- France

- /

- Consumer Durables

- /

- ENXTPA:BIG

Market Cool On BigBen Interactive's (EPA:BIG) Revenues Pushing Shares 29% Lower

BigBen Interactive (EPA:BIG) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

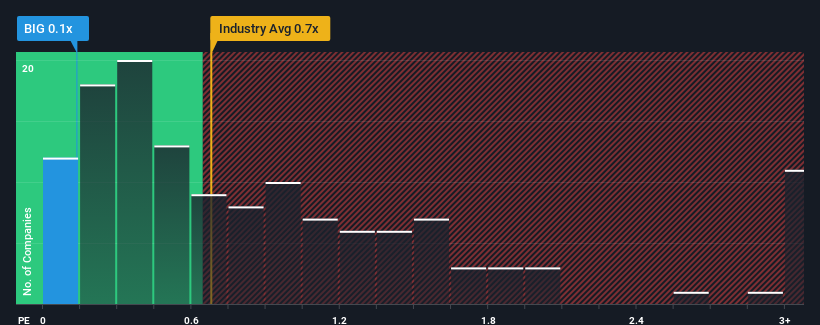

In spite of the heavy fall in price, there still wouldn't be many who think BigBen Interactive's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in France's Consumer Durables industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for BigBen Interactive

What Does BigBen Interactive's Recent Performance Look Like?

Recent times have been pleasing for BigBen Interactive as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think BigBen Interactive's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, BigBen Interactive would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.0% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 7.5% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.6% each year, which is noticeably less attractive.

In light of this, it's curious that BigBen Interactive's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price dropping off a cliff, the P/S for BigBen Interactive looks to be in line with the rest of the Consumer Durables industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BigBen Interactive currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - BigBen Interactive has 5 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if BigBen Interactive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BIG

BigBen Interactive

Designs, produces, and distributes accessories for video game consoles, and smartphones and tablets in France and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives