Stock Analysis

- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

Exploring Undervalued Opportunities On Euronext Paris With Stocks Discounted Between 15.4% And 41.7%

Reviewed by Simply Wall St

As France approaches a pivotal snap election, the market has shown signs of volatility with the CAC 40 Index experiencing a notable decline. Amidst this environment, identifying undervalued stocks can offer investors potential opportunities for growth as they navigate through these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wavestone (ENXTPA:WAVE) | €54.60 | €93.67 | 41.7% |

| Lectra (ENXTPA:LSS) | €28.35 | €44.30 | 36% |

| Arcure (ENXTPA:ALCUR) | €5.52 | €7.66 | 28.0% |

| Vivendi (ENXTPA:VIV) | €9.838 | €16.02 | 38.6% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €6.02 | €9.92 | 39.3% |

| Tikehau Capital (ENXTPA:TKO) | €21.30 | €32.15 | 33.7% |

| Esker (ENXTPA:ALESK) | €183.10 | €261.11 | 29.9% |

| Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €11.72 | €15.29 | 23.4% |

| Thales (ENXTPA:HO) | €151.50 | €263.69 | 42.5% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.84 | €6.30 | 39.1% |

Underneath we present a selection of stocks filtered out by our screen

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a global digital platform offering services and payments solutions for companies, employees, and merchants, with a market capitalization of approximately €9.97 billion.

Operations: The company generates its revenue primarily from business services, which accounted for €2.31 billion.

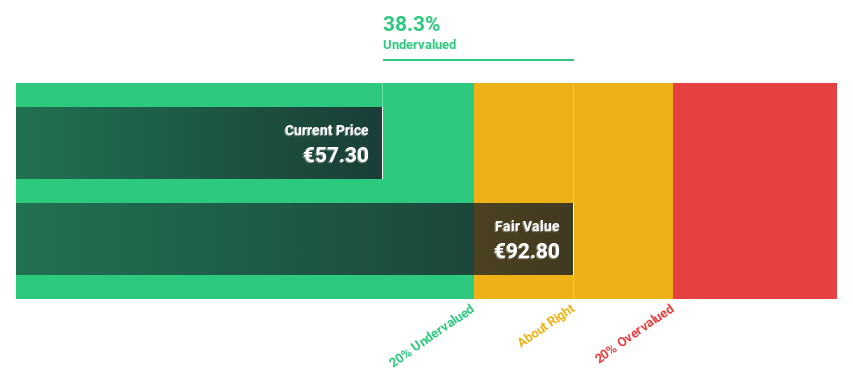

Estimated Discount To Fair Value: 15.4%

Edenred, priced at €40.1, is trading 15.4% below our fair value estimate of €47.43, indicating undervaluation based on discounted cash flows. The company's earnings are expected to grow by 20.3% annually, outpacing the French market's 10.9%. However, Edenred carries a high level of debt and its dividend coverage is weak with a yield of 2.74%. Analyst consensus suggests a potential price increase of 54.4%. Recent activities include a Q1 sales statement and an annual general meeting in April 2024.

- Our expertly prepared growth report on Edenred implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Edenred here with our thorough financial health report.

Figeac Aero Société Anonyme (ENXTPA:FGA)

Overview: Figeac Aero Société Anonyme is a company based in France that manufactures, supplies, and sells equipment and sub-assemblies for the aeronautics sector, with a market capitalization of approximately €238.09 million.

Operations: The company generates its revenue by manufacturing, supplying, and selling aeronautics equipment and sub-assemblies primarily in France.

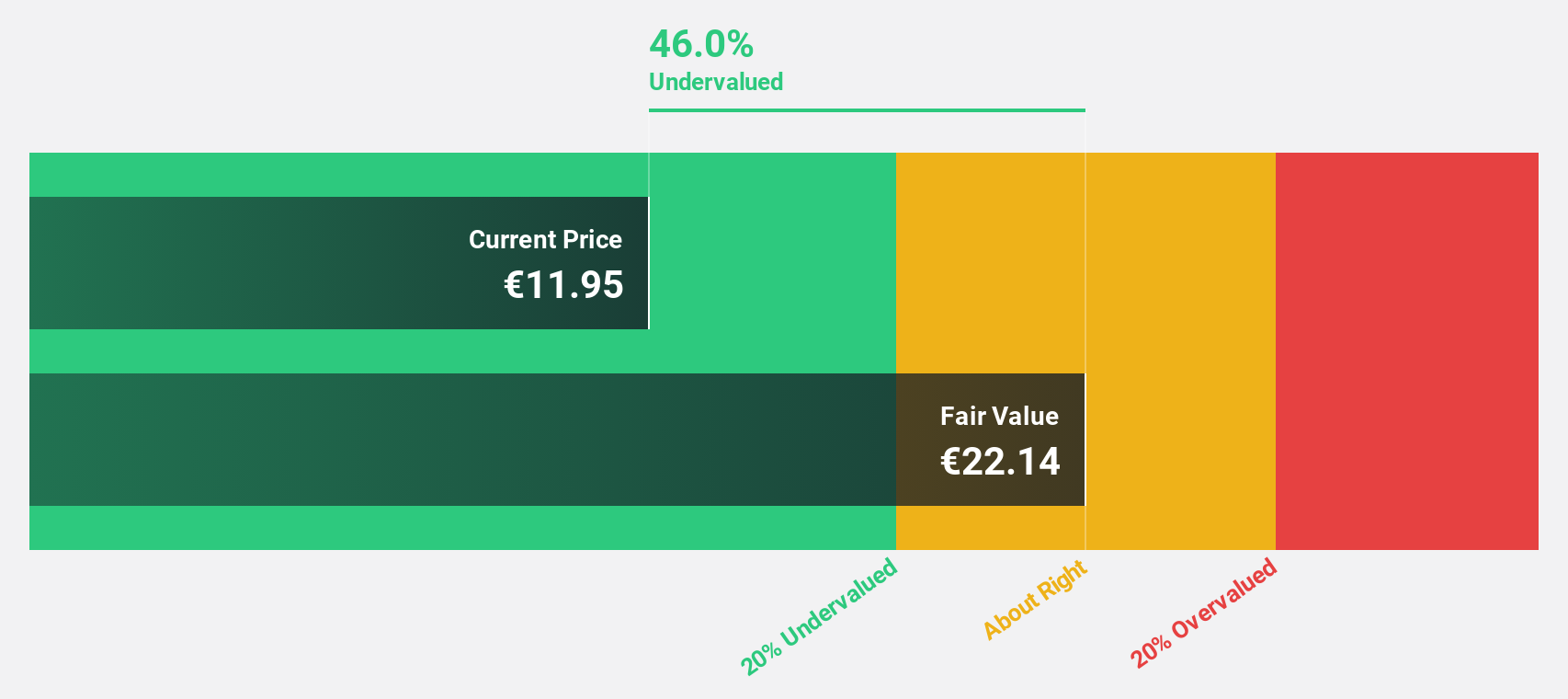

Estimated Discount To Fair Value: 39.3%

Figeac Aero, priced at €6.02, is significantly undervalued with a fair value estimate of €9.92. It's expected to grow earnings by 93.51% annually, surpassing the market forecast and transitioning into profitability within three years. Despite slower revenue growth at 8.9% compared to the broader market's expectation of 20%, it outperforms the French market average of 5.7%. Recent reports show an improvement in financials with sales reaching €397.2 million and a reduced net loss from the previous year.

- In light of our recent growth report, it seems possible that Figeac Aero Société Anonyme's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Figeac Aero Société Anonyme.

Wavestone (ENXTPA:WAVE)

Overview: Wavestone SA is a technology consulting firm operating mainly in France and globally, with a market capitalization of approximately €1.35 billion.

Operations: The firm generates €701.06 million from management consulting and information system services.

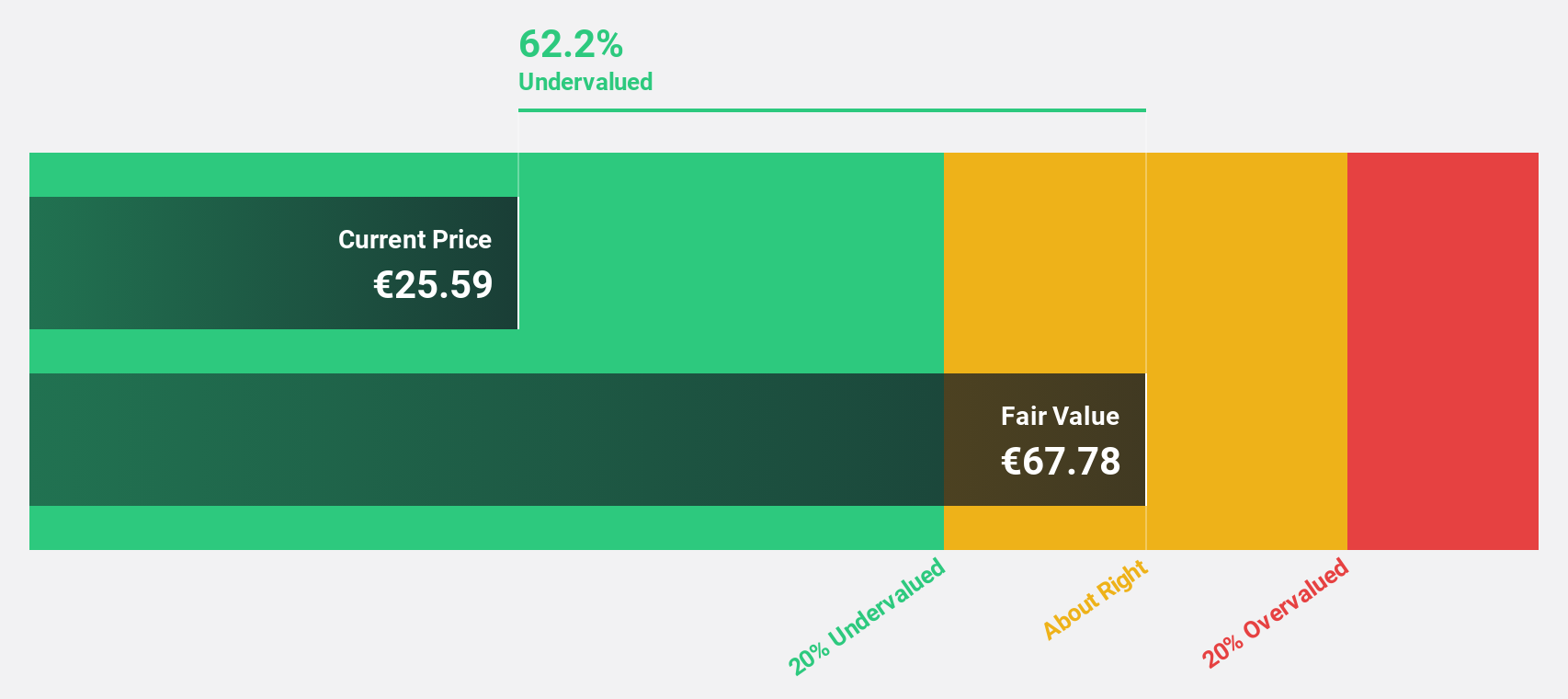

Estimated Discount To Fair Value: 41.7%

Wavestone, trading at €54.6 against a fair value of €93.67, appears significantly undervalued based on its cash flows. Its earnings have grown by 16.2% over the past year and are projected to increase by 22% annually, outpacing the French market's growth rate of 10.9%. Despite some shareholder dilution last year, recent financial results show robust performance with sales up to €701.06 million and net income rising to €58.2 million from €50.07 million previously.

- The growth report we've compiled suggests that Wavestone's future prospects could be on the up.

- Click here to discover the nuances of Wavestone with our detailed financial health report.

Seize The Opportunity

- Explore the 13 names from our Undervalued Euronext Paris Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Edenred is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

High growth potential low.