- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

A Fresh Look at Elis (ENXTPA:ELIS) Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for Elis.

Elis’s share price has crept up nearly 2% over the past month, adding to solid year-to-date momentum with a 28% gain. Its one-year total shareholder return stands at 11%. This positive stretch hints at growing confidence in Elis’s long-term positioning, even as recent trading has seen some modest dips.

If you’re weighing your next move, this could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With shares closing at €24.12 and estimates pointing to a potential 15% upside, the question stands: does Elis trade at a discount with room for further gains, or is future growth already reflected in its price?

Most Popular Narrative: 12.4% Undervalued

Elis’s most popular narrative sees the fair value at €27.53, compared to the latest close of €24.12, revealing a notable gap. The stage is set by strong secular trends and management initiatives that are driving a bullish case for the company’s future trajectory.

Persistent outsourcing momentum across healthcare, workwear, and cleanroom segments, supported by stricter hygiene requirements and regulations, continues to drive new contract wins and organic revenue growth, aligning Elis with high-visibility, recurring revenue streams.

Want to see what’s propelling this value estimate? The narrative is underpinned by bold expectations of steady top-line expansion, margin improvement, and ambitious profit growth. Find out which financial levers the narrative believes will unlock future returns. Some underlying assumptions may surprise you.

Result: Fair Value of €27.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure in Latin America or a slowdown in the hospitality sector could challenge the optimistic outlook that analysts have set for Elis.

Find out about the key risks to this Elis narrative.

Another View: What Do Market Ratios Say?

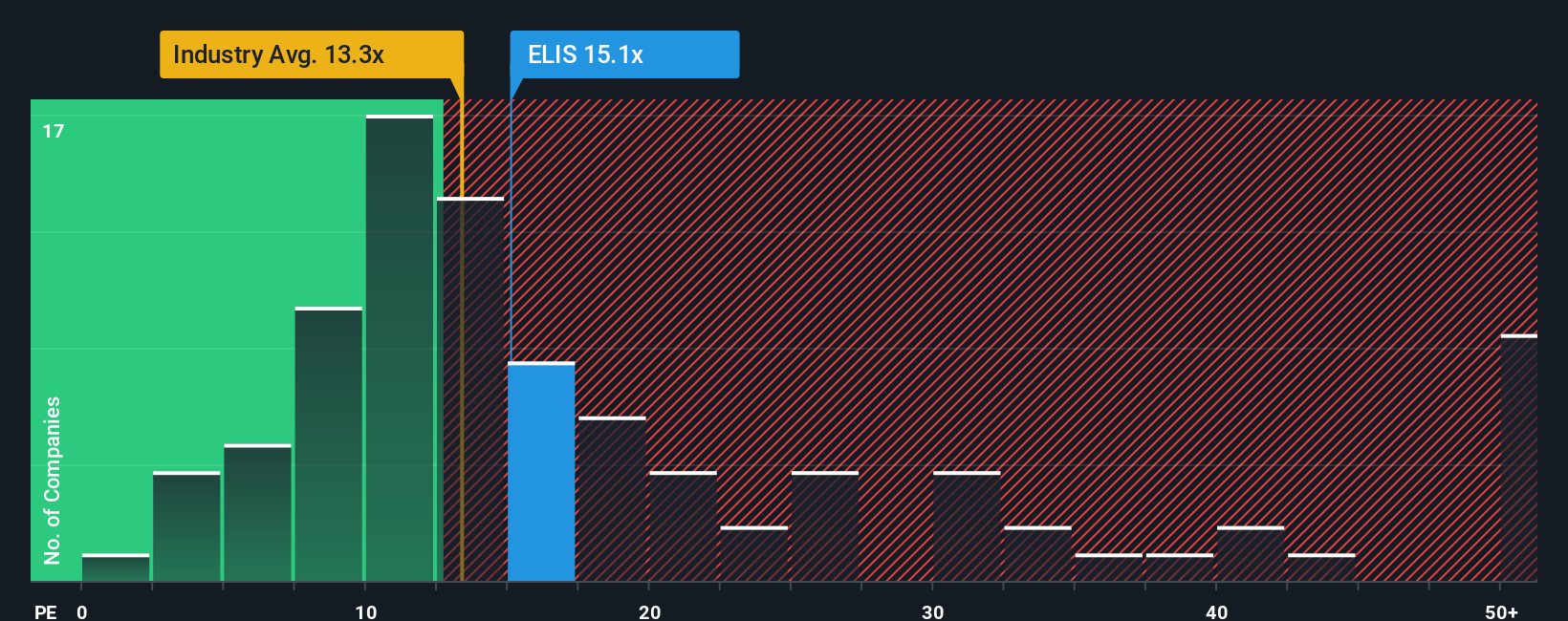

Taking a look at how shares are priced using the price-to-earnings ratio, Elis trades at 15.1 times earnings, which is higher than the European industry average of 13.3 and slightly above its own fair ratio of 14.6. This means the market sees Elis as more expensive than some competitors and even its long-term fair value benchmark. Is this a signal of optimism or a sign that the price has run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elis Narrative

If you want to dig into the details or see things from a different angle, you can craft your own story for Elis in just a few minutes. Do it your way

A great starting point for your Elis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Now’s the perfect time to look beyond Elis and pinpoint fresh areas for potential returns. Don’t miss the stocks already catching the attention of savvy investors.

- Tap into income potential by scanning for secure, high-yield picks within these 16 dividend stocks with yields > 3% and see which companies are rewarding shareholders.

- Capitalize on the future of computing by starting your search with these 28 quantum computing stocks and spot leaders in quantum breakthroughs changing the industry landscape.

- Ride the wave of innovation by getting ahead of the curve with these 25 AI penny stocks, highlighting firms shaping the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives