Kering (ENXTPA:KER): Exploring Current Valuation as Investors Weigh Recent Share Price Trends

Reviewed by Simply Wall St

Kering (ENXTPA:KER) shares have drifted slightly lower over the past week, continuing a gradual downward trend this month. Investors seem to be weighing recent performance and broader market sentiment as the company’s stock reacts in line with sector dynamics.

See our latest analysis for Kering.

While Kering’s shares remain subdued in the short term, it is worth noting that the stock has rebounded strongly since the start of the year, with a year-to-date share price return of nearly 25%. However, when viewed from a longer perspective, total shareholder returns over the past three and five years are still deeply negative. This recent rally suggests that momentum may be returning, as investors reassess the group’s growth outlook and valuation in the context of ongoing sector volatility.

If you’re interested in spotting what’s next on the market radar, now is the perfect time to discover fast growing stocks with high insider ownership

With shares hovering just below analyst price targets and recent gains offset by longer-term weakness, the key question remains: Is Kering currently undervalued, or has the market already factored in the company’s outlook, leaving little room for upside?

Most Popular Narrative: Fairly Valued

Kering’s last close of €294.50 sits nearly in line with the fair value implied by the most popular narrative, signaling the market’s current indecision. Investors are tuned in as the story pivots around pricing power and future margin expansion.

Kering's store network optimization, involving the closure of underperforming locations and a focus on higher-quality, experiential retail, supports improved brand positioning. This enables stronger pricing power and has the potential to increase gross margins and operating leverage over time.

What is the key factor powering this valuation? Only insiders know how far store cuts and tactical product launches will push margins, and whether expectations on profit growth are sustainable. The full narrative reveals the assumptions driving the fair value call. Ready to see what sets this story apart?

Result: Fair Value of €296.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent brand weakness or a slow recovery in key regions could quickly derail these fair value projections and stall future earnings growth.

Find out about the key risks to this Kering narrative.

Another View: Market Multiples Raise Caution

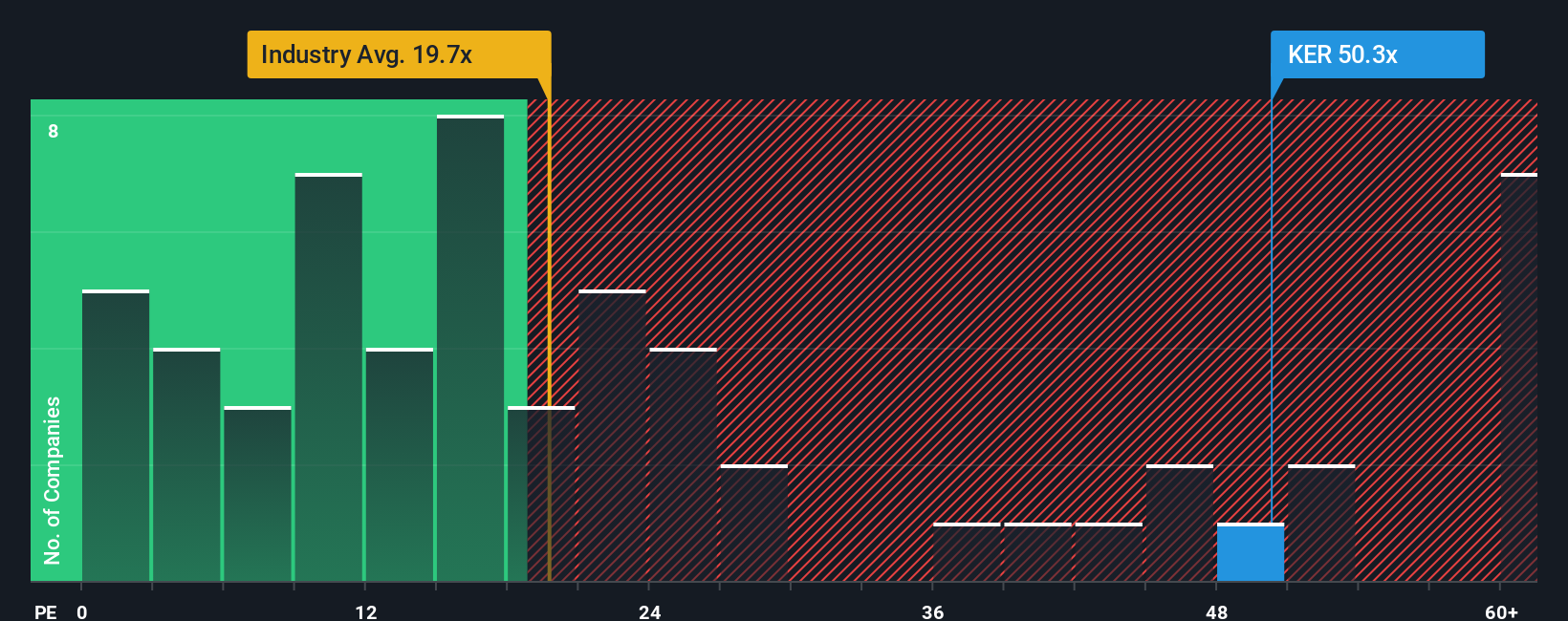

Taking a different lens, Kering’s current valuation using its price-to-earnings ratio paints a more challenging picture. The company is trading at 49.5x earnings, a premium not just to luxury peers averaging 31.7x, but also to the European industry’s 20.6x. The fair ratio is estimated at 33x, spotlighting a notable valuation gap that signals investors may be taking on added risk if sentiment turns. Might these rich multiples hold up if growth is slow to return?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kering Narrative

If you see the story unfolding differently or would rather dive into the numbers firsthand, you can shape your own view in just minutes. Do it your way

A great starting point for your Kering research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next winning stock could be waiting just one click away. Branch out and strengthen your portfolio with smart, high-potential ideas curated by Simply Wall Street’s screener tools.

- Pursue reliable income streams by checking out these 14 dividend stocks with yields > 3% offering attractive yields above 3% for steady returns.

- Get ahead of disruptive trends by backing innovation with these 25 AI penny stocks that are pushing the boundaries in artificial intelligence.

- Capitalize on tomorrow’s financial infrastructure by viewing these 81 cryptocurrency and blockchain stocks which is transforming global markets through blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Average dividend payer with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026