- France

- /

- Oil and Gas

- /

- ENXTPA:ES

Undiscovered Gems In France Including 3 Promising Small Caps

Reviewed by Simply Wall St

The French market has shown resilience amid global volatility, with the CAC 40 Index managing to close slightly higher despite broader economic concerns. Recent data indicates that while consumer demand is softening, certain sectors continue to exhibit robust performance. In this context, discovering promising small-cap stocks can be particularly rewarding. These companies often offer unique growth opportunities and can benefit from niche markets or innovative business models that larger firms might overlook.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally with a market cap of approximately €1.72 billion.

Operations: Esso S.A.F. generates revenue primarily from refining and distributing petroleum products, with total revenue of €18.93 billion. The company's financial performance includes a notable net profit margin trend over recent periods.

EssoF, a lesser-known player in the French oil and gas sector, has seen its debt-to-equity ratio improve from 5.8 to 1.2 over five years, indicating stronger financial health. This year marked its return to profitability, with a price-to-earnings ratio of 3.3x compared to the French market's 14.5x, suggesting potential undervaluation. Despite reporting EUR116 million net income for H1 2024 against EUR265.6 million last year, EssoF's cash exceeds total debt and free cash flow remains positive at EUR790 million as of June 30th, offering some stability amidst volatility.

- Navigate through the intricacies of EssoF with our comprehensive health report here.

Examine EssoF's past performance report to understand how it has performed in the past.

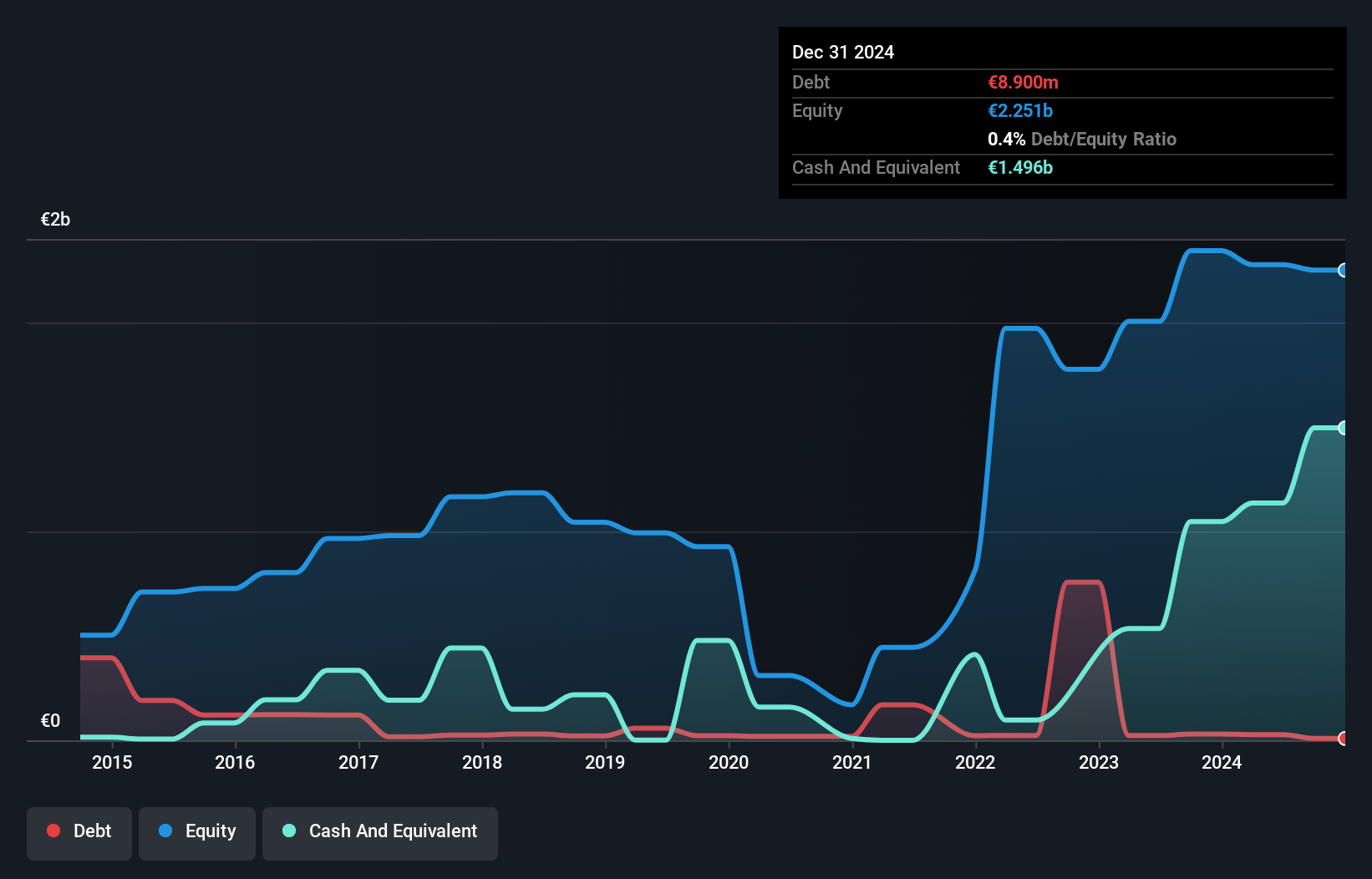

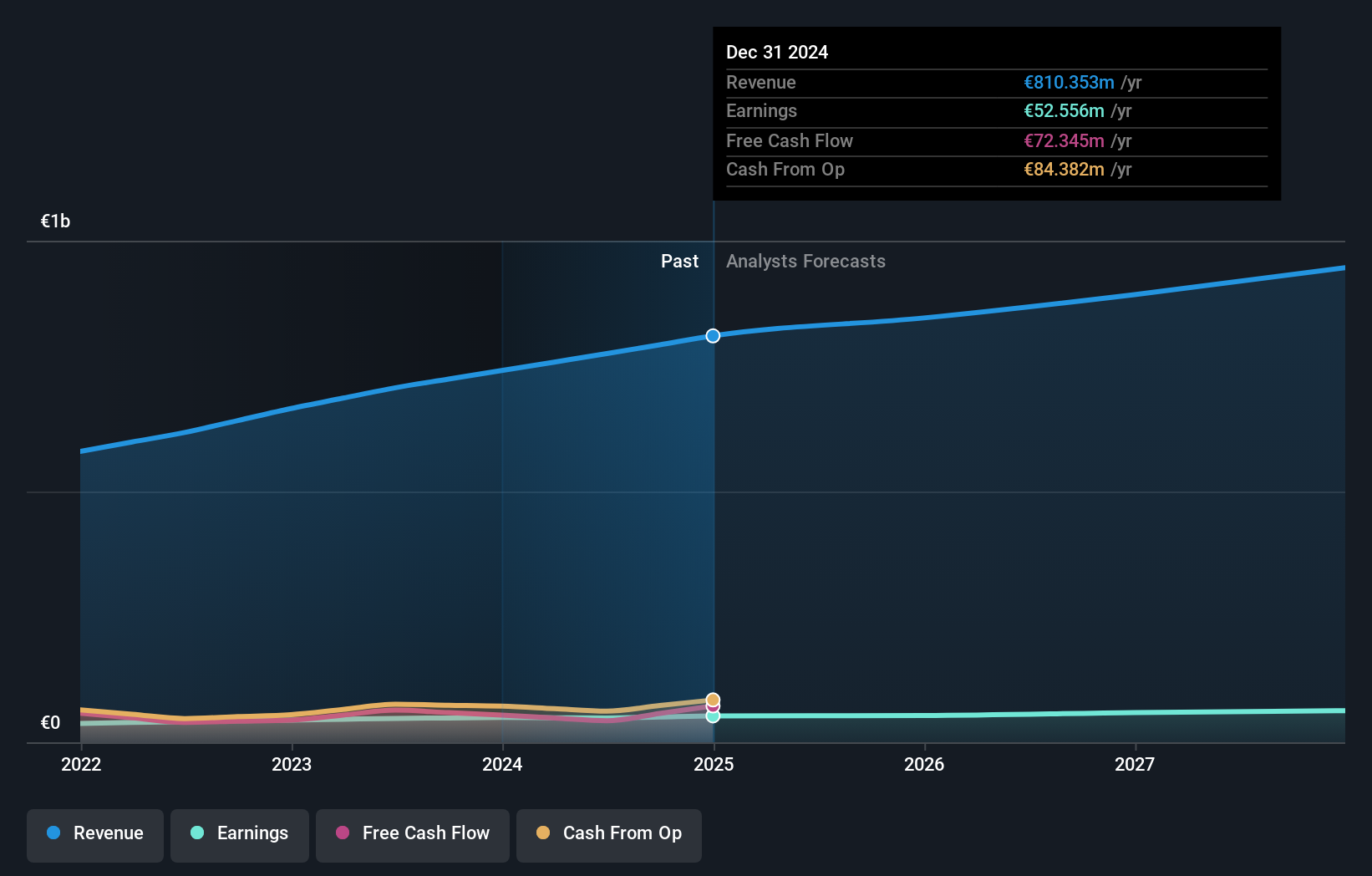

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services in France and internationally with a market cap of €1.02 billion.

Operations: Neurones generates revenue from three primary segments: Infrastructure Services (€468.49 million), Application Services (€219.47 million), and Consulting (€53.21 million).

NRO's debt to equity ratio has risen from 0.1% to 1.8% over the past five years, yet it holds more cash than total debt, indicating strong financial health. Trading at 17.5% below its estimated fair value, it's a potential bargain. Earnings grew by 11.7% last year, outpacing the IT industry's -9.9%. With high-quality earnings and positive free cash flow, NRO forecasts €800 million in revenues for 2024 with an operating profit of around 9.5%.

- Get an in-depth perspective on Neurones' performance by reading our health report here.

Review our historical performance report to gain insights into Neurones''s past performance.

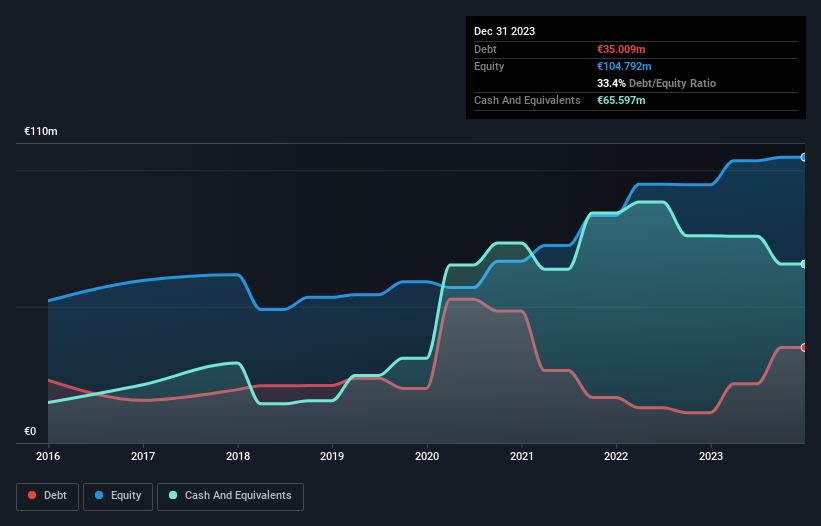

Roche Bobois (ENXTPA:RBO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Roche Bobois S.A. engages in the furniture design and distribution business worldwide, with a market cap of €484.02 million.

Operations: Roche Bobois generates revenue primarily from its Roche Bobois USA/Canada segment (€150.21 million) and Roche Bobois France segment (€118.72 million), with additional contributions from Europe (excluding France) at €105.94 million and Cuir Center at €43.39 million.

Roche Bobois, a notable player in the luxury furniture market, has seen its earnings grow 34.9% annually over the past five years. The company’s debt to equity ratio improved from 39.5% to 33.4%, indicating better financial health. Trading at 51% below estimated fair value, it offers an attractive valuation for investors. Additionally, Roche Bobois boasts high-quality earnings and strong interest coverage with EBIT covering interest payments by 13.7 times.

- Click to explore a detailed breakdown of our findings in Roche Bobois' health report.

Gain insights into Roche Bobois' past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 35 Euronext Paris Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssoF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ES

EssoF

Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally.

Flawless balance sheet with proven track record.