- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

Will Thales (ENXTPA:HO) Leadership Change Reinforce Its Innovation Edge in the Dutch Market?

Reviewed by Sasha Jovanovic

- Thales has named Otto de Bont as the incoming CEO of Thales the Netherlands, effective April 1, 2026, following the retirement of Gerben Edelijn after 16 years in the role and a 36-year career at the company.

- With his background in transformation and high-tech industries, de Bont’s appointment points to a continued focus on innovation, local engineering strength, and advanced solutions across the Dutch operations of Thales.

- We’ll explore how the appointment of Otto de Bont as Dutch CEO could influence Thales’ ongoing innovation and growth strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Thales Investment Narrative Recap

Thales attracts shareholders who believe in Europe’s enduring defense modernization, robust demand for advanced tech, and the company’s ability to secure recurring, innovation-driven revenues. The appointment of Otto de Bont as CEO of Thales the Netherlands is not expected to materially affect the most immediate catalysts, namely, accelerated European defense spending and margin recovery in Cyber & Digital, but continuity in leadership could help mitigate execution risks tied to digital transformation and local market demands in the longer term.

The most relevant recent company announcement is Thales’ confirmation of 2025 organic sales growth expectations in October, providing short-term visibility into top-line momentum. This sales guidance remains underpinned by robust demand in defense and digital markets, areas that de Bont will be deeply involved with in his new role, especially as the company aims for further innovation and local engineering expansion in the Netherlands.

By contrast, investors should also be alert to lingering execution risks within the Cyber & Digital segment if integration and transformation efforts do not keep pace with market shifts and competitors…

Read the full narrative on Thales (it's free!)

Thales' outlook anticipates €26.5 billion in revenue and €2.2 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 7.5% and a €1.2 billion increase in earnings from the current €1.0 billion.

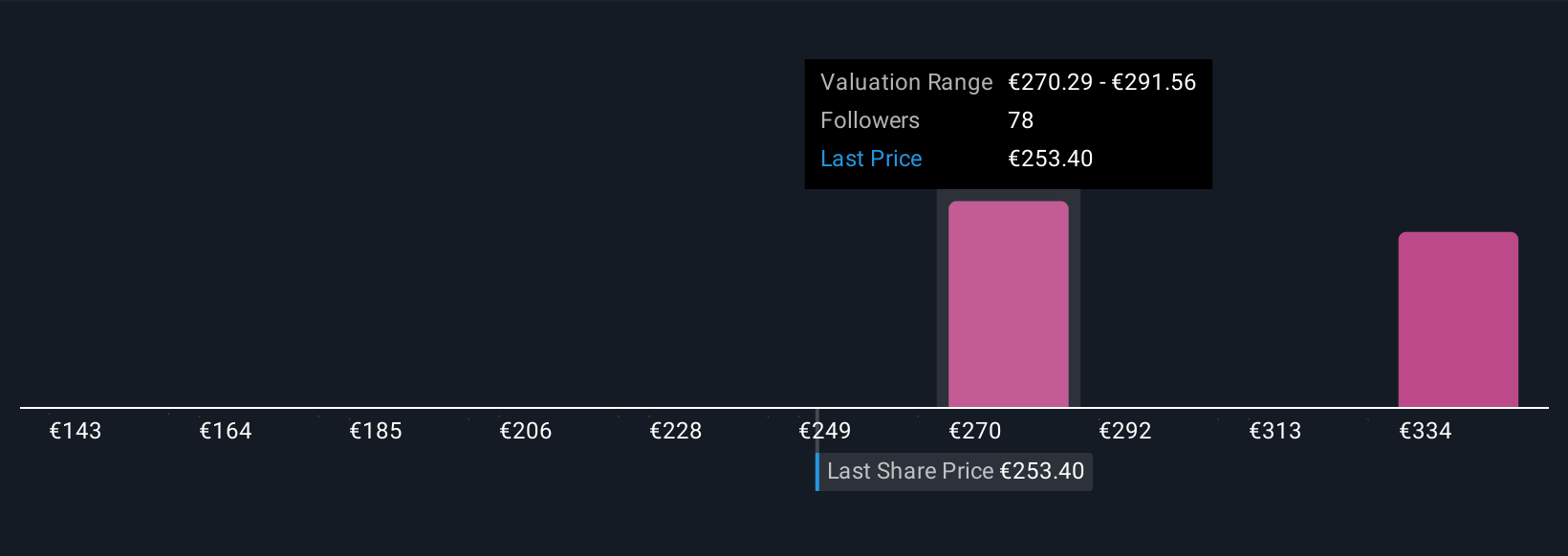

Uncover how Thales' forecasts yield a €279.69 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span €163.37 to €372.55, reflecting wide variation in how investors assess Thales’ outlook. As the company focuses on margin expansion in high-tech segments like Cyber & Digital, individual perspectives highlight the importance of scrutinizing both upside catalysts and persistent execution risks.

Explore 9 other fair value estimates on Thales - why the stock might be worth as much as 67% more than the current price!

Build Your Own Thales Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thales research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thales research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thales' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success