- France

- /

- Professional Services

- /

- ENXTPA:BVI

If EPS Growth Is Important To You, Bureau Veritas (EPA:BVI) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bureau Veritas (EPA:BVI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Bureau Veritas

Bureau Veritas' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Bureau Veritas grew its EPS by 7.0% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

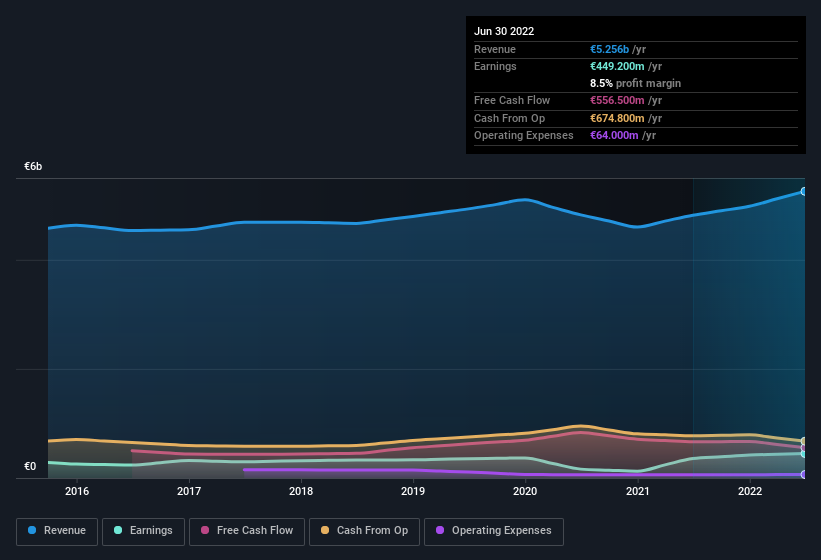

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Bureau Veritas maintained stable EBIT margins over the last year, all while growing revenue 9.1% to €5.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Bureau Veritas' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Bureau Veritas Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a €12b company like Bureau Veritas. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold €16m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Bureau Veritas Deserve A Spot On Your Watchlist?

One important encouraging feature of Bureau Veritas is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bureau Veritas , and understanding these should be part of your investment process.

Although Bureau Veritas certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bureau Veritas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BVI

Bureau Veritas

Provides laboratory testing, inspection, and certification services.

Excellent balance sheet with proven track record and pays a dividend.