- France

- /

- Professional Services

- /

- ENXTPA:TEP

Examining Teleperformance Shares After 35.7% Drop and Regulatory News in 2025

Reviewed by Bailey Pemberton

- Wondering if Teleperformance is a hidden gem or if its recent prices are too risky? You are not alone, as many investors are scanning for undervalued stocks in today’s market.

- The share price is down by 2.6% over the last week, and it has lost 35.7% over the past year. This has understandably caught the attention of both bargain hunters and cautious investors.

- Much of that volatility comes in the wake of fresh regulatory concerns and management changes. These factors have been widely discussed in news cycles and have fueled both optimism and anxiety as the market tries to reposition its expectations.

- Teleperformance currently scores a strong 5 out of 6 on our valuation checklist, putting it firmly on the radar for value investors. Next, we will break down what this score really means using different valuation methods, while saving the most insightful approach for the end of the article.

Find out why Teleperformance's -35.7% return over the last year is lagging behind its peers.

Approach 1: Teleperformance Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach gives investors an idea of what the business is worth based on its capacity to generate future cash, rather than just market sentiment or earnings multiples.

For Teleperformance, the latest figures show a trailing twelve month Free Cash Flow (FCF) of €1.37 billion. Analyst projections cover the next five years, with Free Cash Flow estimates remaining close to €1 billion each year. Further growth is extrapolated beyond this period. By 2035, Teleperformance's FCF is expected to reach approximately €1.1 billion, according to extended projections.

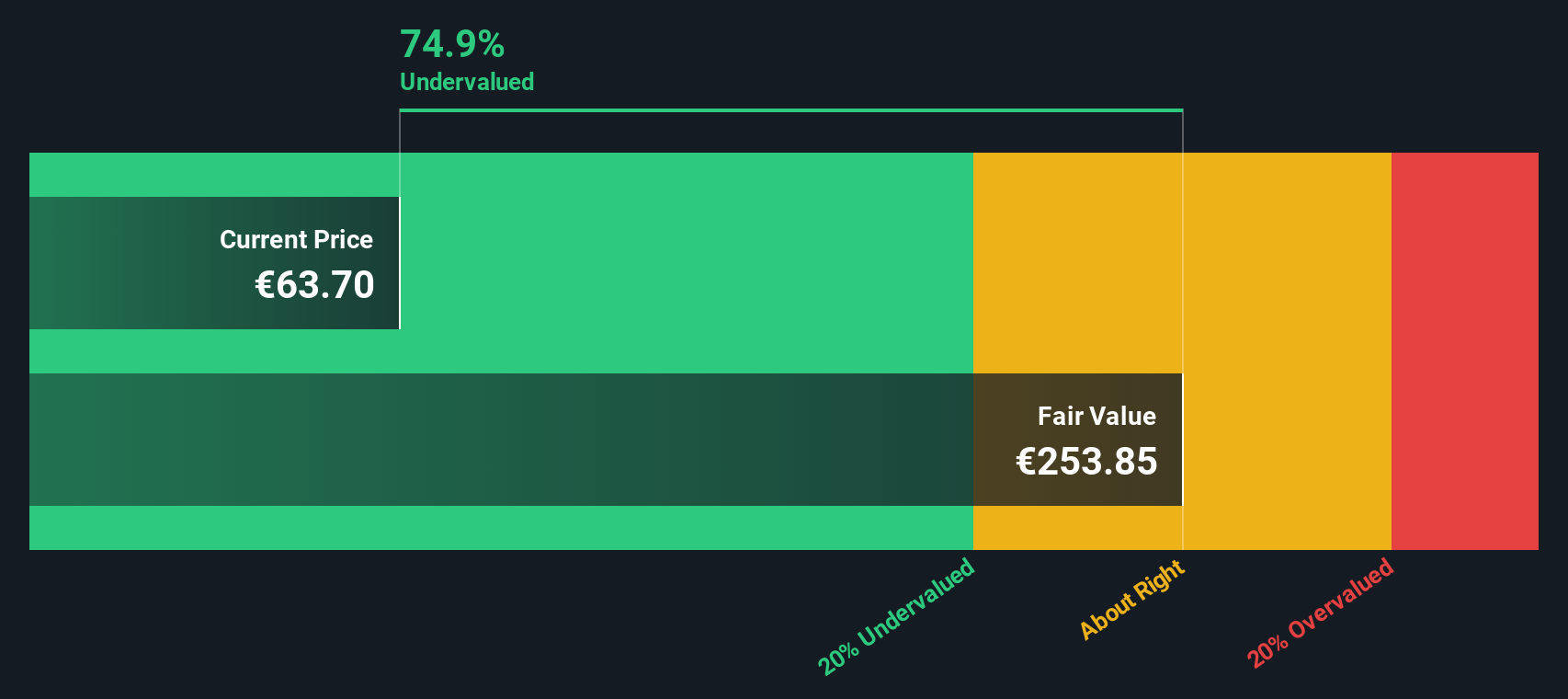

Using the 2 Stage Free Cash Flow to Equity model, Simply Wall St calculates an intrinsic value of €215.48 per share. This figure suggests Teleperformance stock is trading at a discount of 72.0 percent compared to its calculated fair value, which points to significant undervaluation in the current market. The robust cash generation profile and conservative forecasts support this view, even as the company navigates recent volatility.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teleperformance is undervalued by 72.0%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Teleperformance Price vs Earnings

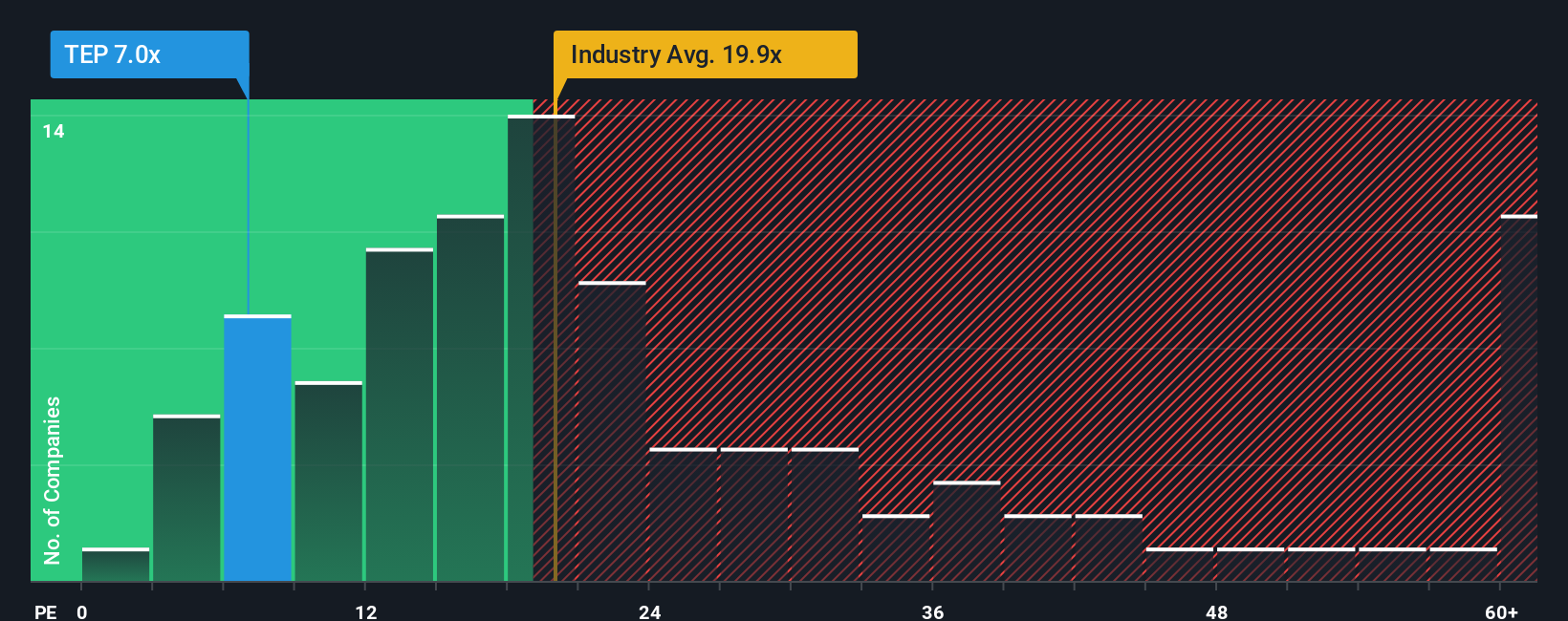

For profitable companies like Teleperformance, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it directly reflects what investors are willing to pay for each euro of current earnings. A lower PE often hints at undervaluation, while a higher one can be supported by strong growth prospects or lower perceived risk.

The "normal" or fair PE ratio depends on how fast the company is expected to grow and the level of risk it faces. Higher earnings growth or greater market stability usually justify higher PE ratios. Conversely, uncertainty or slow growth trends push the fair ratio lower.

Teleperformance is currently trading at a PE ratio of just 7.29x. This stands out against the Professional Services industry average of 18.92x and is also below the peer group average of 20.14x. On the surface, this suggests the stock might be cheap compared to similar companies.

However, instead of looking only at competitors or sector averages, Simply Wall St calculates a tailored "Fair Ratio" for Teleperformance based on its earnings growth prospects, profit margins, market size, and risks. For Teleperformance, the Fair Ratio is 15.66x. This method is more accurate than blanket comparisons, as it considers the company’s unique qualities alongside industry and market factors.

With Teleperformance’s actual PE (7.29x) well below the Fair Ratio (15.66x), the shares look strongly undervalued through this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teleperformance Narrative

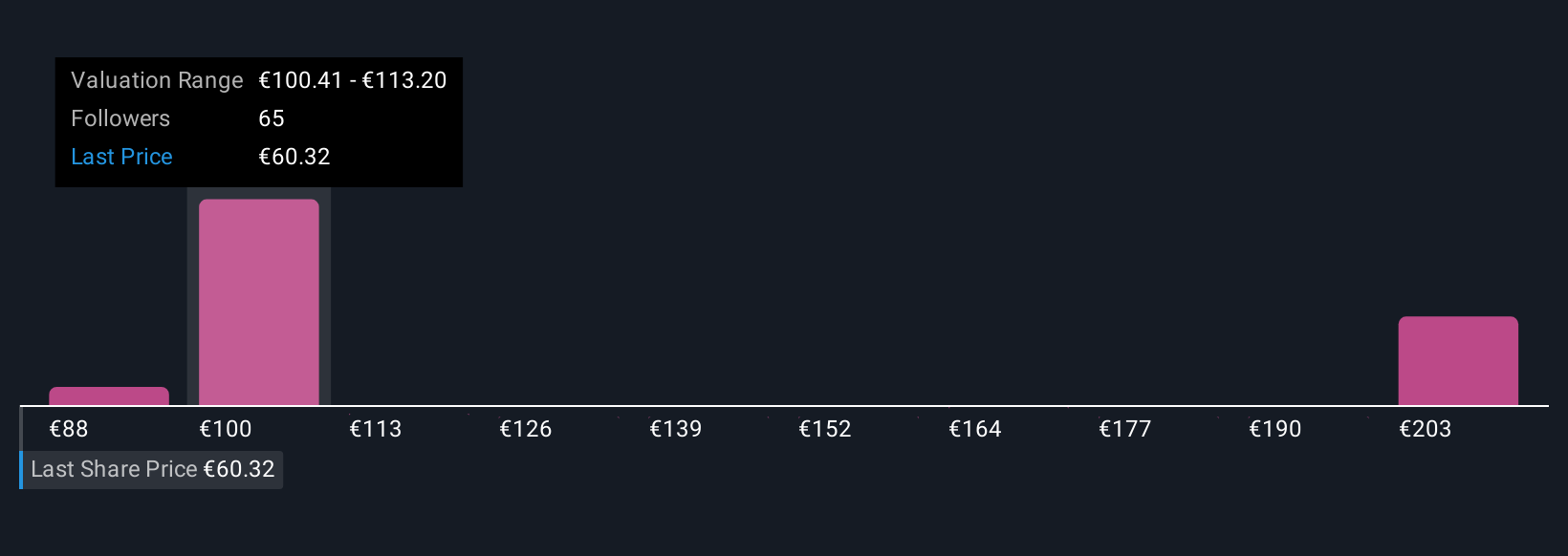

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, approachable tool that lets you attach a story—your personal perspective on Teleperformance—to the numbers, including your assumed fair value and forecasts of future revenue, earnings, and margins.

Narratives connect the company’s big-picture story and business context directly to a financial forecast and ultimately a fair value calculation. This approach helps you see how your assumptions translate into an actionable estimate. Rather than relying on fixed formulas, Narratives allow you to quickly and visually model how your views about Teleperformance’s future prospects and risks shape its valuation.

On the Simply Wall St Community page, millions of investors use Narratives to clarify their thinking and compare their fair value to the current share price, helping decide when to buy or sell. Narratives stay up to date by automatically factoring in new information like earnings releases or major news, ensuring your perspective always reflects current reality.

For example, some Teleperformance investors see upside from global expansion and innovation and project a fair value as high as €195.00 per share. More cautious users, concerned about contract losses or regulatory risks, estimate a fair value closer to €91.00. With Narratives, you can easily make sense of these extremes and decide what makes the most sense for your own investment thesis.

Do you think there's more to the story for Teleperformance? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teleperformance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TEP

Teleperformance

Operates as a digital business services company in France and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives