- France

- /

- Electrical

- /

- ENXTPA:LR

Legrand SA's (EPA:LR) latest 4.9% decline adds to one-year losses, institutional investors may consider drastic measures

Key Insights

- Given the large stake in the stock by institutions, Legrand's stock price might be vulnerable to their trading decisions

- A total of 25 investors have a majority stake in the company with 43% ownership

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

Every investor in Legrand SA (EPA:LR) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 54% to be precise, is institutions. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And institutional investors endured the highest losses after the company's share price fell by 4.9% last week. The recent loss, which adds to a one-year loss of 3.0% for stockholders, may not sit well with this group of investors. Institutions or "liquidity providers" control large sums of money and therefore, these types of investors usually have a lot of influence over stock price movements. As a result, if the decline continues, institutional investors may be pressured to sell Legrand which might hurt individual investors.

Let's take a closer look to see what the different types of shareholders can tell us about Legrand.

View our latest analysis for Legrand

What Does The Institutional Ownership Tell Us About Legrand?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

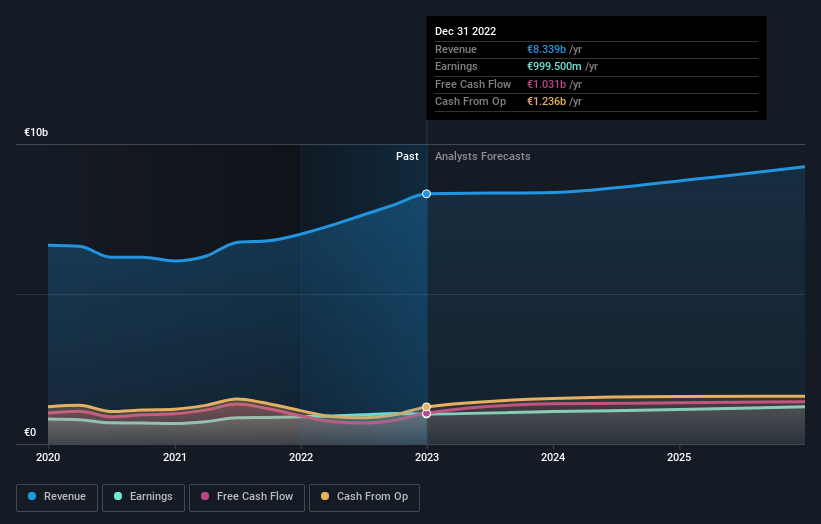

We can see that Legrand does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Legrand, (below). Of course, keep in mind that there are other factors to consider, too.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. We note that hedge funds don't have a meaningful investment in Legrand. The company's largest shareholder is Massachusetts Financial Services Company, with ownership of 10%. Meanwhile, the second and third largest shareholders, hold 5.1% and 3.7%, of the shares outstanding, respectively.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Legrand

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Legrand SA. It is a very large company, and board members collectively own €377m worth of shares (at current prices). we sometimes take an interest in whether they have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 44% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LR

Legrand

Manufactures, distributes, and sells electrical and digital building infrastructures in Europe, North and Central America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026