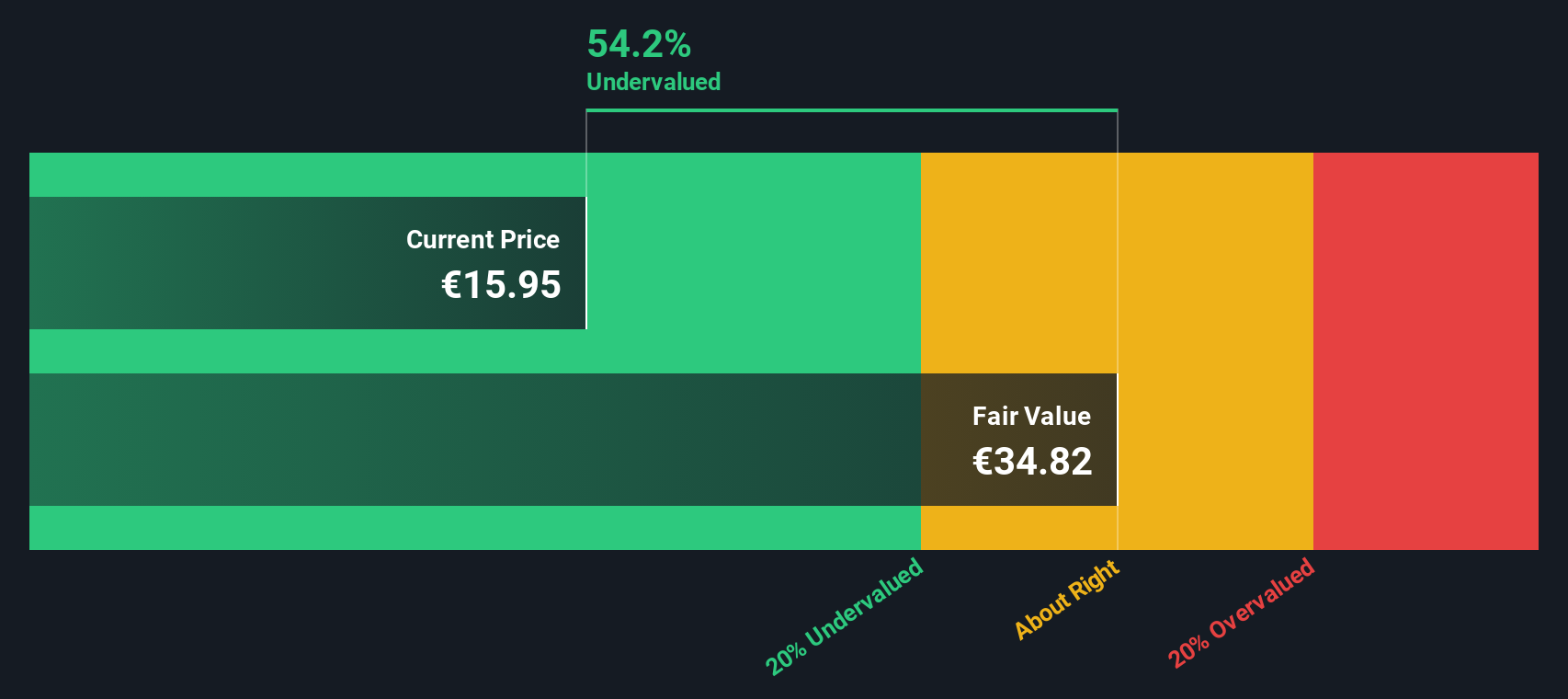

- On a valuation basis, Vallourec currently scores a 5 out of 6 on our value checks, meaning it looks undervalued by most measures. Let us dive into what drives that score, the valuation models behind it, and stick around for a perspective on valuation you will not want to miss at the end of this article.

Find out why Vallourec's 15.3% return over the last year is lagging behind its peers.

Approach 1: Vallourec Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates what a company is truly worth by projecting its future cash flows and then discounting them back to their present value. This approach tries to answer what Vallourec is reasonably worth today based on its expected ability to generate cash in the years ahead.

Vallourec’s current Free Cash Flow (FCF) sits at €375.3 million. Analysts provide detailed forecasts for the next several years, with expectations that FCF will climb to around €475.5 million by 2028. Beyond the analyst forecasts, longer-term projections based on Simply Wall St’s extrapolation suggest that cash flows could continue to grow gradually over the next decade, with the ten-year projection reaching approximately €470.3 million by 2035.

All of these projected cash flows are discounted back to today to arrive at a fair value for the stock. For Vallourec, this DCF analysis results in an estimated intrinsic value of €37.23 per share. With current market pricing implying a 55.5% discount, the DCF model signals the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vallourec is undervalued by 55.5%. Track this in your watchlist or portfolio, or discover 851 more undervalued stocks based on cash flows.

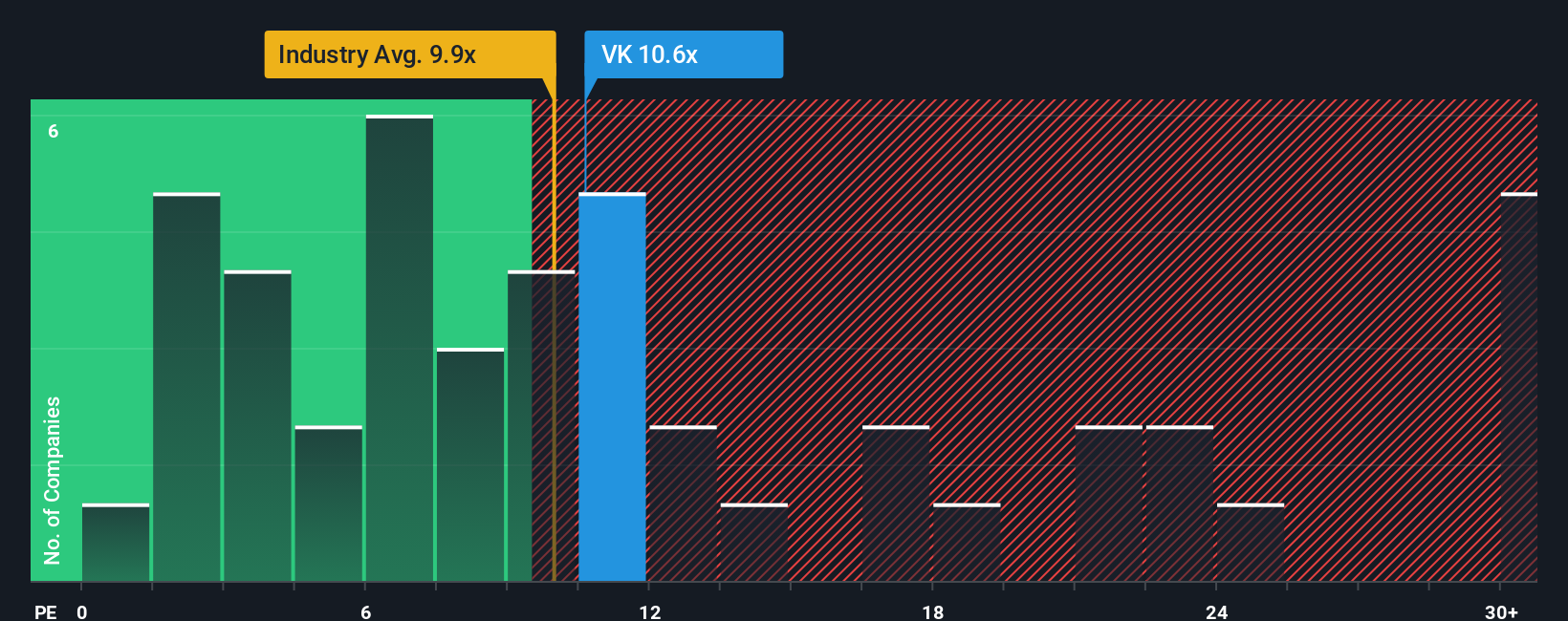

Approach 2: Vallourec Price vs Earnings

For companies like Vallourec that are generating steady profits, the Price-to-Earnings (PE) ratio is a popular metric to gauge value. This ratio captures how much investors are willing to pay for each euro of earnings, making it a simple but effective way to compare similar businesses’ valuations.

The "fair" or “normal” PE ratio for a company is influenced by factors like how fast it is expected to grow, the stability of its earnings, and the risks it faces. Higher growth prospects or more resilient earnings typically justify a higher PE, while greater risks often pull the PE ratio down.

Vallourec is currently trading at a PE of 10.92x. This is lower than both the Energy Services industry average of 14.56x and the average of its direct peers at 17.69x. On the surface, this suggests the stock may be undervalued compared to rivals.

However, Simply Wall St’s proprietary "Fair Ratio" for Vallourec stands at 14.60x. The Fair Ratio is more insightful than a plain industry or peer comparison because it specifically accounts for Vallourec’s unique growth outlook, risk profile, market cap, and profit margins. This ensures we are not comparing apples to oranges, which is especially important when companies within the same industry can have very different prospects.

Comparing Vallourec’s current PE (10.92x) with its Fair Ratio (14.60x) indicates the stock is currently undervalued by this measure as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vallourec Narrative

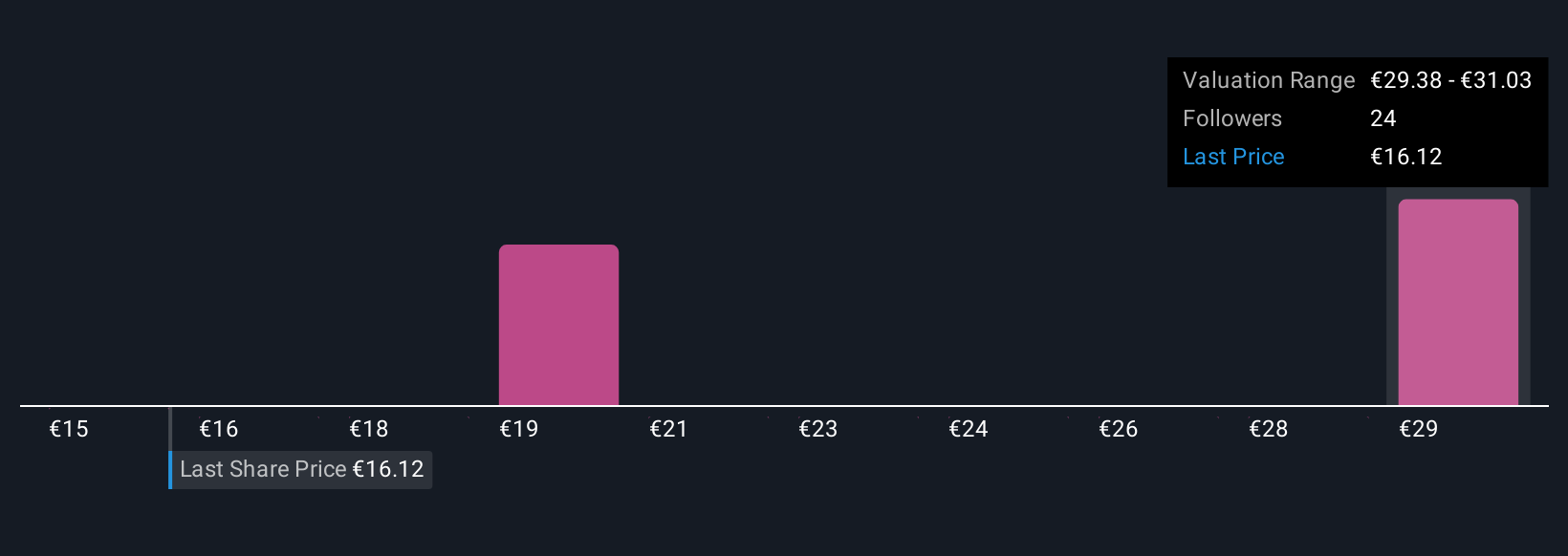

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your story and interpretation of a company’s future, where you combine your expectations for revenue, profit margins, and growth with what is happening in the business to form your personal fair value estimate.

Narratives connect the dots from what a company is doing today to where you think it is headed financially and ultimately what price you believe is fair for the stock. They make investing easy and accessible. On Simply Wall St’s Community page, used by millions, anyone can create, view, and discuss Narratives and fair values for stocks like Vallourec.

With Narratives, you can decide when to buy or sell by comparing your own or the crowd’s Fair Value to the current market Price, all while seeing how Narratives update as new news or earnings emerge. For example, some investors with a bullish Narrative on Vallourec see upside to €22.6 per share thanks to premium product focus and global contracts, while more cautious perspectives emphasize risks in oil demand and FX volatility, leading to fair values as low as €18.8.

Do you think there's more to the story for Vallourec? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VK

Vallourec

Through its subsidiaries, provides tubular solutions for the oil and gas, industry, and new energies markets in Europe, North America, South America, Asia, the Middle East, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives