- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

Is Safran (ENXTPA:SAF) Undervalued? Exploring the Latest Analyst Narratives on Valuation

Reviewed by Simply Wall St

Safran (ENXTPA:SAF) has recently drawn the attention of investors following a period of steady price movements. While there is no single headline-grabbing event driving the shift, the stock’s trajectory may still leave many wondering if it signals a broader shift in sentiment or if it is simply typical for a company of its scale in the aerospace sector. For anyone tracking large-cap European industrial stocks, Safran’s recent performance is a subtle reminder that sometimes the absence of dramatic headlines can be an opportunity in itself.

Looking back over the past year, Safran’s share price has climbed 46%, with momentum building notably since the start of the year. Even after a modest dip in the past month, the longer-term gains highlight investors’ renewed optimism about the company’s outlook. Other recent movements have been more muted, suggesting the market could be digesting previous growth or waiting for a clearer catalyst.

With all of this in mind, the real question now is whether Safran’s current price reflects all its future potential, or if there is still room for buyers to gain an edge.

Most Popular Narrative: 9.2% Undervalued

The prevailing narrative among analysts suggests Safran is trading below its estimated fair value. This points to meaningful upside if the company delivers on expected growth and margins. This view is shaped by long-term opportunities in both aerospace and defense segments, with macro trends and recent strategic initiatives supporting the outlook.

"Safran's ongoing investment and leadership in fuel-efficient, lower-emission propulsion (hybrid-electric, sustainable aviation technologies) are already translating into new commercial and R&D partnerships. This positions the firm to capture incremental market share and secure pricing power as environmental regulation and ESG criteria gain importance. This trend is expected to support margin expansion and topline resilience."

Curious what is really fueling this bullish valuation? The most widely followed narrative relies on ambitious financial forecasts, sector dominance, and an expectation of robust profit progression over the coming years. Think future earnings power worthy of a premium, but what are the key numbers and assumptions powering that fair value? Peel back the narrative and discover the detailed projections that separate Safran from its peers.

Result: Fair Value of €307.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing supply chain pressures and the challenge of integrating recent acquisitions could quickly unravel Safran’s upbeat outlook if these issues are not managed well.

Find out about the key risks to this Safran narrative.Another View: Discounted Cash Flow Offers a Different Take

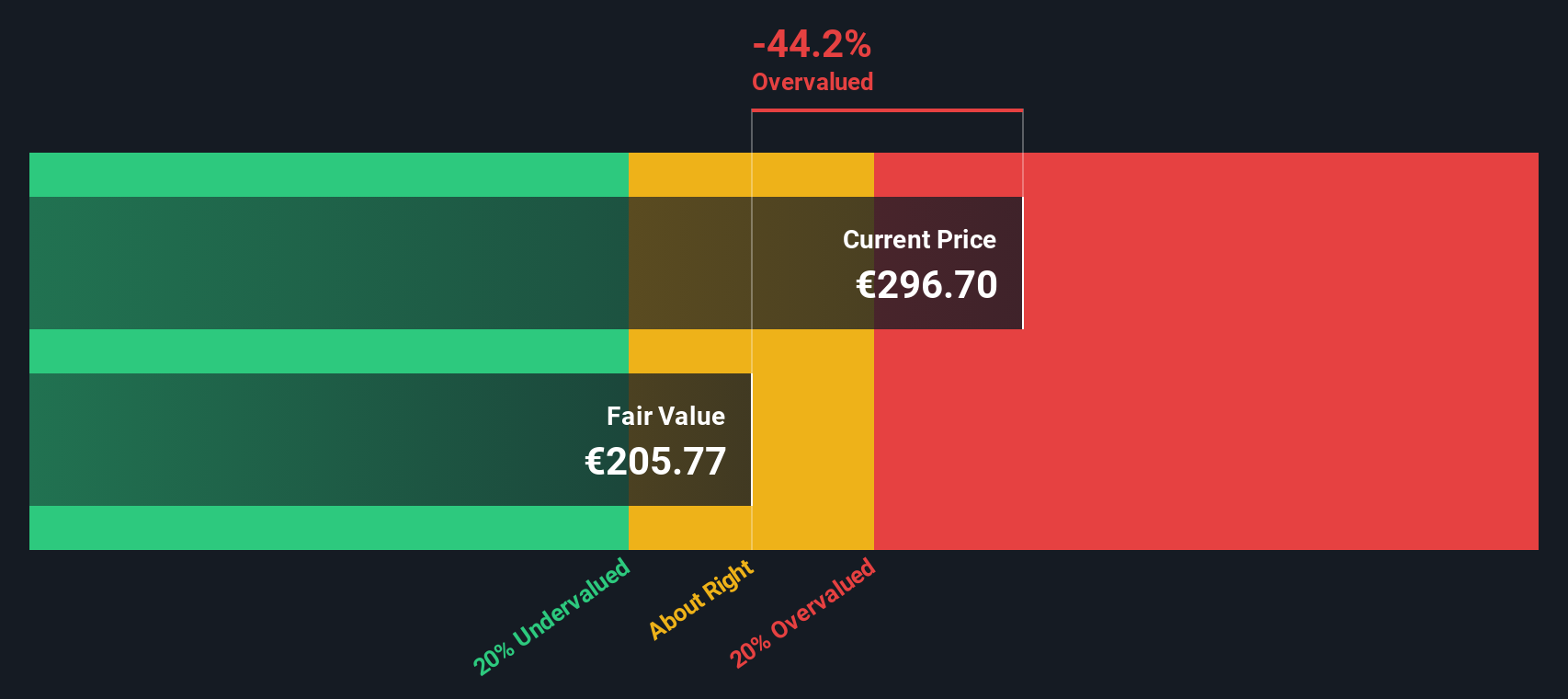

While many analysts focus on Safran's potential using future earnings forecasts, the SWS DCF model paints a less optimistic picture. This method suggests the company might actually be overvalued at present. So which approach truly reflects Safran's prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Safran for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Safran Narrative

If you have a different perspective or want to draw your own conclusions, you can put together your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Safran.

Looking for More Investment Ideas?

Why settle for just one opportunity? Unlock an edge by tracking exciting sectors and trends powered by the Simply Wall Street Screener. Smart investors know staying ahead of the crowd is important; missing these could mean missing tomorrow's winners.

- Supercharge your growth portfolio by targeting breakout companies using penny stocks with strong financials for early access to hidden gems with genuine financial backing.

- Put your money to work with assets offering real income, harnessing dividend stocks with yields > 3% that spotlight reliable companies boasting strong, consistent yields above 3%.

- Get a head start in one of the fastest-growing sectors by following healthcare AI stocks and spot market leaders blending AI innovation with medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:SAF

Safran

Engages in the aerospace and defense businesses in France, rest of Europe, the Americas, the Asia-Pacific, Africa, and the Middle East.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives