- France

- /

- Oil and Gas

- /

- ENXTPA:FDE

If You Had Bought La Française de l'Energie (EPA:LFDE) Stock Three Years Ago, You Could Pocket A 29% Gain Today

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, the La Française de l'Energie S.A. (EPA:LFDE) share price is up 29% in the last three years, clearly besting the market return of around 12% (not including dividends).

See our latest analysis for La Française de l'Energie

While La Française de l'Energie made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

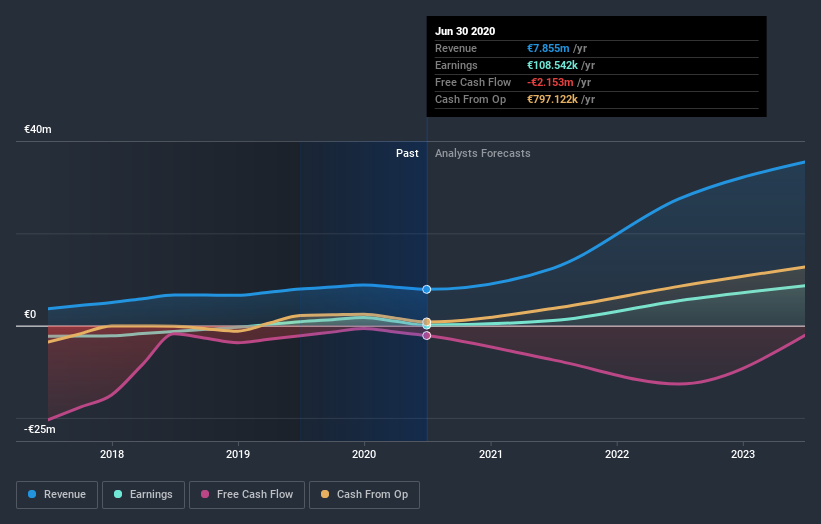

La Française de l'Energie's revenue trended up 23% each year over three years. That's much better than most loss-making companies. The share price rise of 9% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at La Française de l'Energie. If the company is trending towards profitability then it could be very interesting.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that La Française de l'Energie has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling La Française de l'Energie stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, La Française de l'Energie's total shareholder return last year was 27%. So this year's TSR was actually better than the three-year TSR (annualized) of 9%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand La Française de l'Energie better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with La Française de l'Energie , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading La Française de l'Energie or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:FDE

La Française de l'Energie

Operates as a carbon-negative energy production company in France.

High growth potential with adequate balance sheet.