- France

- /

- Commercial Services

- /

- ENXTPA:ALDLT

Delta Plus Group's (EPA:ALDLT) earnings trajectory could turn positive as the stock soars 10% this past week

It's nice to see the Delta Plus Group (EPA:ALDLT) share price up 10% in a week. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 32% in one year, under-performing the market.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Delta Plus Group had to report a 18% decline in EPS over the last year. This reduction in EPS is not as bad as the 32% share price fall. So it seems the market was too confident about the business, a year ago. The P/E ratio of 11.01 also points to the negative market sentiment.

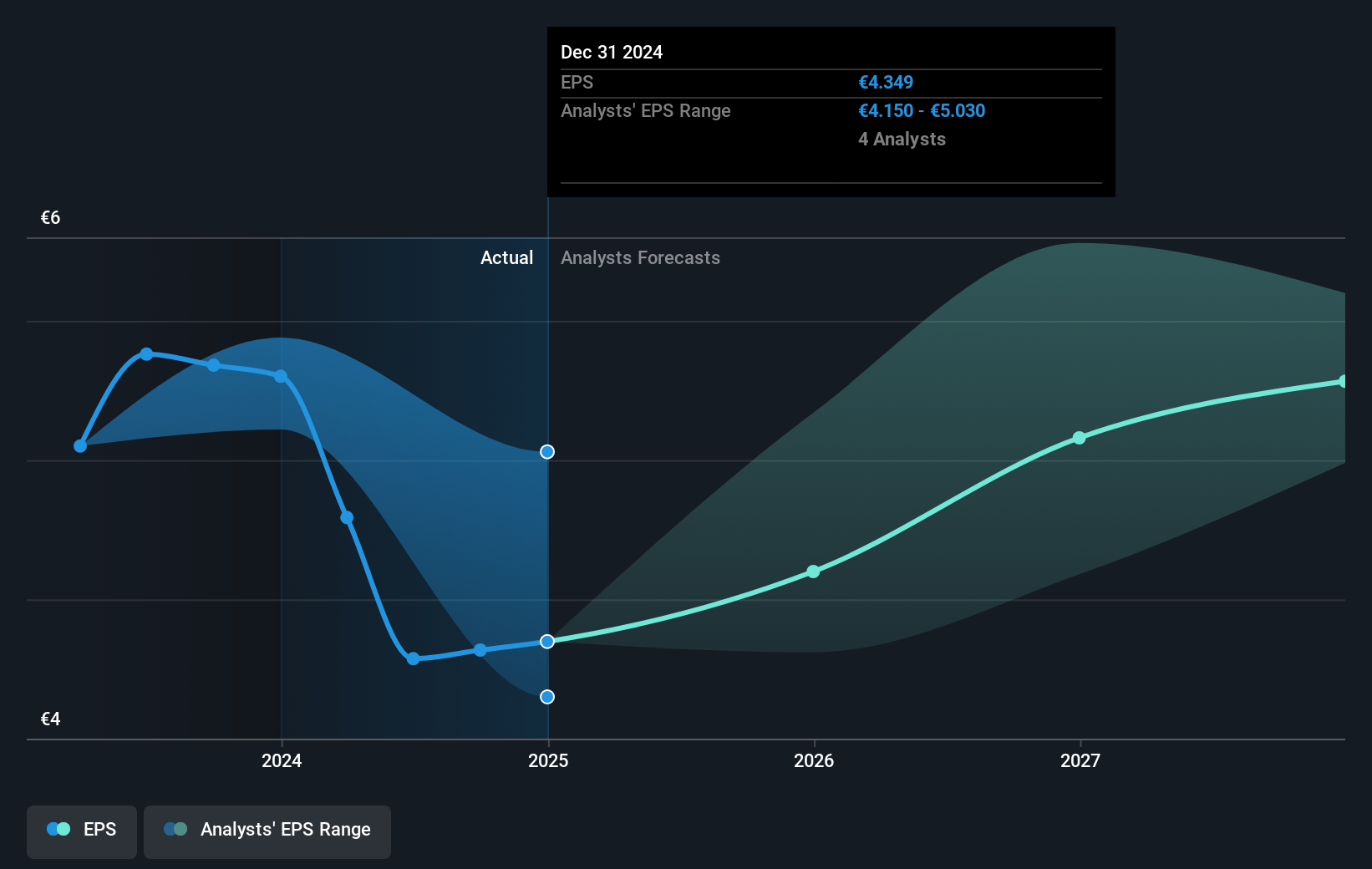

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Delta Plus Group's key metrics by checking this interactive graph of Delta Plus Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 3.4% in the last year, Delta Plus Group shareholders lost 30% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Delta Plus Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Delta Plus Group you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDLT

Delta Plus Group

Engages in design, manufacture, and distribution of a range of personal protective equipment worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives