- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

How Carrefour’s (ENXTPA:CA) Return to the Euronext 150 Index May Reshape Investor Expectations

Reviewed by Sasha Jovanovic

- On November 3, 2025, Carrefour SA was added to the Euronext 150 Index, following a recent removal and re-inclusion within a short span.

- Inclusion in a major index like Euronext 150 can shape investor access to the stock by prompting increased activity from index-tracking funds.

- We'll explore how Carrefour's entry into the Euronext 150 Index may influence analyst expectations and the company's ongoing transformation.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Carrefour Investment Narrative Recap

To be comfortable as a Carrefour shareholder, one has to believe in the company’s ability to transform its business amid intense European competition and volatile consumer trends, especially in France. While Carrefour's re-entry into the Euronext 150 Index may attract short-term attention from index funds, it does not materially alter the immediate catalyst of operational restructuring, nor does it reduce the key risk of margin pressure in core markets.

Among recent news, the debut of the Concordis purchasing alliance stands out, aiming to improve Carrefour's buying power and cost efficiency across Europe. This announcement ties directly into the ongoing catalyst of cost reduction initiatives, which remain essential in offsetting the financial impact of weaker margins and competitive markets.

However, beneath renewed index inclusion, investors should remain alert to the risk that...

Read the full narrative on Carrefour (it's free!)

Carrefour's narrative projects €88.8 billion revenue and €1.3 billion earnings by 2028. This requires a 0.2% yearly revenue decline and a €974 million increase in earnings from €326.0 million today.

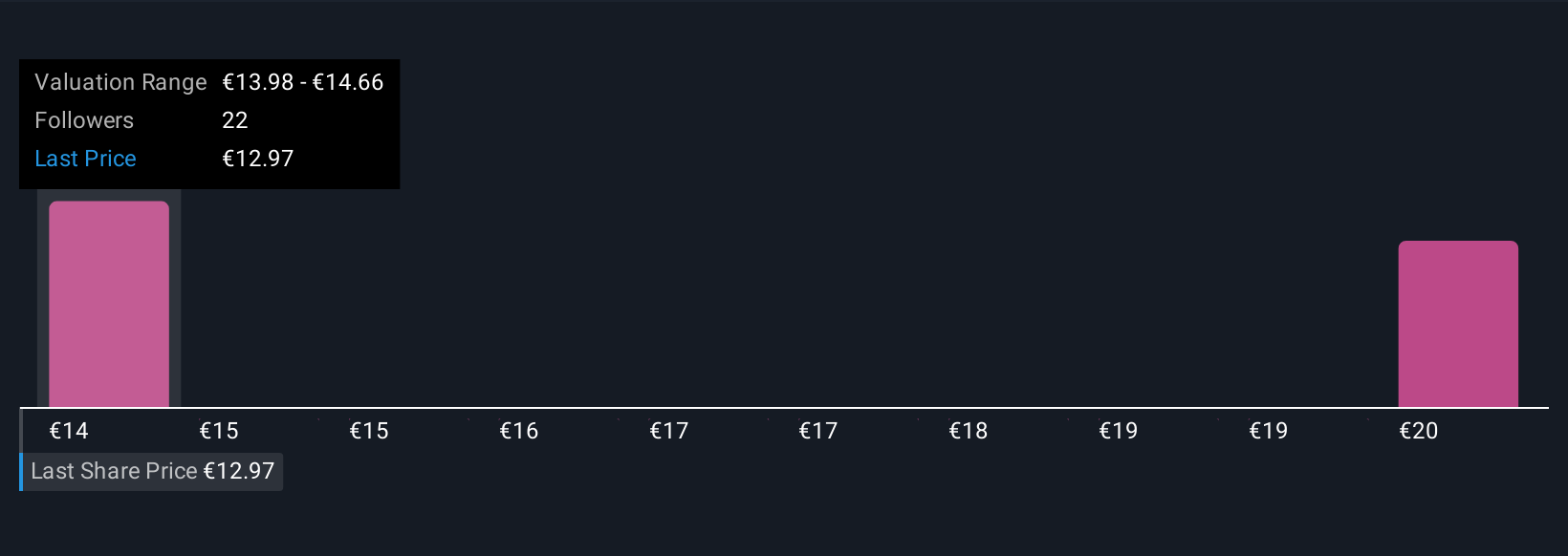

Uncover how Carrefour's forecasts yield a €13.98 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Carrefour range from €13.98 to €23.89, reflecting three distinct viewpoints from the Simply Wall St Community. In contrast, ongoing competition and price pressures in Europe could continue to challenge Carrefour’s efforts to improve profitability, so you may want to consider several perspectives on future performance.

Explore 3 other fair value estimates on Carrefour - why the stock might be worth as much as 80% more than the current price!

Build Your Own Carrefour Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carrefour research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Carrefour research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carrefour's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CA

Carrefour

Operates as a food retailer in France, Spain, Italy, Belgium, Poland, Romania, Brazil, Argentina, the Middle East, Africa, and Asia.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives