- France

- /

- Energy Services

- /

- ENXTPA:VIRI

Investors Appear Satisfied With Viridien Société anonyme's (EPA:VIRI) Prospects As Shares Rocket 52%

Viridien Société anonyme (EPA:VIRI) shares have continued their recent momentum with a 52% gain in the last month alone. The last month tops off a massive increase of 162% in the last year.

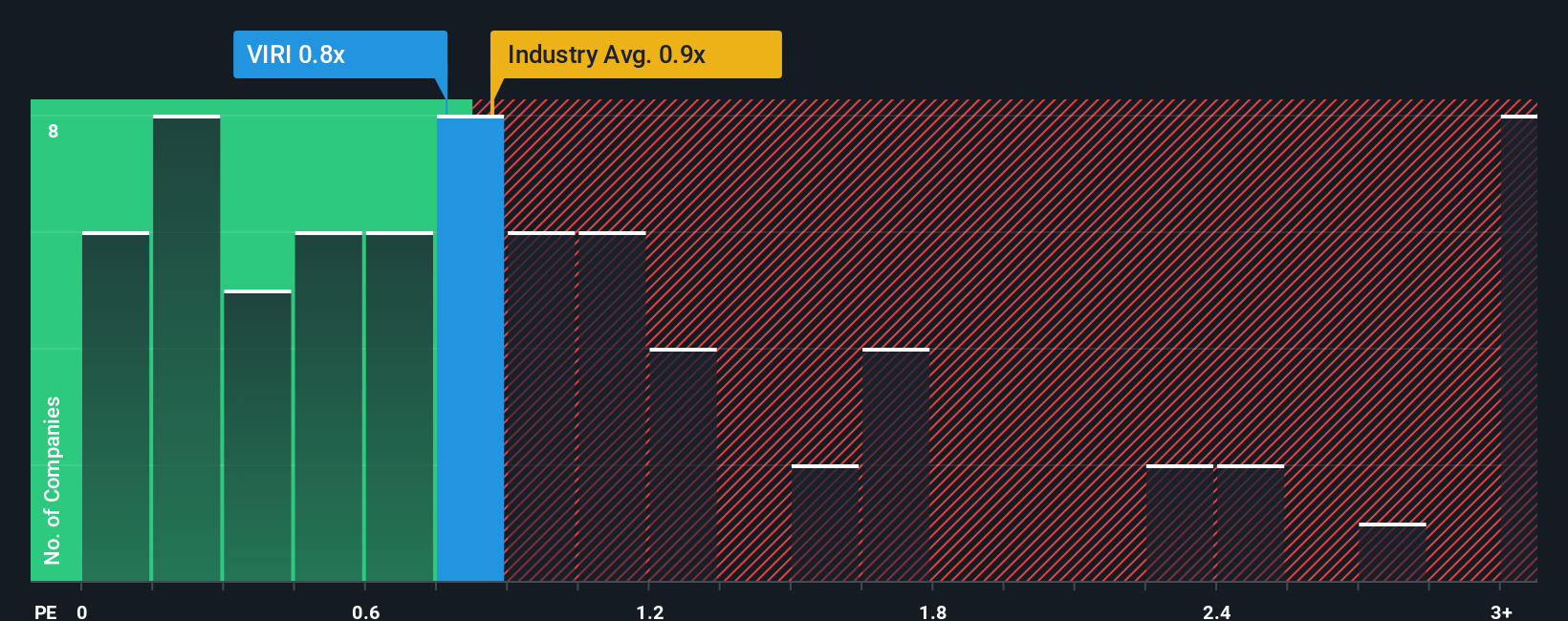

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Viridien Société anonyme's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in France is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Viridien Société anonyme

How Has Viridien Société anonyme Performed Recently?

Recent times have been advantageous for Viridien Société anonyme as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Viridien Société anonyme.How Is Viridien Société anonyme's Revenue Growth Trending?

In order to justify its P/S ratio, Viridien Société anonyme would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 3.3% per year over the next three years. With the industry predicted to deliver 2.7% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why Viridien Société anonyme is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Viridien Société anonyme's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Viridien Société anonyme's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Energy Services industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Viridien Société anonyme you should be aware of, and 2 of them are significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VIRI

Viridien Société anonyme

Provides data, products, services, and solutions in Earth science, data science, sensing, and monitoring in North America, Latin America, the Central and South Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives