Undiscovered Gems And 2 Other Promising Stocks With Solid Foundations

Reviewed by Simply Wall St

Amidst a backdrop of global market gains and small-cap indexes outperforming their larger counterparts, investors are navigating a landscape marked by strong labor market indicators and stabilizing economic conditions. In this environment, identifying stocks with solid fundamentals—those that exhibit resilience through robust financial health and strategic positioning—can be particularly rewarding for those seeking undiscovered gems in the investment world.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Assystem (ENXTPA:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Assystem S.A. is a global company that offers engineering and infrastructure project management services, with a market capitalization of €539.99 million.

Operations: Assystem S.A. generates revenue through its engineering and infrastructure project management services. The company's financial performance is reflected in its market capitalization of €539.99 million, indicating its valuation in the market.

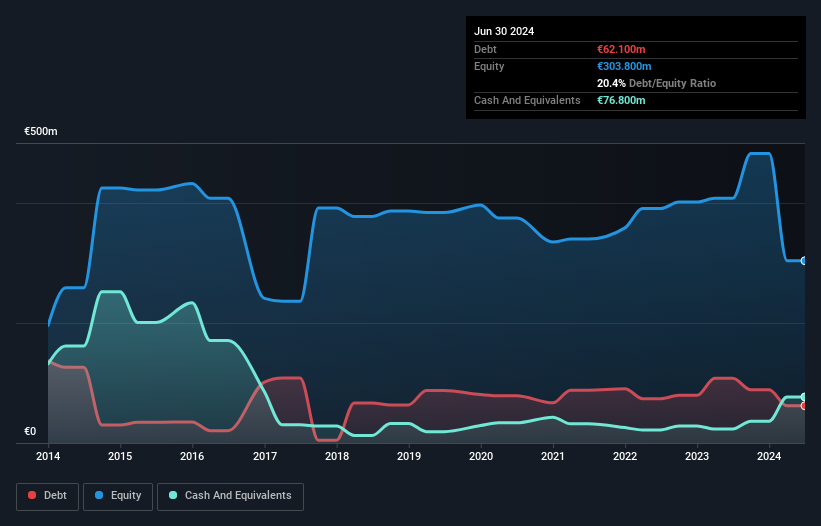

Assystem, a nimble player in the engineering sector, has shown robust earnings growth of 137.7% over the past year, outpacing its industry peers. Despite this impressive performance, recent challenges have led to a revision in their 2024 revenue target to €610 million due to delays in nuclear projects and budget issues in France and the UK. The company's debt-to-equity ratio has improved from 22.8% to 20.4% over five years, indicating prudent financial management. However, a significant one-off gain of €85.2 million impacted recent results, highlighting potential volatility in earnings quality moving forward.

- Dive into the specifics of Assystem here with our thorough health report.

Review our historical performance report to gain insights into Assystem's's past performance.

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market capitalization of approximately SEK10.70 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics segment, contributing SEK 1.04 billion, and Adult Health segment, adding SEK 306.08 million.

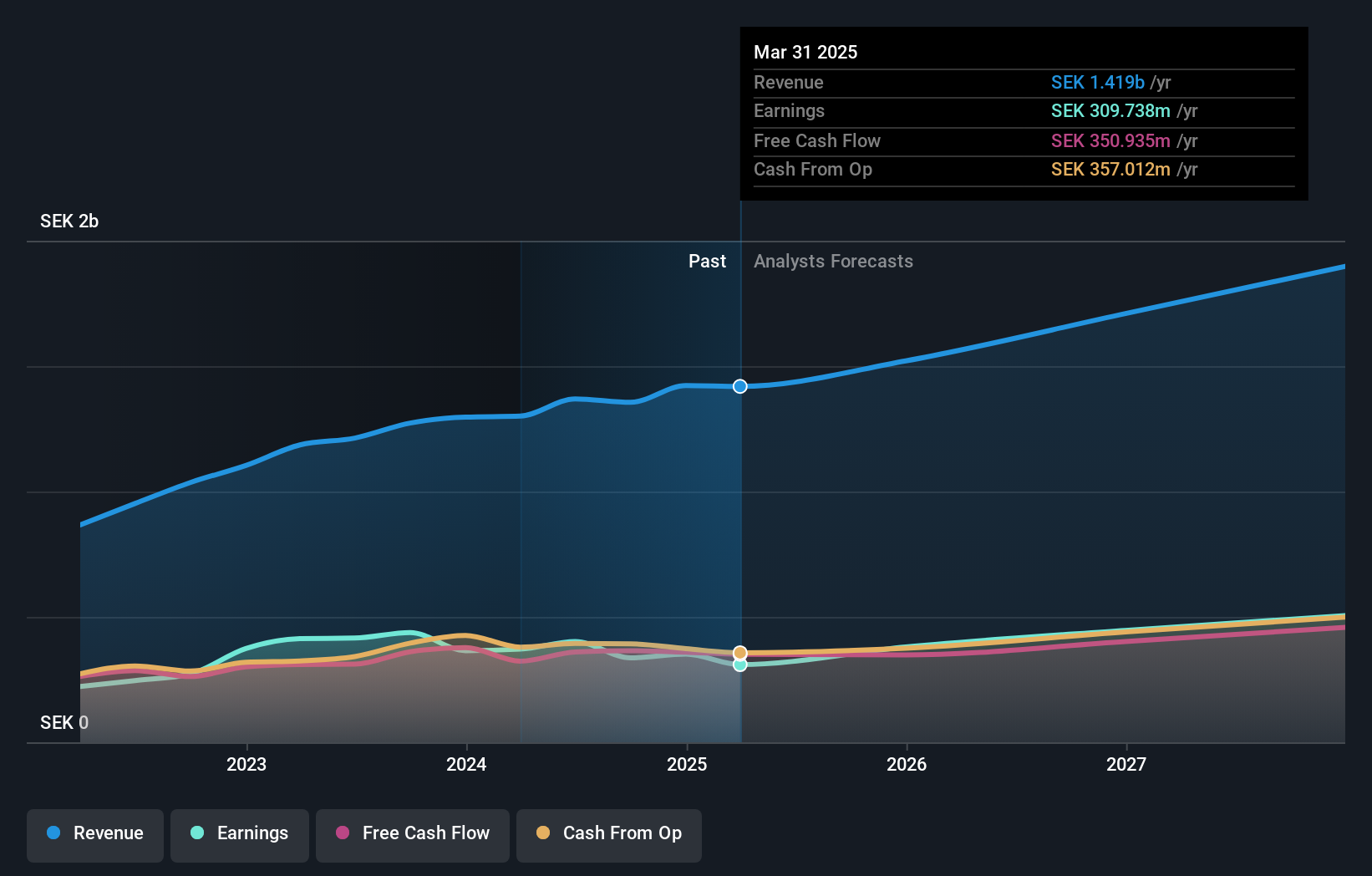

BioGaia, a nimble player in the biotech sector, stands out with its debt-free status over the past five years. Despite a challenging year with earnings shrinking by 23%, it still boasts high-quality earnings and positive free cash flow, which was SEK 365.13 million as of September 2024. Recent financials reveal a mixed bag; third-quarter sales dipped to SEK 303.97 million from SEK 317.69 million last year, while net income fell sharply to SEK 36.6 million from SEK 101.5 million previously. However, projected annual earnings growth of around 16% suggests potential for recovery and value creation moving forward.

- Navigate through the intricacies of BioGaia with our comprehensive health report here.

Assess BioGaia's past performance with our detailed historical performance reports.

Poly Plastic Masterbatch (SuZhou)Ltd (SZSE:300905)

Simply Wall St Value Rating: ★★★★★☆

Overview: Poly Plastic Masterbatch (SuZhou) Co., Ltd specializes in the research, development, production, and sale of fiber masterbatches both in China and internationally, with a market cap of CN¥5.66 billion.

Operations: Poly Plastic Masterbatch (SuZhou) Co., Ltd generates revenue primarily from its industrial segment, totaling CN¥1.38 billion. The company's financial performance is influenced by trends in gross profit margin, which reflects the efficiency of production and pricing strategies.

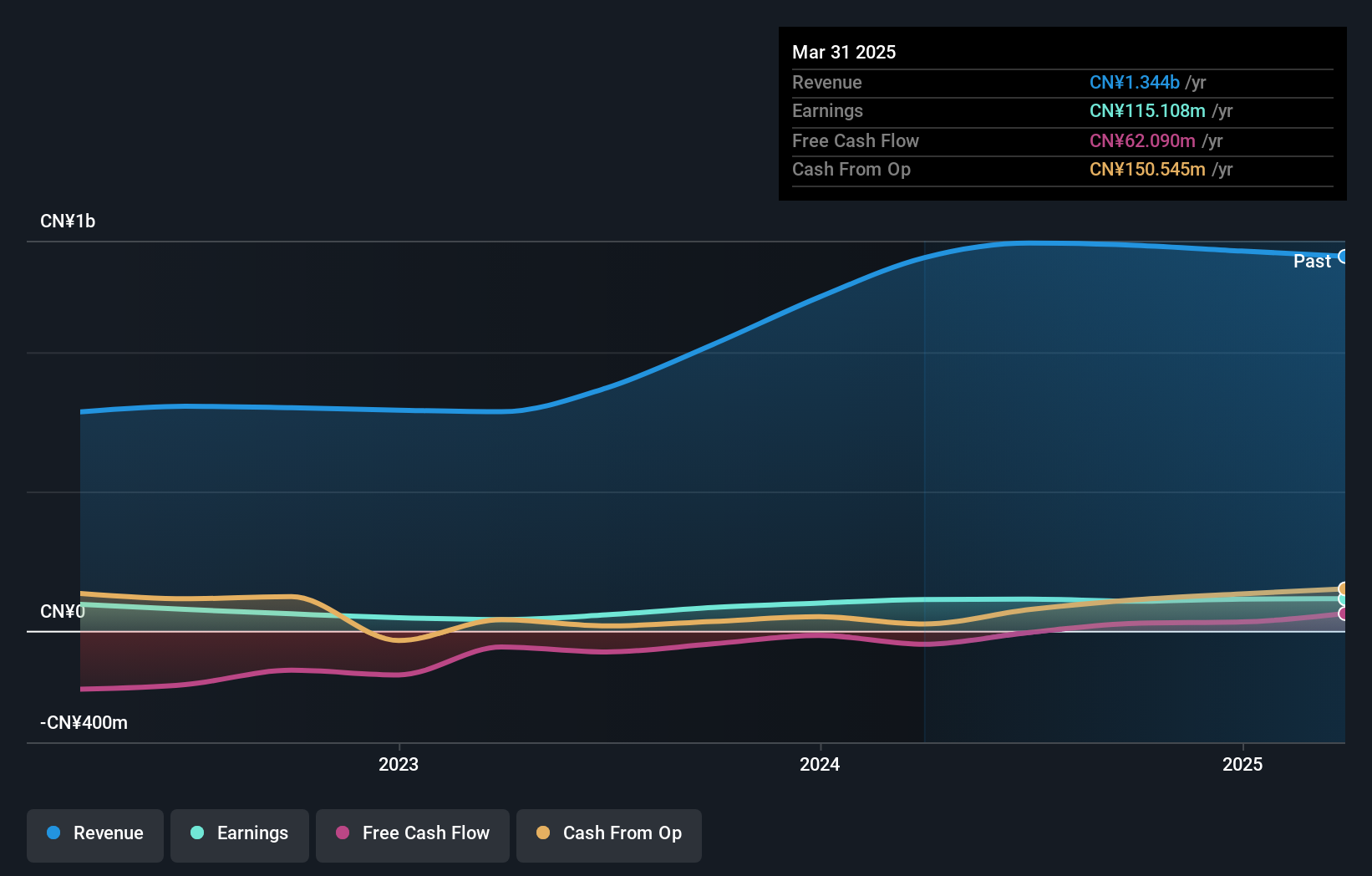

Poly Plastic Masterbatch (SuZhou) Ltd has shown notable progress, with earnings growth of 27% over the past year, outpacing the Chemicals industry which faced a 5.3% drop. The company reported CNY 1.01 billion in sales for the first nine months of 2024, up from CNY 824.81 million last year, while net income rose to CNY 80.87 million from CNY 74.22 million previously. Despite a highly volatile share price recently, it maintains more cash than total debt and has high-quality past earnings, suggesting financial stability even amid fluctuations and strategic changes like Yunnan International Trust's acquisition of a stake in the company for approximately CNY 220 million.

Key Takeaways

- Get an in-depth perspective on all 4640 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300905

Poly Plastic Masterbatch (SuZhou)Ltd

Engages in the research and development, production, and sale of fiber masterbatches in China and internationally.

Excellent balance sheet with acceptable track record.