As the European market navigates a landscape of mixed stock index performances and stable interest rates from the European Central Bank, investors are keenly observing how these factors influence small-cap companies. With inflation near target and economic growth showing signs of resilience, identifying promising stocks requires a careful analysis of fundamentals and market positioning.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Alantra Partners | NA | -6.09% | -33.39% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

TotalEnergies EP Gabon Société Anonyme (ENXTPA:EC)

Simply Wall St Value Rating: ★★★★☆☆

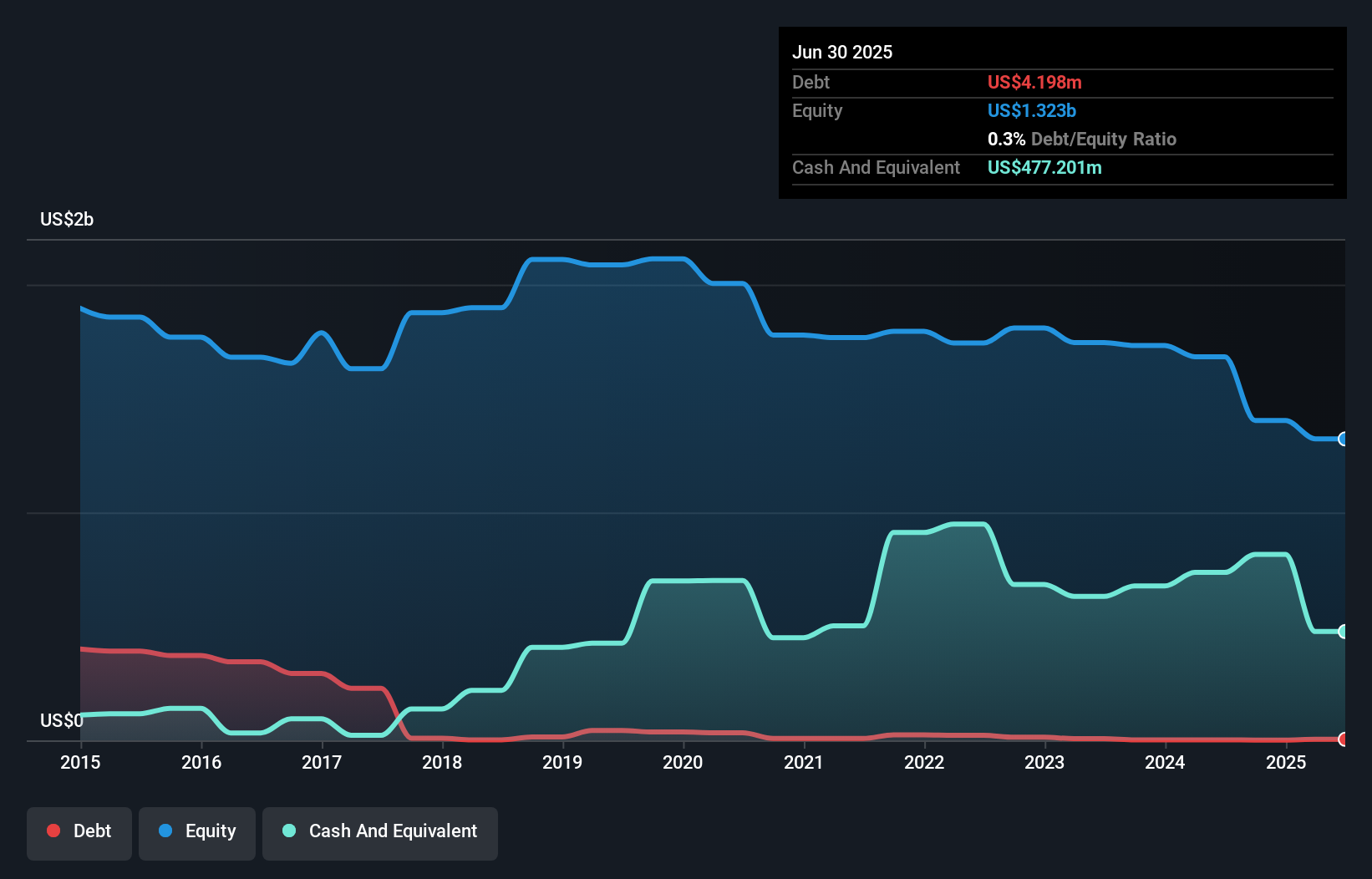

Overview: TotalEnergies EP Gabon Société Anonyme is involved in the mining, exploration, and production of crude oil in Gabon and has a market capitalization of €846 million.

Operations: TotalEnergies EP Gabon generates revenue primarily from its oil and gas exploration and production segment, totaling $437.59 million.

TotalEnergies EP Gabon, a smaller player in the energy sector, has seen its earnings grow by 48% over the past year, outpacing the industry average of 7.8%. Despite this impressive growth, recent financials show a dip with half-year sales at US$216.56 million versus US$243.69 million last year and net income dropping to US$22.19 million from US$52.94 million. The company is trading at 59% below estimated fair value and recently joined both the CAC Small Index and CAC All-Tradable Index, hinting at increased visibility in European markets despite current challenges in profitability.

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★★★☆

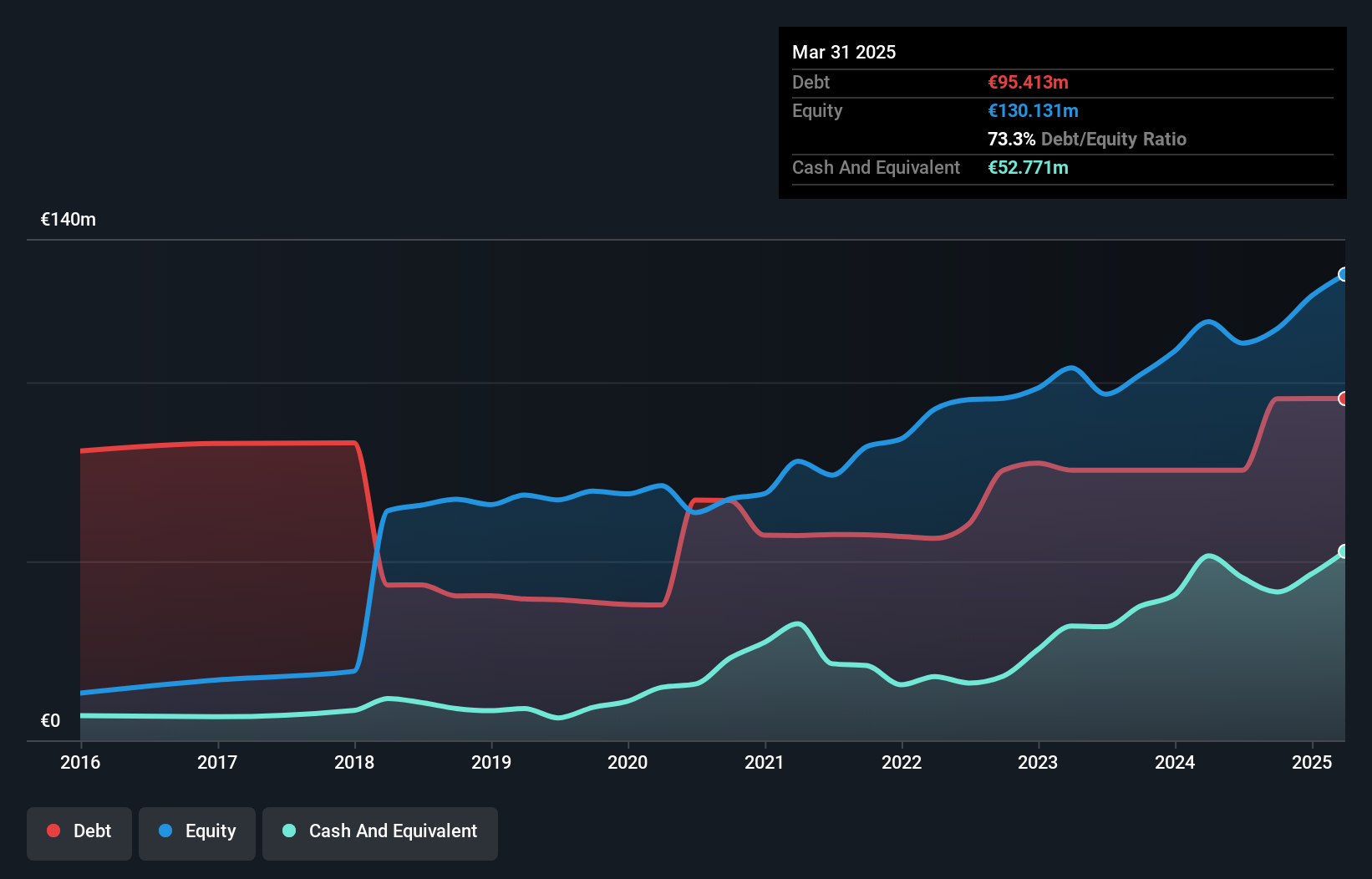

Overview: Harvia Oyj is a company engaged in the sauna industry, with a market capitalization of €690.61 million.

Operations: Harvia Oyj generates revenue primarily from its Building Materials - HVAC Equipment segment, with reported earnings of €188.89 million.

Harvia Oyj, a player in the wellness sector, has seen its debt to equity ratio improve from 105.5% to 82.3% over five years, indicating better financial stability. The company's earnings quality remains high despite a recent -5.5% dip in growth compared to the industry average of 1.7%. Harvia's EBIT covers interest payments comfortably at 6.6 times, reflecting strong operational efficiency. Trading at nearly half its estimated fair value and with a forecasted annual earnings growth of 17.77%, Harvia is poised for expansion through strategic partnerships and innovative product launches like the Fenix control panel and MyHarvia app, targeting both consumer and commercial markets globally.

technotrans (XTRA:TTR1)

Simply Wall St Value Rating: ★★★★★★

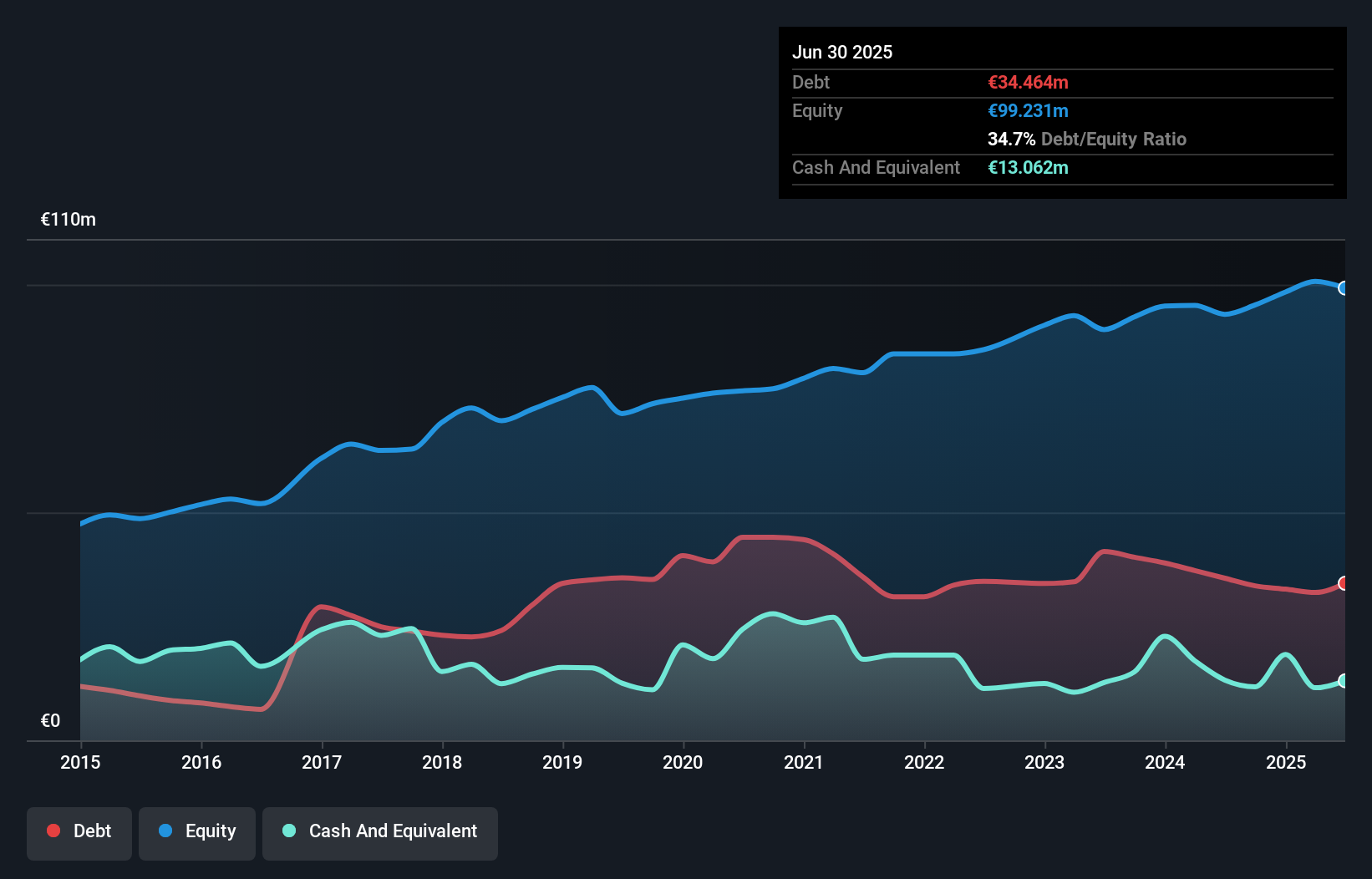

Overview: technotrans SE is a global technology and services company with a market capitalization of €245.22 million.

Operations: The company generates revenue primarily from its Technology segment (€182.69 million) and Services segment (€61.97 million). The Technology segment is the larger contributor to total revenue.

Technotrans, a nimble player in the European market, has showcased impressive earnings growth of 33.8% over the past year, outpacing its industry peers. The company's debt to equity ratio has improved significantly from 58.1% to 34.7% over five years, indicating prudent financial management. With a net debt to equity ratio at a satisfactory 21.6%, Technotrans is well-positioned financially and its interest payments are comfortably covered by EBIT at 12.4 times coverage. Recent developments include securing a follow-up order for liquid cooling systems in data centers and reporting half-year revenue of €120.58 million with net income doubling compared to last year, highlighting strong operational performance and strategic positioning in sustainable cooling solutions amidst economic uncertainties.

Taking Advantage

- Get an in-depth perspective on all 324 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TTR1

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives