- France

- /

- Electrical

- /

- ENXTPA:NEX

Is Nexans Fairly Priced After 21% Share Price Surge and Renewable Energy Wins?

Reviewed by Bailey Pemberton

- Wondering if Nexans is a hidden gem or fairly valued at today’s price? You’re not alone; many investors are taking a closer look right now.

- The stock has shown notable momentum with a 21.2% gain year-to-date and a robust 21.8% climb over the past year, signaling strong interest and potential shifts in investor sentiment.

- Recent headlines have highlighted Nexans’ expanding role in energy transition projects across Europe and new contract wins in the renewable energy sector. These developments have added fuel to the optimism around the company, underlining both growth prospects and evolving risks.

- With a current valuation score of 3 out of 6, there is a lot more to unpack about how Nexans stacks up using different valuation lenses. Plus, we will uncover an even more insightful way to think about its fair value by the end of this article.

Approach 1: Nexans Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting those cash flows back to today’s value. This approach aims to capture the true worth of a business based on its expected ability to generate cash for shareholders in the years ahead.

For Nexans, the latest twelve months of Free Cash Flow stands at €554.5 million. According to analyst forecasts, annual Free Cash Flow is expected to decline over time, with projections showing €339 million by 2028. While analysts provide estimates for the first five years, Simply Wall St extrapolates these projections further and suggests continued, moderate declines past 2028.

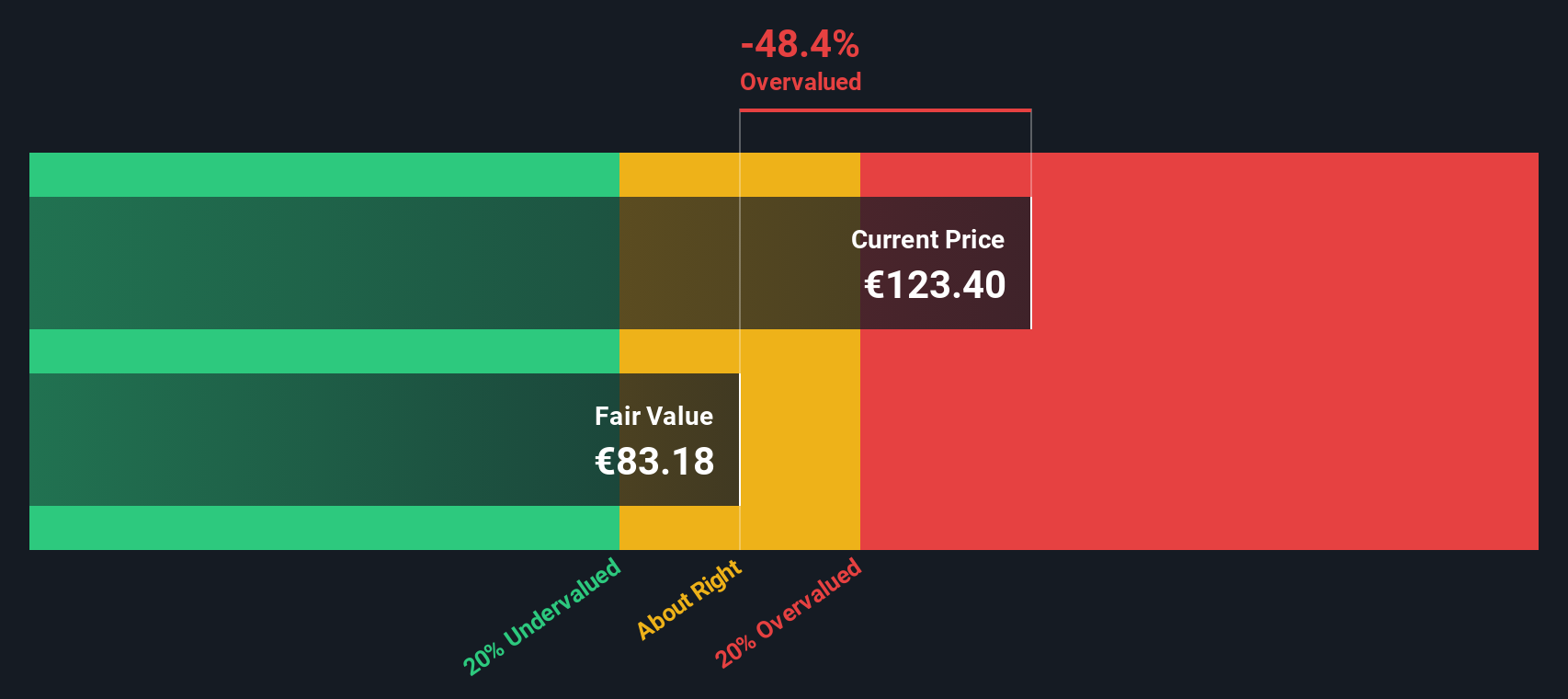

Running these figures through the 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value per share of €83.50. When compared to Nexans’ current share price, the stock appears to be trading at a 51.4% premium to its DCF-derived fair value. This suggests that, at present, Nexans is materially overvalued according to its discounted cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nexans may be overvalued by 51.4%. Discover 929 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nexans Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored metric when valuing profitable companies because it directly links a company’s current share price to how much it is earning today. For investors, the PE ratio offers a quick gauge to assess whether a stock is trading at an attractive price relative to its profits.

What counts as a "fair" or "normal" PE often depends on factors such as a company’s expected growth and its risk profile. Faster-growing, more stable businesses tend to command higher PE ratios, while companies with lower growth expectations or higher risks typically trade at a discount.

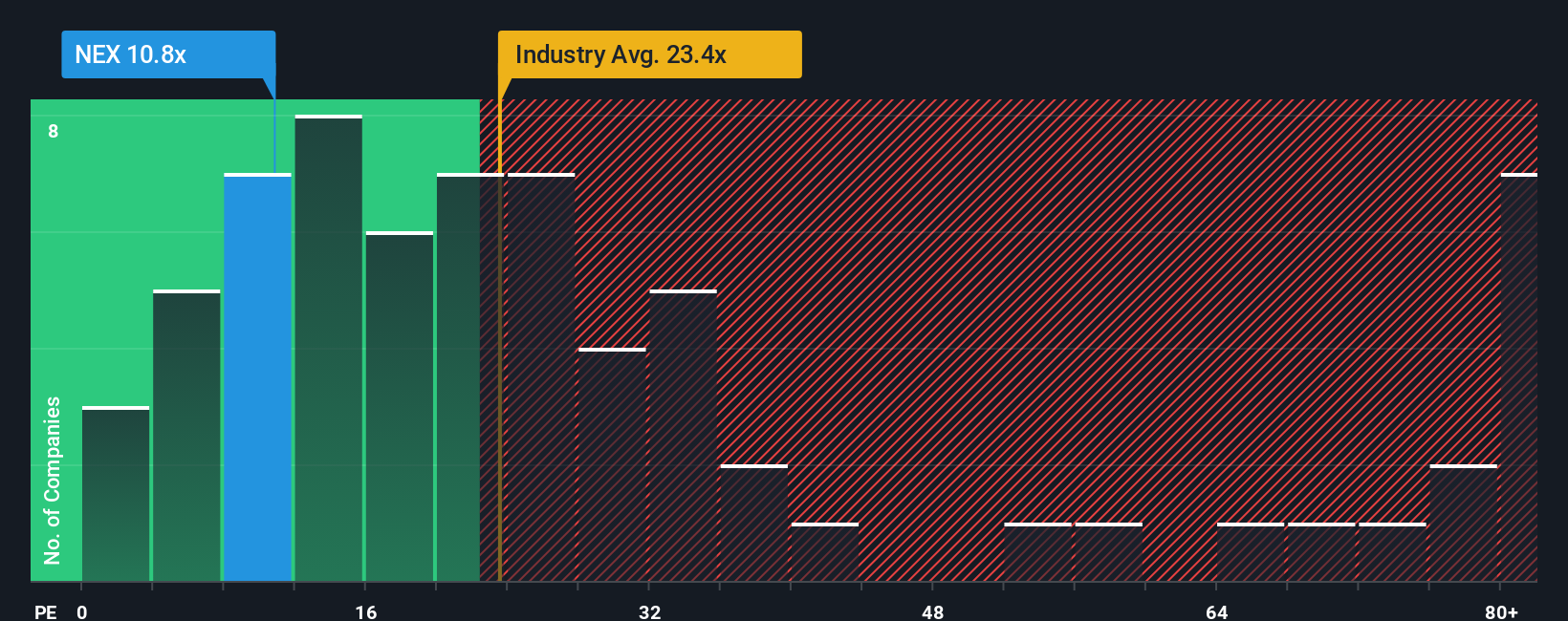

Nexans currently trades on a PE of 11.4x, which is substantially lower than the Electrical industry average of 29.4x and below the average of its listed peers at 21.8x. On the surface, this makes Nexans appear quite cheap versus both its sector and closest competitors.

However, Simply Wall St’s Fair Ratio offers a more tailored benchmark by considering Nexans' own earnings growth outlook, margins, market cap, and risk factors. This proprietary Fair Ratio for Nexans is 15.0x. Unlike a blunt industry or peer comparison, the Fair Ratio adjusts for what is realistically fair for the company based on its unique characteristics.

Comparing the actual PE of 11.4x to the Fair Ratio of 15.0x suggests Nexans is trading below its fair value on this metric, indicating an undervalued opportunity at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nexans Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a straightforward tool that lets you combine your view of Nexans, including its story, expected growth, and financial potential, with your estimates for future revenue, earnings, and margins. This creates a clear link between the company’s journey and a data-driven fair value.

Narratives help you distill complex investment decisions by connecting your perspective on what’s likely to happen next for Nexans to a transparent, personalized financial forecast. Widely used on Simply Wall St’s Community page, Narratives are accessible for all investors and make it easy to see at a glance whether the current price looks attractive relative to a fair value shaped by your own logic and forecasts.

Because Narratives update in real time as new information arrives, such as earnings or major news, your fair value and thesis always stay current. For example, one investor may see Nexans’ aggressive move into electrification as supporting a bullish fair value of €136 per share, while another focused on market risks and margin pressures might estimate fair value at only €91. Both points of view are captured and compared against today’s price. This dynamic approach helps you decide with confidence whether to buy, hold, or sell.

Do you think there's more to the story for Nexans? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NEX

Nexans

Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026