There's No Escaping Tianjin Ringpu Bio-Technology Co.,Ltd.'s (SZSE:300119) Muted Earnings Despite A 29% Share Price Rise

Tianjin Ringpu Bio-Technology Co.,Ltd. (SZSE:300119) shares have continued their recent momentum with a 29% gain in the last month alone. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

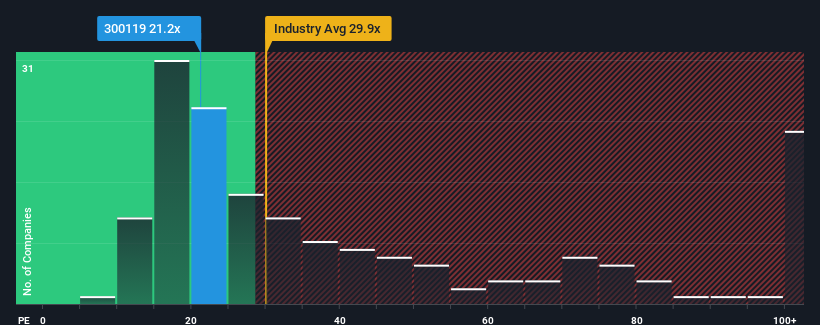

Even after such a large jump in price, Tianjin Ringpu Bio-TechnologyLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.2x, since almost half of all companies in China have P/E ratios greater than 36x and even P/E's higher than 70x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Tianjin Ringpu Bio-TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Tianjin Ringpu Bio-TechnologyLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Tianjin Ringpu Bio-TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 17% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 19% over the next year. Meanwhile, the rest of the market is forecast to expand by 39%, which is noticeably more attractive.

With this information, we can see why Tianjin Ringpu Bio-TechnologyLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Tianjin Ringpu Bio-TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Tianjin Ringpu Bio-TechnologyLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Tianjin Ringpu Bio-TechnologyLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Ringpu Bio-TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300119

Tianjin Ringpu Bio-TechnologyLtd

Engages in the research and development, production, and sale of veterinary raw materials, drug preparation, functional additives, and veterinary biological products.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives