- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU) Valuation in Focus After Recent Share Price Decline

Reviewed by Simply Wall St

Schneider Electric (ENXTPA:SU) shares have experienced a dip this week, prompting investors to take a closer look at the company’s recent performance and overall valuation. The stock’s month return is down nearly 8%.

See our latest analysis for Schneider Electric.

This latest downturn in Schneider Electric’s share price comes after a steady run last quarter and a sharp rally over the last three years. The 1-year total shareholder return is just shy of break-even at -3.5 percent, while the 3-year total shareholder return remains an impressive 69.5 percent. Although recent momentum is clearly fading, market sentiment could shift quickly given the company’s strong track record and ongoing business transformation.

If this shift in momentum has you wondering what else is out there, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares recently sliding, investors are left weighing Schneider Electric’s future growth prospects. Is the current dip signaling an undervalued opportunity, or are expectations for further gains already fully reflected in the price?

Most Popular Narrative: 14.5% Undervalued

Schneider Electric’s most widely followed narrative places its fair value at €265.10, significantly higher than the recent closing price of €226.55. The gap suggests strong conviction in the company’s multi-year growth story and emerging sector tailwinds.

The company's transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double-digit rates, should drive higher margins and recurring earnings. There is further upside potential as AVEVA's SaaS conversion completes by 2027.

Want a glimpse behind the bullish price target? This narrative leans on ambitious software growth assumptions and a steep jump in future earnings quality. Are the profitability upgrades achievable, or wishful thinking? The numbers underpinning this valuation might surprise you.

Result: Fair Value of €265.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures and weak European construction could challenge Schneider Electric’s bullish outlook if improvements in these areas do not occur.

Find out about the key risks to this Schneider Electric narrative.

Another View: Are Shares Actually Expensive?

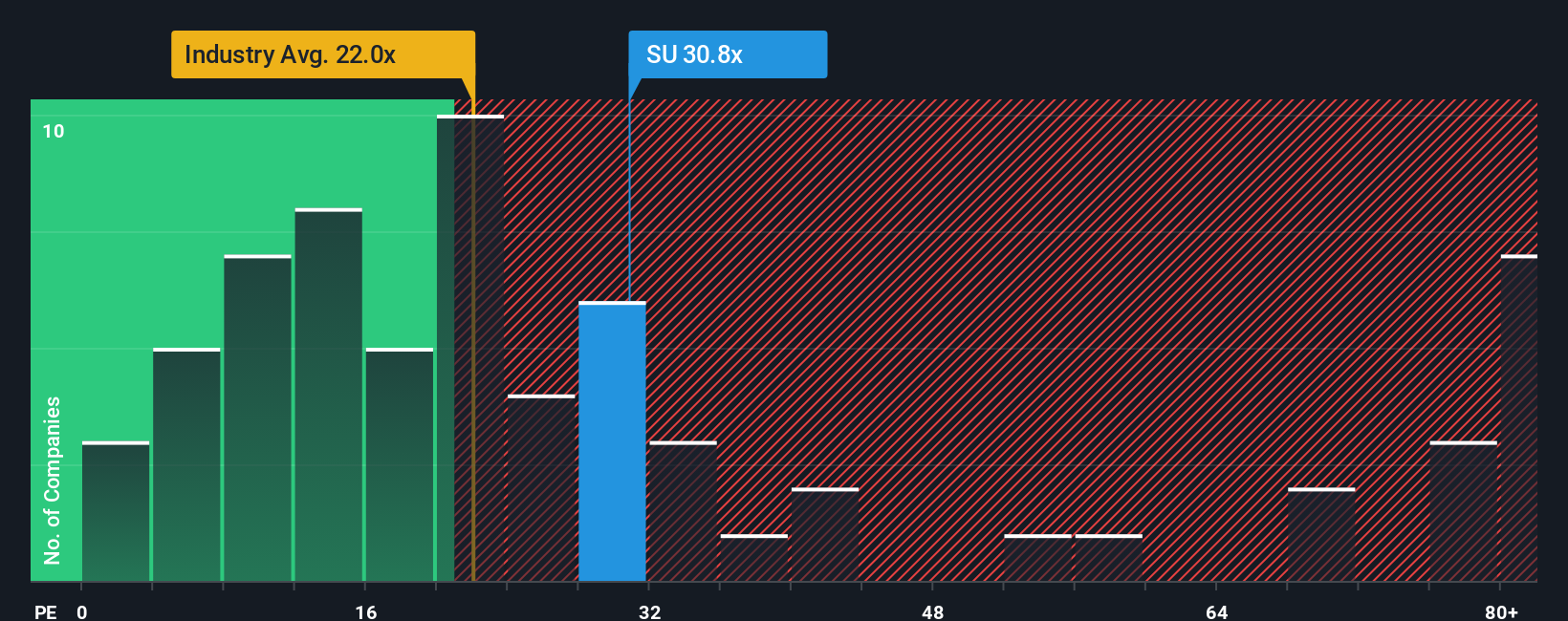

While the main narrative finds Schneider Electric undervalued based on long-term growth drivers, the current price-to-earnings ratio sits at 29.7x, notably higher than both the industry average of 22.9x and peer average of 24.7x. Even so, the fair ratio model suggests a higher bar at 34.2x. This puts investors in a tough position: are you betting on further upside or already stretching expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider Electric Narrative

If you want a different perspective or prefer to dive into the details yourself, you can build your own valuation narrative in just minutes, Do it your way

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd and supercharge your portfolio with investment opportunities you will not want to miss. Simply Wall St’s Screeners are packed with unique stocks primed for growth, disruption, or reliable income. Start your search now:

- Capture generous yields and steady returns by reviewing these 18 dividend stocks with yields > 3%, which delivers consistent dividends above 3%.

- Ride the AI wave and tap into rapid innovation with these 27 AI penny stocks, positioned for the next stage of smart technology adoption.

- Fuel your portfolio with long-term value by targeting these 894 undervalued stocks based on cash flows, trading below their intrinsic worth based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives