- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

Is There Still Upside for Elis After Shares Jumped 27.8% This Year?

Reviewed by Simply Wall St

Thinking of what your next move should be with Elis stock? You are definitely not alone. Whether you are looking to double down, trim your position, or take a fresh look, Elis has caught the eye of investors after a year that could make just about anyone sit up. Just this year, Elis shares have soared 27.8%, and they are up an impressive 29.3% over the past twelve months. Of course, the ride has not all been smooth, as a recent 5.9% dip across the last month reminds us that even strong stocks are rarely a one-way trip.

What stands out about Elis is not just the upward momentum. Behind the share price, a lot has been happening in the company’s operating environment, with some market developments raising questions around risk and reward. Still, long-term investors who have stuck with Elis have seen their patience rewarded, with the stock returning a remarkable 120.2% over three years and 139.2% over five years.

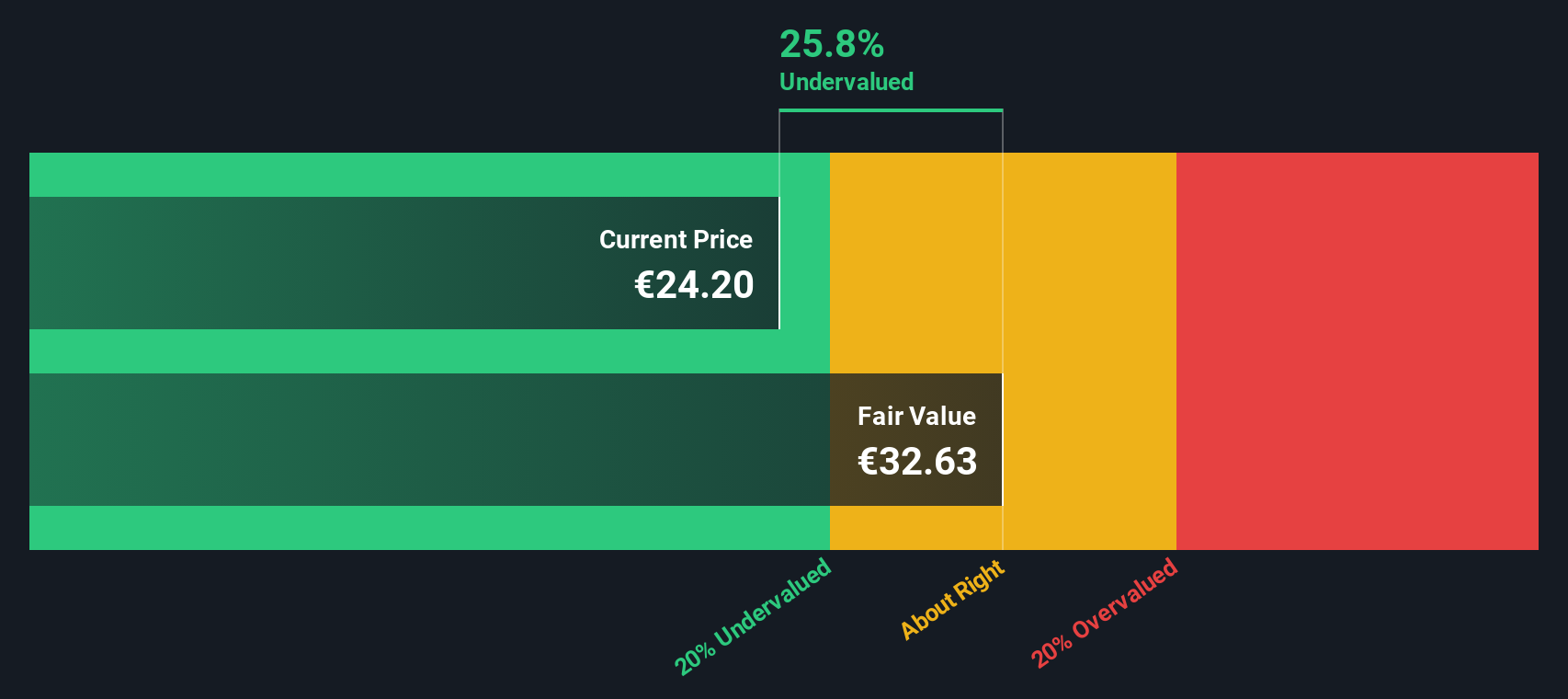

The big question, though, is whether Elis is still undervalued after all this growth, or if the ship has sailed. Based on six major valuation checks, Elis passes four, giving it a solid value score of 4. What do these checks actually mean, and how do they stack up against market optimism?

In the next section, I will break down each valuation method, explain what the value score tells us, and share the usual ways investors assess whether a stock is a bargain. But, stick around because there is an even more insightful perspective on valuation coming up at the end of the article that you will not want to miss.

Elis delivered 29.3% returns over the last year. See how this stacks up to the rest of the Commercial Services industry.Approach 1: Elis Discounted Cash Flow (DCF) Analysis

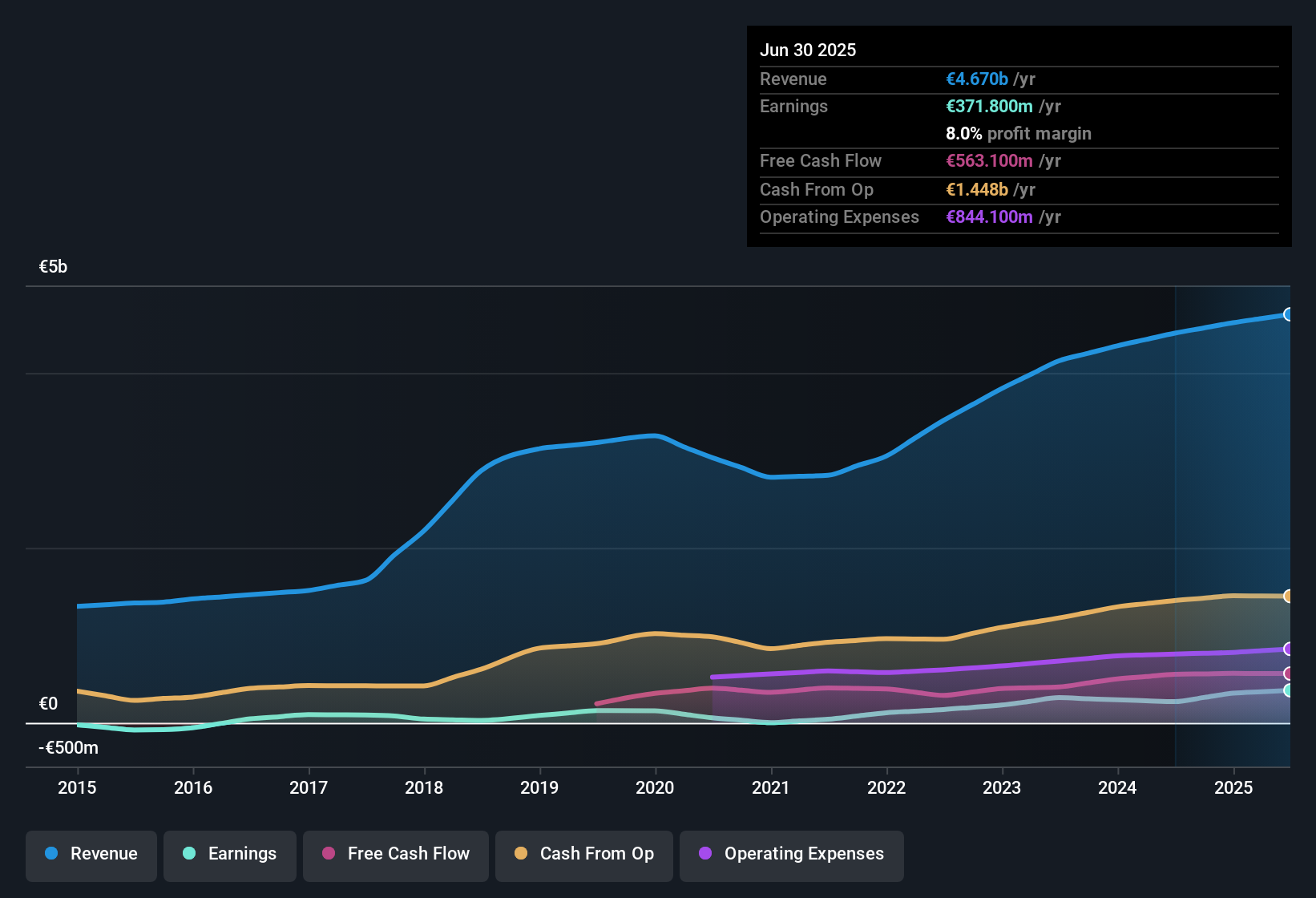

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting those values back to today. Essentially, it answers what Elis would be worth if you added up all the money the business is expected to generate, in today’s euros.

For Elis, the most recent Free Cash Flow comes in at approximately €561 million. Analysts have projected figures out to 2029, and by then, free cash flow is estimated to reach €479 million. Projections further into the future use automatic extrapolations. The first five years rely on analyst consensus. All figures are quoted in euros. For Elis, these remain at the hundreds of millions level and do not cross the billion threshold in any year.

Based on this forecast, the DCF analysis estimates the fair value of Elis shares at €37.91. Compared with the current share price, this suggests the stock trades at a 36.5% discount. According to this model, this indicates meaningful undervaluation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Elis.

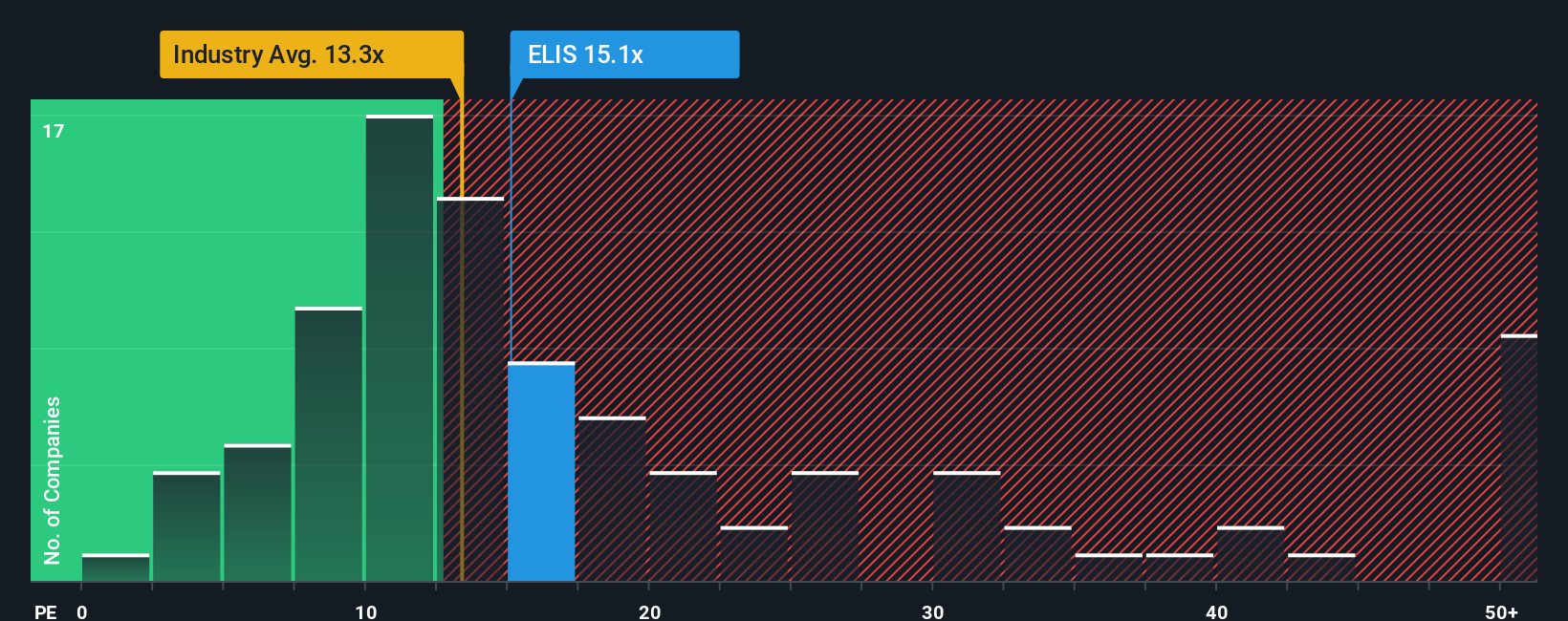

Approach 2: Elis Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as the preferred valuation method for profitable companies like Elis. This multiple helps investors gauge how much they are paying for each euro of the company’s earnings, making it a straightforward yardstick for companies that reliably generate profits.

A “normal” PE ratio, however, depends on more than just a comparison with other companies. Expected earnings growth, profit margins, and perceived business risks all help define what investors are willing to pay. Generally, a higher PE is justified if growth prospects are robust and risks are low. Companies facing headwinds or slow growth tend to trade at lower PEs.

Right now, Elis trades at a PE ratio of 15.1x. For context, this sits below the Commercial Services industry average of 17.3x and well under the peer group average of 20.1x. Beyond these surface-level benchmarks, Simply Wall St provides a proprietary “Fair Ratio” for Elis, which takes into account the company’s earnings growth potential, industry specifics, profit margin, market capitalization, and a risk profile unique to Elis. The current Fair Ratio for Elis is 15.5x. This offers a more tailored comparison than industry and peer averages because it reflects the full context of what makes Elis unique in its sector.

Comparing the Fair Ratio to Elis’ actual PE, the stock appears to be valued just about right relative to its prospects and risks.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Elis Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative connects your view of a company's story—your expectations about its future—with financial forecasts and a resulting estimate of fair value. Narratives are an easy, accessible tool found on Simply Wall St’s Community page, allowing investors to bring together their own assumptions about future revenue, profit margins, and growth drivers, and see how those inputs shape their valuation of Elis.

This approach lets you link what’s happening on the ground, such as industry shifts, management decisions, or regulation changes, directly to numbers like fair value and price targets. This can help you decide if the current price presents a buying or selling opportunity. Narratives update dynamically as new information, such as earnings reports or news, comes in and keeps your view relevant and actionable over time. For example, some investors believe Elis could be worth as much as €37.91 a share if recurring revenues keep growing and digitalisation drives margins higher. Others see fair value closer to €27.53 if risks like margin pressure and FX headwinds weigh on results. With Narratives, you can track, compare, and refine your own investment story as the facts evolve.

Do you think there's more to the story for Elis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives