As European markets continue to rally, buoyed by slower inflation and potential interest rate cuts from the European Central Bank, investors are increasingly turning their attention to dividend stocks for stable income. In this favorable economic climate, identifying solid dividend-paying stocks can be a prudent strategy for those looking to benefit from consistent returns amidst market volatility.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.49% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.89% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.10% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.25% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.88% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.94% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.65% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.34% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

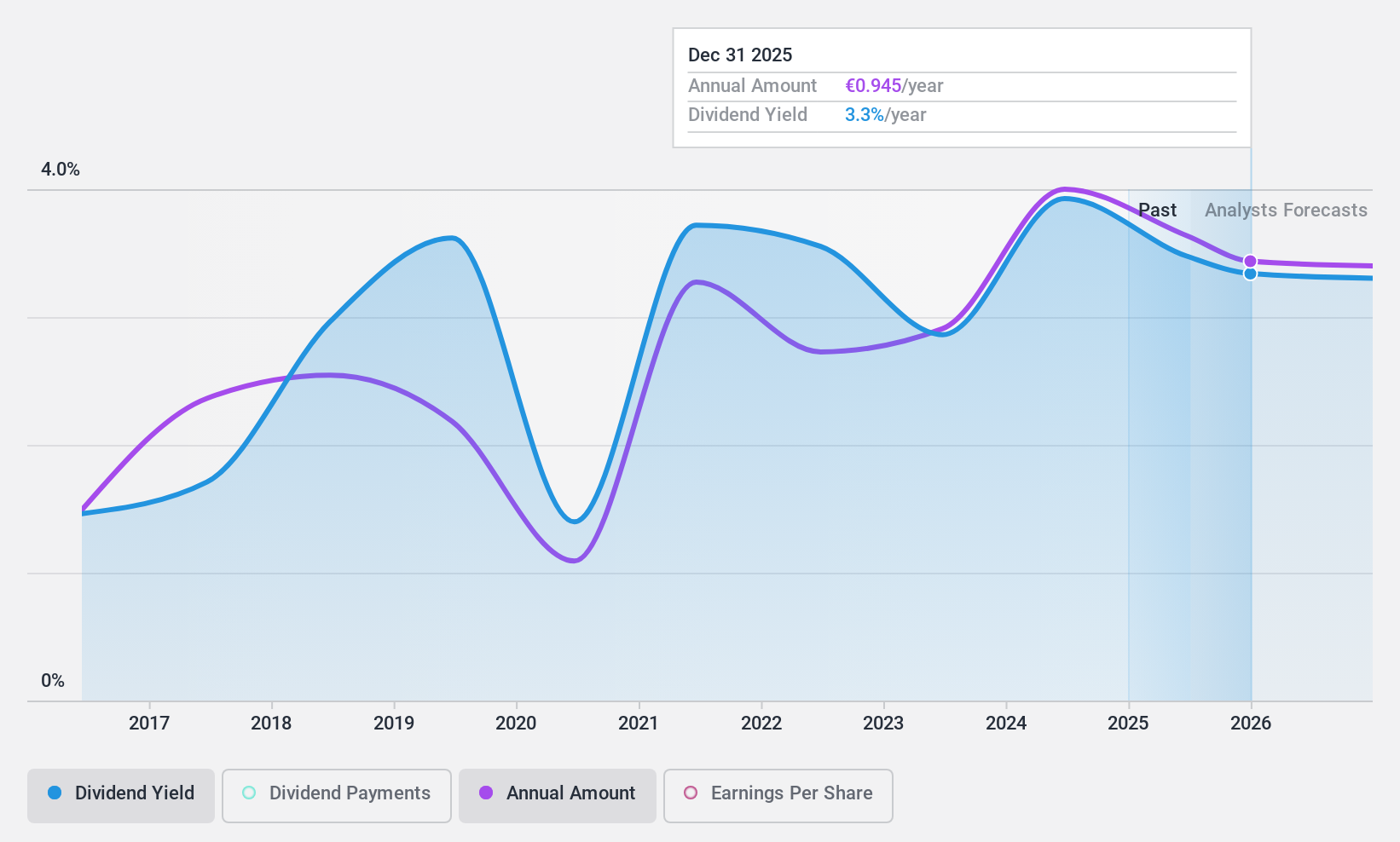

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. produces and sells food packaging products in France and internationally, with a market cap of €554.59 million.

Operations: Groupe Guillin S.A. generates revenue primarily from its Packaging Sector (€837.39 million) and Material Sector (€48.24 million).

Dividend Yield: 3.7%

Groupe Guillin's dividend payments are well-covered by earnings (payout ratio: 27%) and cash flows (cash payout ratio: 18.5%), indicating sustainability. However, the dividend track record has been unreliable and volatile over the past decade. Despite this, dividends have grown over the last 10 years. The stock trades at a significant discount to its estimated fair value and shows good relative value compared to peers and industry standards.

- Navigate through the intricacies of Groupe Guillin with our comprehensive dividend report here.

- The analysis detailed in our Groupe Guillin valuation report hints at an deflated share price compared to its estimated value.

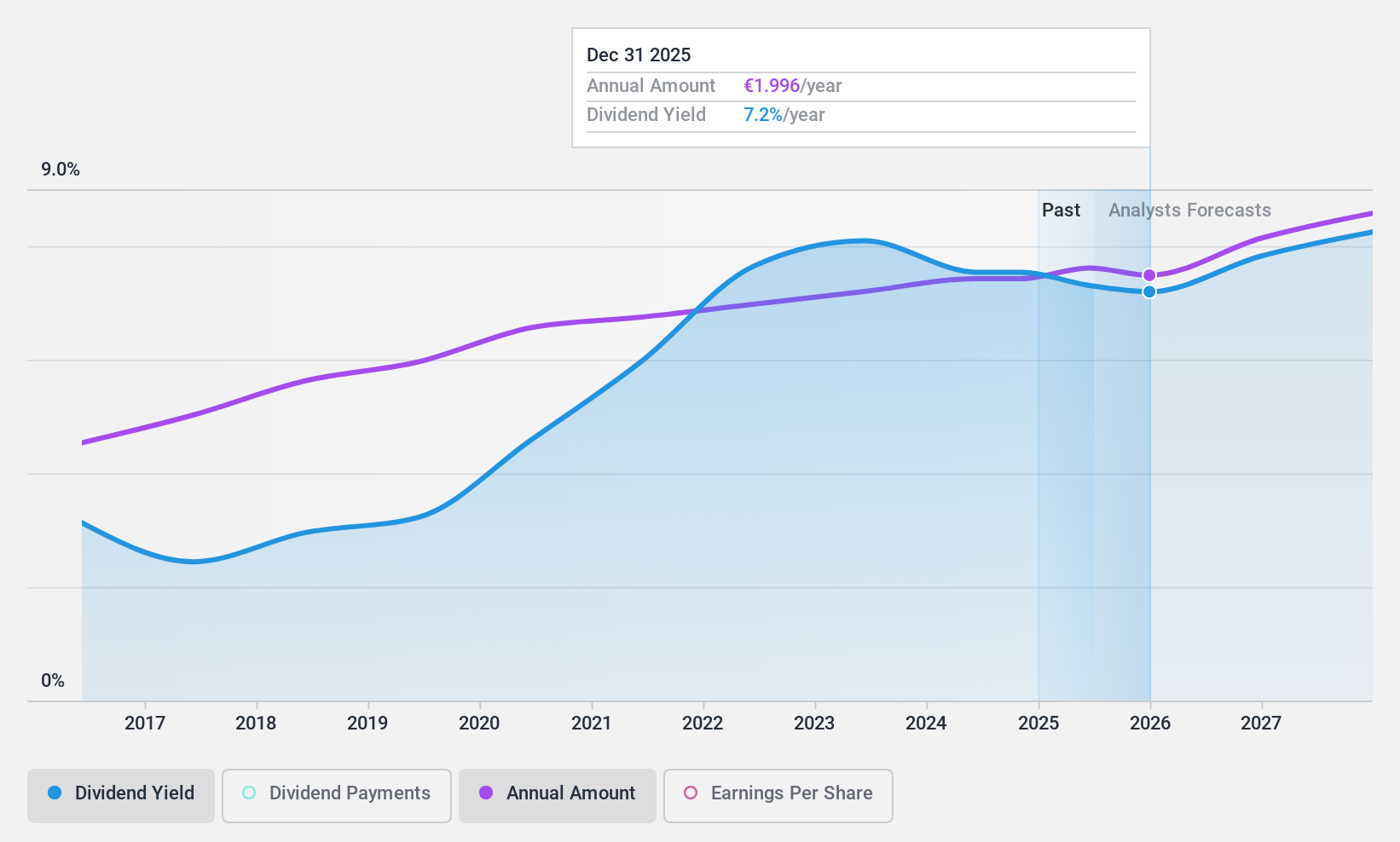

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean with a market cap of €2.99 billion.

Operations: Rubis generates revenue primarily from Energy Distribution (€6.58 billion) and Renewable Electricity Production (€48.64 million).

Dividend Yield: 6.9%

Rubis's dividend payments have been stable and growing over the past decade, with a payout ratio of 57.7% covered by earnings and a cash payout ratio of 73.8%. Despite its high debt level, the company offers an attractive dividend yield of 6.89%, which is in the top quartile for French stocks. Trading at a price-to-earnings ratio of 8.5x, Rubis presents good value compared to the broader French market (15.1x).

- Click to explore a detailed breakdown of our findings in Rubis' dividend report.

- In light of our recent valuation report, it seems possible that Rubis is trading behind its estimated value.

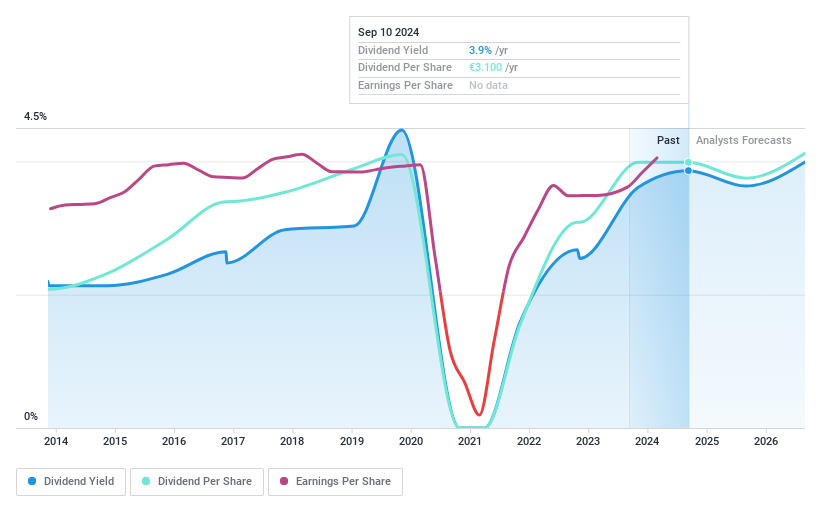

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global provider of food services and facilities management, with a market cap of €11.83 billion.

Operations: Sodexo S.A. generates revenue from Europe (€8.30 billion), North America (€10.74 billion), and the Rest of the World (€4.12 billion).

Dividend Yield: 3.8%

Sodexo's dividend payments have been volatile over the past decade, but recent increases and a payout ratio of 63.2% covered by earnings suggest some stability. The cash payout ratio is a low 44%, indicating strong coverage by cash flows. Despite its high debt level, Sodexo announced a special interim dividend of €6.24 per share in August 2024, reflecting robust liquidity supported by an upsized €1.75 billion credit facility extension to July 2029.

- Click here and access our complete dividend analysis report to understand the dynamics of Sodexo.

- In light of our recent valuation report, it seems possible that Sodexo is trading beyond its estimated value.

Next Steps

- Gain an insight into the universe of 36 Top Euronext Paris Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALGIL

Groupe Guillin

Produces and sells food packaging products in France and internationally.

Very undervalued with flawless balance sheet and pays a dividend.