- France

- /

- Electrical

- /

- ENXTPA:NEX

Assessing Nexans (ENXTPA:NEX) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Nexans (ENXTPA:NEX) has been on investor radars lately, with stock performance showing mixed signals over the past few months. Looking at recent returns, shares have gained 6% in the last day and 2% this week.

See our latest analysis for Nexans.

Nexans has shown notable momentum this year, with a 20.9% share price return year to date and a 17.7% total shareholder return over the last twelve months. Recent positive moves suggest investors are responding to shifting sentiment about the company’s long-term prospects, despite share price volatility earlier in the year.

If Nexans’ run has sparked your curiosity, it could be the right moment to broaden your outlook and discover fast growing stocks with high insider ownership

With recent momentum driving Nexans shares higher, investors are left wondering whether this is a case of undervaluation with more upside ahead or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 5.7% Undervalued

Nexans’ most popular narrative sets its fair value at €133.79, slightly above the last close price of €126.10. The market looks nearly in line, but a modest upside remains if the analysts’ view plays out.

The ongoing acceleration of global electrification, renewable energy adoption, grid modernization, and significant investments in infrastructure (especially in Europe and emerging markets) continue to drive strong organic growth in Nexans' Electrification, Power Grid, and Transmission segments. This supports a robust order backlog and increased revenue visibility for coming years. Nexans' strategic transformation into a near pure-play electrification company, combined with sustained focus on high-value-grid, offshore wind, and specialty cabling solutions, positions the company to benefit from expanding high-margin market opportunities and structurally improve group net margins.

Curious how this scenario comes together? The real twist is that the narrative hinges on bold margin expansion and a shift in profit multiples. The consensus unpacks surprising growth and valuation assumptions you won’t want to miss. Discover what drives the fair value just above today’s price.

Result: Fair Value of €133.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen challenges such as escalating competition or volatile raw material costs may still threaten Nexans’ earnings outlook and put pressure on future profitability.

Find out about the key risks to this Nexans narrative.

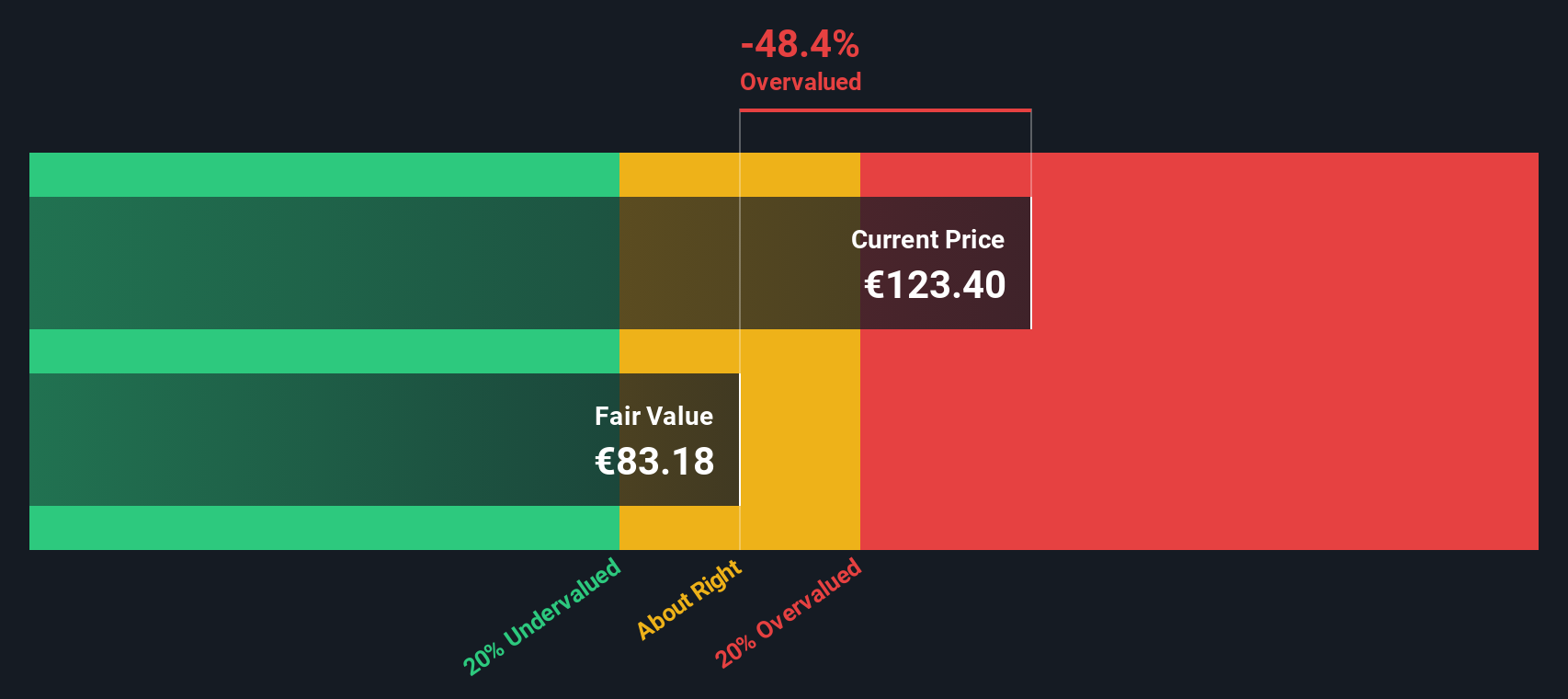

Another View: Our DCF Model Raises Questions

While analysts see slight upside for Nexans based on market consensus, our SWS DCF model paints a different picture. It estimates fair value at €83.67, which suggests the shares are actually trading well above their underlying cash flows. Could short-term optimism be clouding deeper valuation risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nexans for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nexans Narrative

If you have a different take or want to dive into the numbers yourself, you can craft your own view in just a few minutes: Do it your way.

A great starting point for your Nexans research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your portfolio strategy with opportunities you might not have considered yet. There is no time like now to gain an edge on your next smart move.

- Get ahead of the AI wave by checking out these 27 AI penny stocks, which present potential for explosive future growth and industry disruption.

- Secure income streams with these 15 dividend stocks with yields > 3%, offering attractive yields and reliable dividends for greater stability in your investments.

- Capitalize on shifting market trends by targeting these 897 undervalued stocks based on cash flows, which could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NEX

Nexans

Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives