- France

- /

- Professional Services

- /

- ENXTPA:BVI

Do Bureau Veritas' (EPA:BVI) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Bureau Veritas (EPA:BVI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Bureau Veritas with the means to add long-term value to shareholders.

View our latest analysis for Bureau Veritas

Bureau Veritas' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Bureau Veritas grew its EPS by 7.4% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

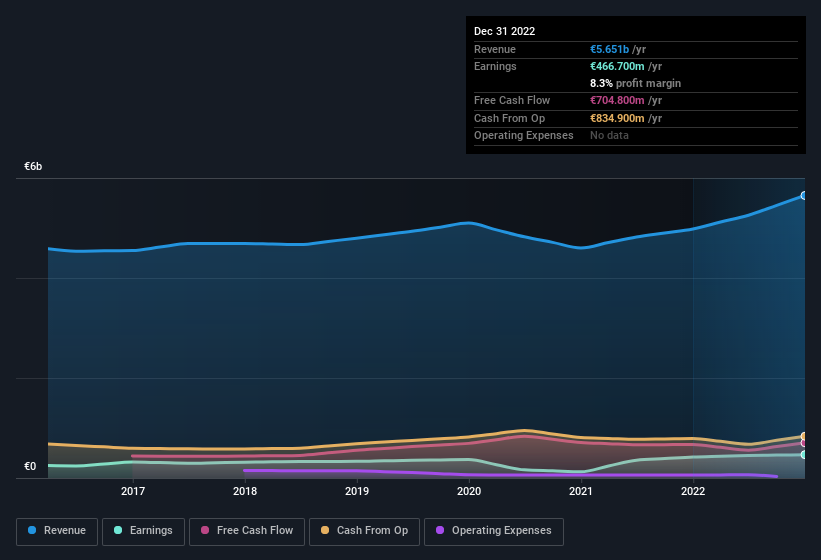

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Bureau Veritas remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to €5.7b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Bureau Veritas?

Are Bureau Veritas Insiders Aligned With All Shareholders?

Owing to the size of Bureau Veritas, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they hold €16m worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Bureau Veritas To Your Watchlist?

One positive for Bureau Veritas is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We don't want to rain on the parade too much, but we did also find 2 warning signs for Bureau Veritas that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bureau Veritas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BVI

Bureau Veritas

Provides laboratory testing, inspection, and certification services.

Excellent balance sheet with proven track record and pays a dividend.