- France

- /

- Electrical

- /

- ENXTPA:LR

Legrand (ENXTPA:LR): Assessing Valuation Following Earnings Growth and 2025 Sales Guidance Confirmation

Reviewed by Simply Wall St

Legrand (ENXTPA:LR) just confirmed its full-year 2025 sales guidance, expecting 10% to 12% growth excluding currency effects. This comes after the release of their latest earnings, which showed year-over-year increases in both sales and net income.

See our latest analysis for Legrand.

Despite Legrand's upbeat 2025 outlook and encouraging earnings growth, the share price recently slid 12.19% in a single day and is down nearly 13% for the week. Strong year-to-date momentum remains intact, however, with a 37.94% share price return so far in 2025 and a 35.68% total shareholder return over the past year. This reinforces the company's long-term growth story even as the market reacts sharply to short-term news.

If you’re eyeing new opportunities beyond industrial leaders like Legrand, now’s the perfect moment to broaden your perspective with fast growing stocks with high insider ownership

With recent price swings and a healthy outlook, investors now face a pivotal question: is Legrand trading at a discount that signals opportunity, or is the market already reflecting its robust future growth prospects?

Most Popular Narrative: 10.2% Undervalued

With Legrand's fair value pinned at €143.94 by the narrative, and the last close at €129.25, the stock attracts attention for those weighing upside against strong recent returns. The narrative’s estimate implies a notable gap between the company’s future potential and the current market reaction, setting the stage for deeper analysis of what is driving this optimistic outlook.

Surging investment in data centers, driven by the growth of artificial intelligence and the increasing digitalization of infrastructure globally, is fueling exceptionally strong demand for Legrand's white space products. This trend, supported by a large backlog and above-1x book-to-bill ratio, is expected to sustain high organic revenue growth through at least 2030.

A multi-billion euro growth wave is building, fueled by seismic shifts in demand and ambitious margin targets. Wondering what powerful projections support this substantial valuation lift? Dive in to uncover the forecasts behind one of the most closely watched price targets on the market.

Result: Fair Value of €143.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained growth depends on ongoing demand for data centers and Legrand's ability to maintain profit margins in the face of global competition and changing end markets.

Find out about the key risks to this Legrand narrative.

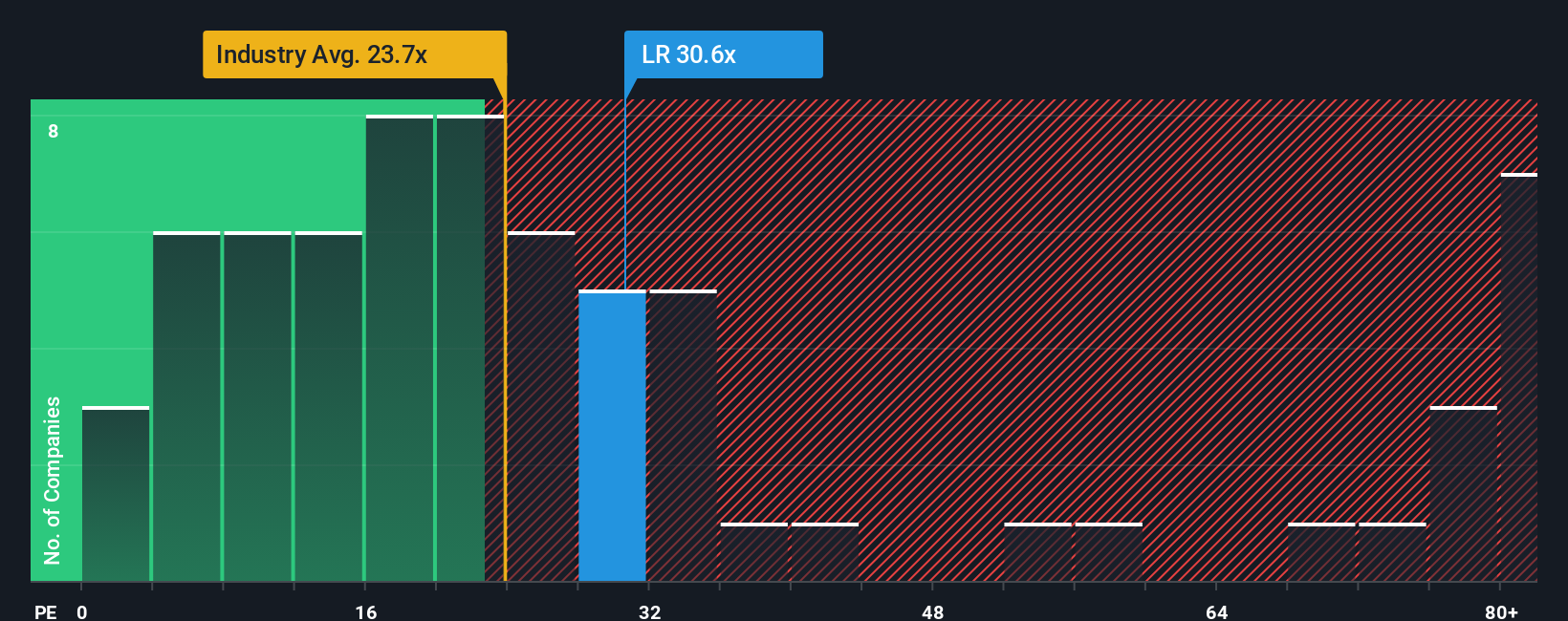

Another View: Market Multiples Raise Caution

Looking at Legrand through the lens of its price-to-earnings ratio, a different picture emerges. Shares trade at 27.8 times earnings, well above both the European Electrical industry average of 23.1x and the peer group average of 16.5x. This premium signals that the stock may be priced for perfection and leaves less room for upside if growth slows or sentiment changes. Could this high valuation increase the risk of disappointment if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Legrand Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build and share your own take in just a few minutes. Do it your way

A great starting point for your Legrand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don't limit themselves to a single story. With so many sectors heating up, now is the time to broaden your research and capitalize on high-potential themes before others catch on.

- Seize the opportunity for long-term growth by checking out these 17 dividend stocks with yields > 3%, which offers yields above 3% and reliable payouts.

- Tap into the AI revolution with access to these 25 AI penny stocks, which builds tomorrow’s intelligent solutions and transforms entire industries.

- Gain an edge on market mispricings by analyzing these 848 undervalued stocks based on cash flows, selected for their attractive cash flow valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LR

Legrand

Manufactures, distributes, and sells electrical and digital building infrastructures in Europe, North and Central America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives