- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU) Valuation in Focus as Investors Gauge Growth Potential

Reviewed by Simply Wall St

See our latest analysis for Schneider Electric.

Schneider Electric’s share price has cooled off after a strong start to the year, with recent selling pressure trimming some gains. Yet, the overall picture remains positive. While the 90-day share price return stands out at 15.05%, longer-term shareholders have enjoyed a 4.43% total return over the past year and an impressive 138.99% over five years. This suggests steady momentum fueled by consistent growth fundamentals.

If you’re tracking industrial leaders like Schneider Electric, now could be a great time to discover fast growing stocks with high insider ownership

But with this strong long-term run and solid growth, is Schneider Electric undervalued right now, or are investors already pricing in all the potential upside that future years could bring?

Most Popular Narrative: 5.6% Undervalued

Schneider Electric’s fair value estimate sits above the latest share price, suggesting that the market may not be fully embracing the growth story built into leading narratives. This difference sets the stage for one of the central arguments that has investors watching closely.

The company's transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double-digit rates, should drive higher margins and recurring earnings. There is further upside potential as AVEVA's SaaS conversion completes by 2027.

What’s powering the narrative’s optimism? There is one underlying shift that could radically change Schneider Electric’s profit profile and margin outlook. Want to know which future business line unlocks this premium price? The full narrative reveals the key forecast fueling this valuation.

Result: Fair Value of $260.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and slower than expected recovery in key segments could quickly change the optimistic outlook for Schneider Electric's growth narrative.

Find out about the key risks to this Schneider Electric narrative.

Another View: What About Market Multiples?

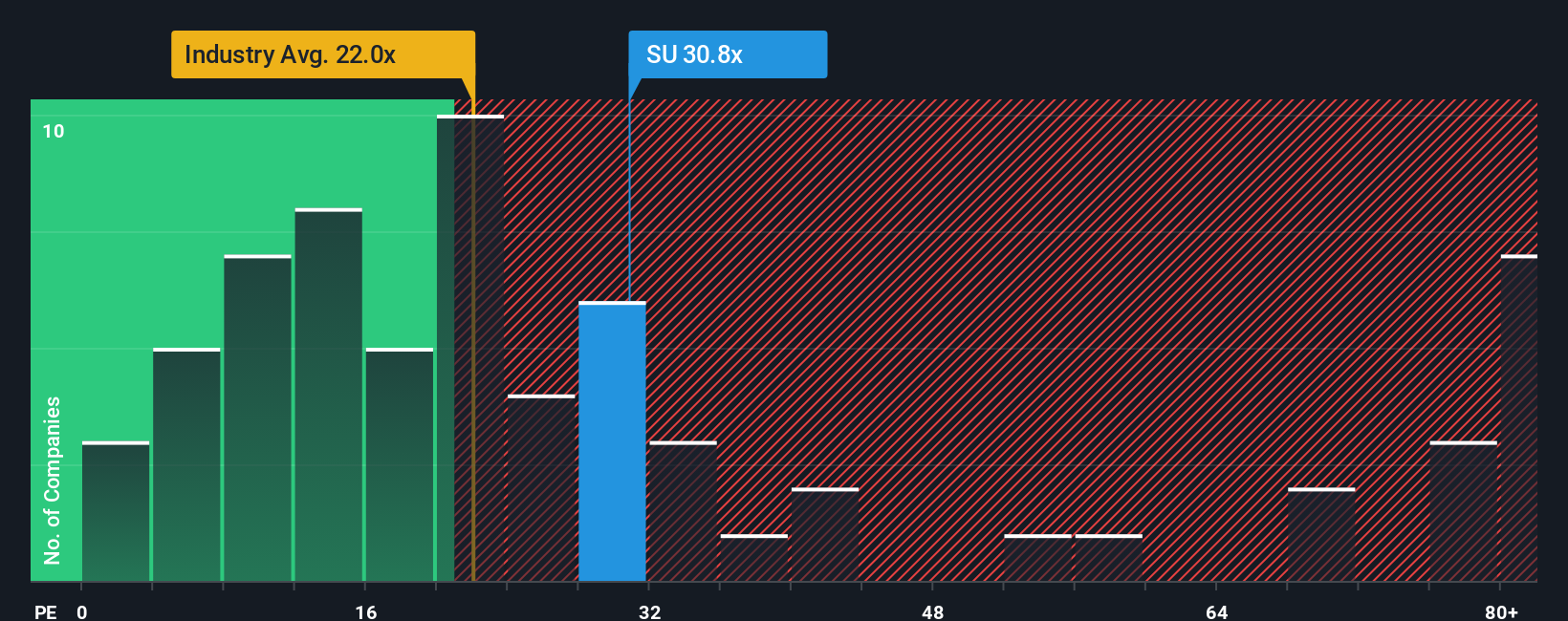

While fair value analysis signals Schneider Electric as undervalued, looking at the market’s pricing through its earnings ratio adds another angle. The company trades at a 32.2x ratio, which is notably higher than both the industry average (23.1x) and its peers (26.6x). However, the fair ratio of 35.5x suggests the market could justify even higher levels. Are investors paying up for quality growth, or does this create valuation risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider Electric Narrative

If you see the story differently or want to dig into the numbers for yourself, you can shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of market trends and unlock fresh opportunities by checking out these tailored stock lists. The right pick could transform your strategy. Don’t let someone else spot the winner before you.

- Capitalize on the latest tech evolution by jumping into these 26 AI penny stocks that are pioneering artificial intelligence adoption.

- Boost your income potential by reviewing these 22 dividend stocks with yields > 3% featuring companies rewarding shareholders with attractive yields above 3%.

- Take advantage of undervalued gems by reviewing these 832 undervalued stocks based on cash flows driven by strong cash flows and built-in upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives